Index providers play an important role in the global ETF market. The US and Europe manage approximately $8trn in assets, the vast majority of which are tracking an equity or fixed income index. ETFs typically track a third-party index that determines what securities are included, with BlackRock or another asset manager following the index playbook.

Given the growing adoption of index providers, their role has now hit the radar of the Securities and Exchange Commission (SEC). The Division of Investment Management announced in mid-June it is considering recommending the SEC seek public comment on the role of certain third-party service providers, such as index providers and model providers, and the implications for the asset management industry. This is likely the first step toward the SEC creating formal rules that index providers, such as MSCI or S&P Dow Jones Indices (SPDJI), would need to adhere to, including how transparent the firms need to be with their selection criteria. Yet we do not expect the SEC to materially alter the role index providers play in the ETF ecosystem.

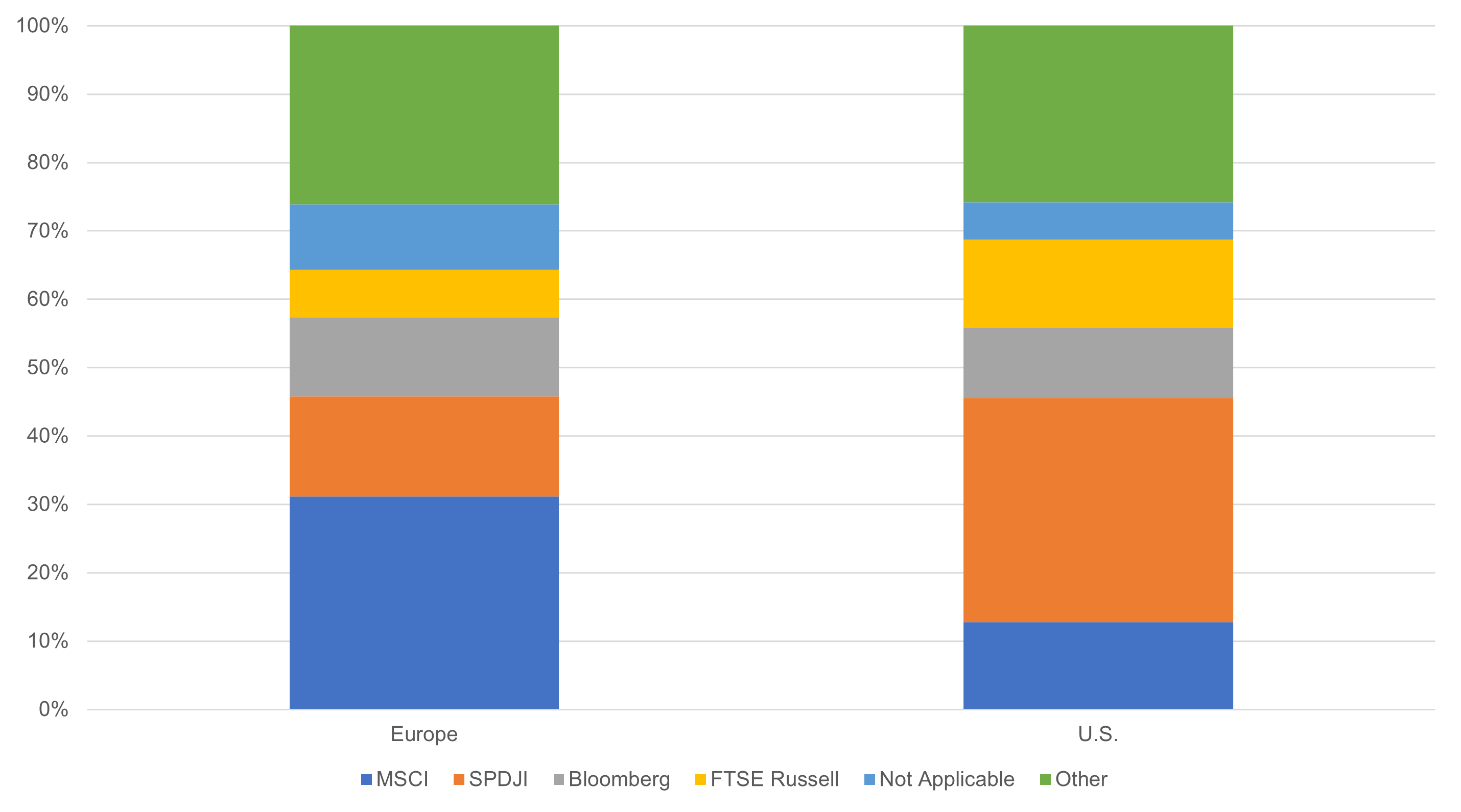

In the US, SPDJI is the dominant provider, with MSCI and FTSE Russell neck and neck for second place. At the end of May 2021, ETFs tracking an SPDJI benchmark managed $2.1trn of assets, which equates to a 33% share of the overall market, according to CFRA’s ETF database. This was more than double the combined assets for products connected to FTSE Russell ($827bn) and MSCI ($817bn). Bloomberg indices ($660bn) are positioned to make up ground as fixed income products gain market share.

SPDJI’s dominance is driven by not only the market-cap weighted large-cap S&P 500 Index-based products, such as the SPDR S&P 500 ETF Trust (SPY), the iShares Core S&P 500 ETF (IVV), and Vanguard S&P 500 ETF (VOO), but also the smart-beta versions such as the Invesco S&P 500 Equal Weight ETF (RSP) and mid- and small-cap products like the iShares Core S&P Mid Cap ETF (IJH) and the iShares Core S&P Small Cap ETF (IJR). US-listed ETFs have more exposure to US stocks than international ETFs do, with such international products often tracking an MSCI or FTSE benchmark like the iShares Core MSCI Emerging Markets ETF (IEMG) or the Vanguard FTSE Developed Markets ETF (VEA).

