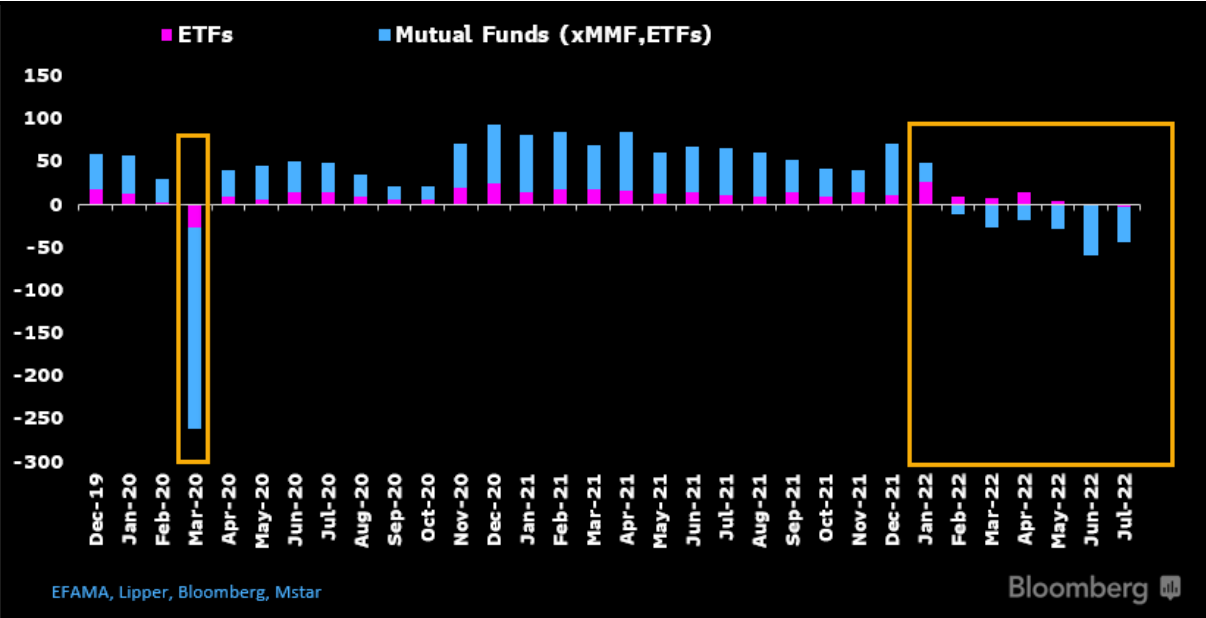

ETF flows have outpaced mutual funds every month so far this year as investors opt for low-fee passive strategies during volatile periods.

According to data from Bloomberg Intelligence, mutual funds in Europe saw a €161bn exodus between the start of the year and the end of July including six months of consecutive months.

Meanwhile, ETFs were significantly behind their record-breaking pace from 2021 but still collected €56bn of new money in the first seven months of the year.

Interestingly, these flows can be explained by two trends in investor allocations. The first is a look at how asset classes fare within different fund wrappers.

By the end of July, bond funds had shed more than €122bn cumulatively, compared to €17bn inflows for fixed income ETFs over the same period.

Similarly, even as equity funds saw positive total flows of €12bn, UCITS equity ETFs booked more decisive growth with €39bn new assets.

