Stock inclusion in broad benchmarks such as the S&P 500 inflates an asset’s valuation and demand from investors, according to research from the universities of California and Stavanger.

The study, titled The impact of ETF index inclusion on stock prices, reflected on previous research which suggested ETFs tracking indices facilitate price discovery of their underlying assets and if shocks occur in ETF markets, these can be transmitted to the securities they track.

Other studies found between 1976 and 1983, stocks gained an average of 2.8% on the day their inclusion in the S&P 500 was announced. Another reported stocks included in the S&P 500 enjoyed an even larger jump between 1989 and 1994, jumping an average 3.1% the day following their entry was announced.

More recently, a 2011 study revealed stock valuations soar 8.8% in the time between S&P 500 entry being announced and a company actually joining the benchmark. Meanwhile, excluded stocks would fall by an average of 15.1% between announcement and enactment days.

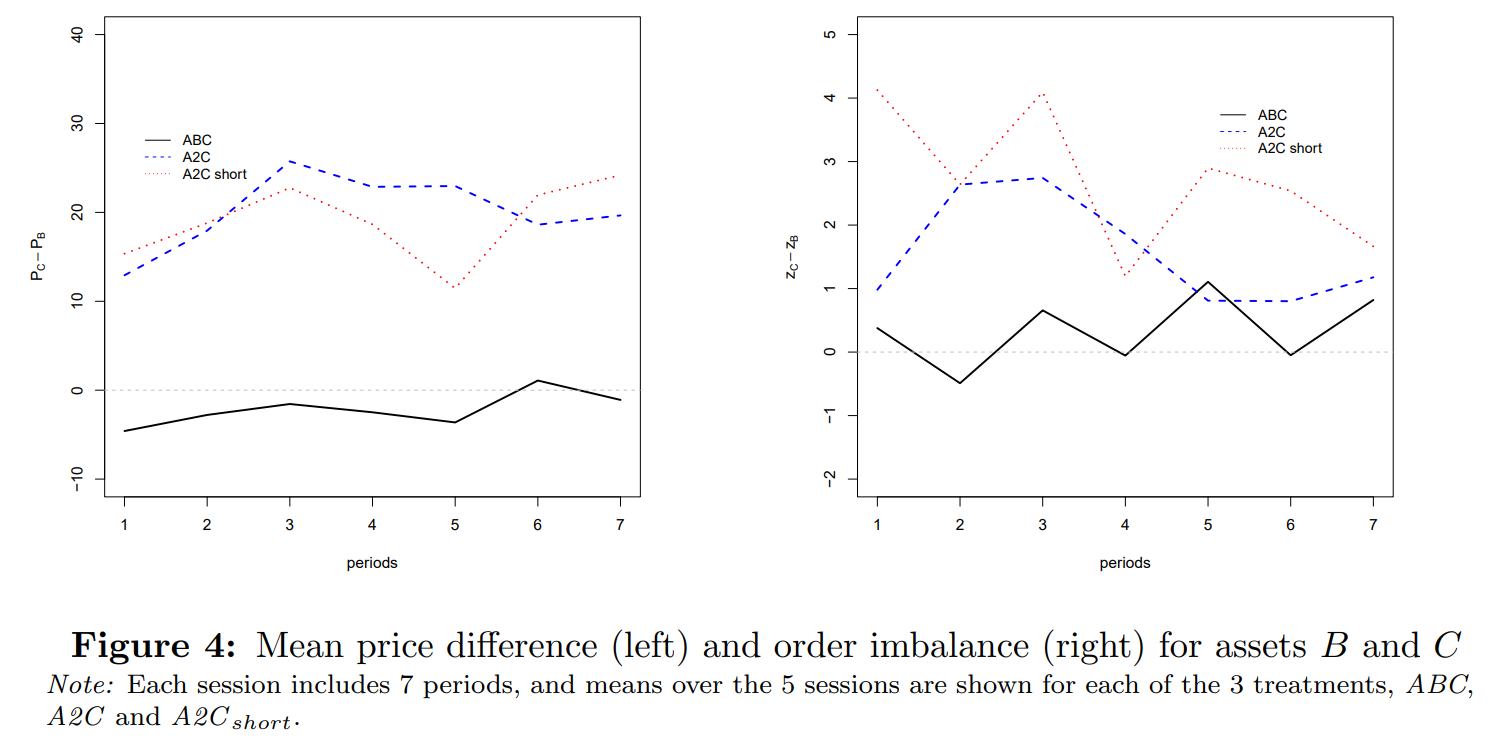

Supporting this, the new research found a “substantial and significant ETF index premium which exists even when short-selling is allowed” and index inclusion causes “order imbalance” to rise between an asset’s outstanding bids relative to their asks.

Unlike most which look at the behaviour of real-world indices performing in an everyday setting, this research used a lab setting, including three hypothetical assets with exactly equivalent fundamentals and then overweighting and removing assets during different treatments.

Supporting past research, asset ‘C’ traded at a higher price when its weight in the ETF index was doubled, while the average price of asset ‘B’ fell when it was excluded.

At the same time, the order imbalance – the number of bids relative to asks – increased for asset ‘B’ after being removed from the ETF basket, meaning there were more outstanding asks than bids.

Interestingly, the order imbalance dynamic strengthened further in the ‘A2C’ short treatment, which was explained by the larger number of underlying assets available for trade when the short-selling constraint is relaxed.

Source: University of California and University of Stavanger

The research concluded: “We find a substantial and significant index premium in a lab setting that excludes other channels, such as signalling, changes in corporate governance and/or investor awareness.

“Moreover, we find that the order imbalance that arises when an identical asset is excluded from the index, plays a significant role in explaining the observed index premium.”

In turn, this could mean ETF index assets could contribute to violations of the Law of One Price when they do not completely cover all the assets in a market. This means the price of assets with seemingly identical qualities within the same market – such as US equities – will differ based on whether they are selected for index inclusion.

These findings somewhat chime with a real-world study conducted by Research Affiliates last year titled Revisiting Tesla’s addition to the S&P 500, which uncovered stock price movements after S&P 500 inclusion, or deletion. However, the report suggested companies added to the index might actually underperform a year on from inclusion date.

Last week,research from the Universities of California and Minnesota argued stock market elasticity – how reactive share prices are to supply and demand – fell by -35% between 2004 and 2016, with the rise of passive investing alone accounting for a 15% decline in market efficiency.

Related articles