In contrast, MSCI is the leading index provider for European listed products. At the end of May, MSCI-based ETFs had an industry leading 31% share of the market, up from 30% three months earlier. MSCI’s share doubled that of SPDJI (15%), despite the S&P 500 benchmark being tracked by two of the three largest European listed offerings, the iShares Core S&P 500 UCITS ETF (CSPX) and the Vanguard S&P 500 UCITS ETF (VUSA) (trading on the London Stock Exchange). BlackRock and DWS have a range of widely held products tracking MSCI benchmarks, including the iShares Core MSCI Emerging Markets IMI UCITS ETF (EIMI), the iShares Core MSCI Europe UCITS ETF (IMEU), the iShares Core MSCI World UCITS ETF (SWDA), the Xtrackers MSCI USA UCITS ETF (XD9U), and the Xtrackers MSCI World UCITS ETF (XDWD).

Unlike in the US, FTSE Russell has a relatively modest presence in Europe, with ETFs tracking its benchmarks capturing just 6.9% share at the end of May, a modest decline from 7.1% three months earlier. Indeed, Bloomberg is the third largest index provider for European products, having captured 12% of the market. The $12.1bn iShares Core Euro Corporate Bond UCITS ETF (IEAC) and the $10.9bn iShares China CNY Bond UCITS ETF (CNYB) are the largest ETFs tracking a Bloomberg benchmark.

According to CFRA, index tracking is not applicable for 9.5% of the European market, as the product is either actively managed or, more commonly, replicating a commodity or currency such as gold or bitcoin. Meanwhile, STOXX, IHS Markit, JP Morgan, and ICE are the largest index providers that make up the remaining 26% of the European market, whereas in the US, CRSP is a major player working with Vanguard.

Chart 1: ETF market share for index providers in Europe and the US

Source: CFRA’s ETF Database, as of May 31, 2021

While many of the same index providers are key cogs in the ETF ecosystems in the US and Europe, their relative standings are distinct. Therefore, CFRA believes investors need to go beyond the name of the issuer when choosing a product.

Todd Rosenbluth is head of ETF and mutual fund research at CFRA