Source: Bloomberg Intelligence

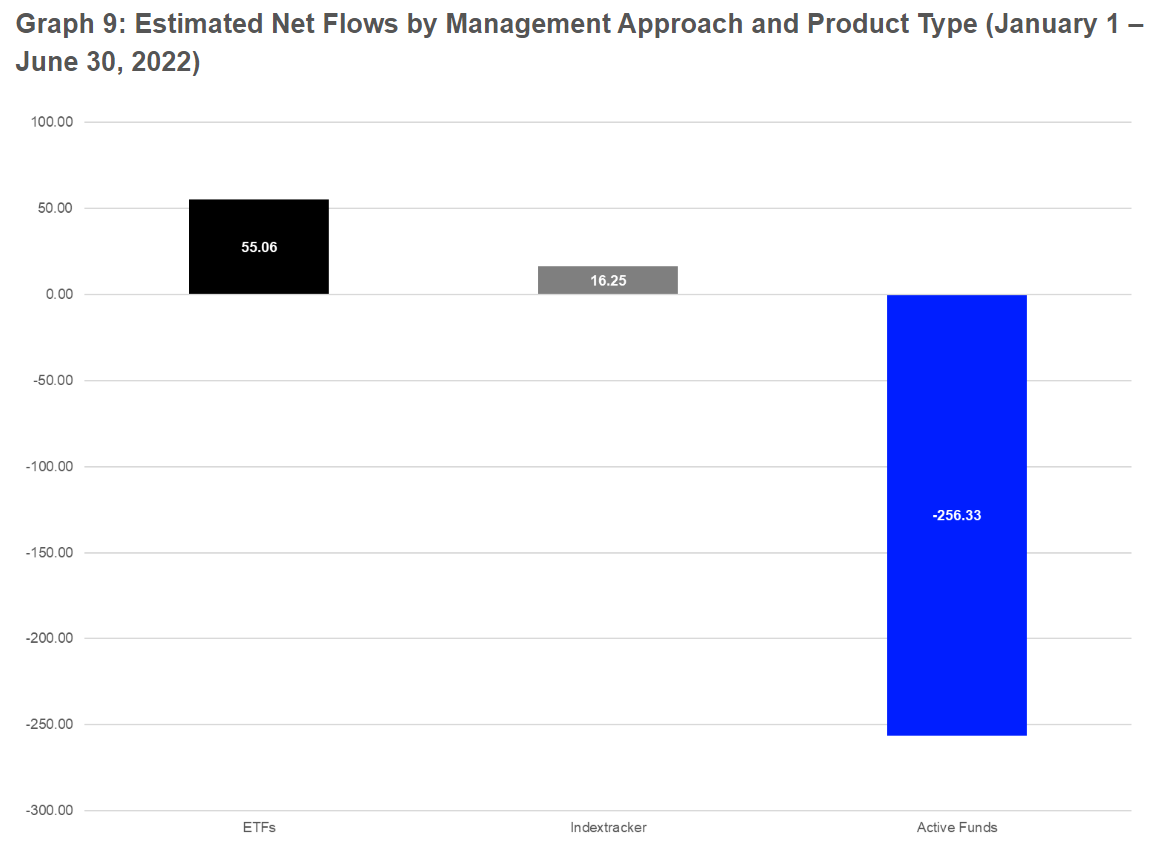

Other than differences in how asset classes have fared within different fund wrappers, investors have also strongly favoured passive management, with a tendency to look at ETFs.

Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, said passive’s share of European fund assets has doubled to almost 20% in under a decade, led by ETFs, cost pressures and active fund underperformance.

“Since most ETFs are passive, their inflows will increase share in the region but the growth of passive falls even outside the ETF wrapper, as passive index-tracking mutual funds have seen inflows of €16.2bn this year,” Psarofagis added.

Detlef Glow, head of Lipper EMEA research at Refinitiv, noted flows into passive ETFs and index-tracking mutual funds have proven especially resilient during volatile periods such as the Global Financial Crisis and the euro crisis, however, ETFs’ greater tendency towards passive management overall meant they enjoyed inflows while mutual funds on the whole saw outflows during these events.

“This investor behaviour may demonstrate that European investors prefer the high transparency of ETFs and index-tracking mutual funds as well as the high (intraday) liquidity of ETFs over the typical black box approach of actively-managed mutual funds, which can only be traded once a day (or in some cases once a week/month),” Glow suggested.

Source: Refinitiv Lipper

Zooming out, it is worth remembering ETFs still significantly lag the scale of either index-tracking or actively-managed mutual funds.

Even as the wrapper has grown in popularity in recent years, with €338bn inflows in Europe between the start of 2020 and end of July this year, this is just over half of the €653bn take for mutual funds as a whole over the same period, according to Bloomberg Intelligence.

However, this is relatively impressive given Europe-listed ETFs finished 2021 with just shy of €1.3trn total assets under management (AUM) last year, around a tenth of the total assets housed in UCITS mutual funds at the time.

Related articles