Chris Brycki is the CEO of Stockspot, Australia's first robo-advisor. We caught up with him and got his take on what makes a good ETF and how robo-advice is evolving.

ETF Stream: What do you look for when picking ETFs for Stockspot's model portfolios? Especially given that some plain vanilla ETFs are very similar (i.e. IOZ, STW, A200).

Chris Brycki: There are a number of things we're looking for. Cost is the first. Cost is very important over the long run. But a lot of plain vanilla ETFs are converging on cost: in US shares there's only a few basis points difference. Once you're talking a few basis points other factors become just as important.

We also look at liquidity, as it allows us to confidently get in and out for clients. It's often driven by underlying assets an ETF invests in, but also the market-making arrangements issuers have.

Size is another factor. We think ETFs should have at least $25m under management: that's our line in the sand. The bigger ETFs become the better the chance they'll survive. If ETFs don't gain traction they shut down, or switch index. Neither of these scenarios is good for our investors - yet both situations are surprisingly common.

Tracking error is also critical. The whole point of an index-based product is it needs to accurately replicate an index. And tracking an index is not as easy as it sounds. I used to manage an index arbitrage portfolio at UBS: it's tough even though it's a rules-based process. Some ETF issuers are better than others at reducing the tracking error. Tracking error can be larger than management fees so it's an important factor to consider.

Fifth is counterparty risk. Does the ETF own the underlying securities? Or does it use structured instruments like derivatives? Some ETFs - like oil trackers - need derivatives. But it creates risk. Securities lending is also something we watch—

--does much of a securities lending market exist in Australia?

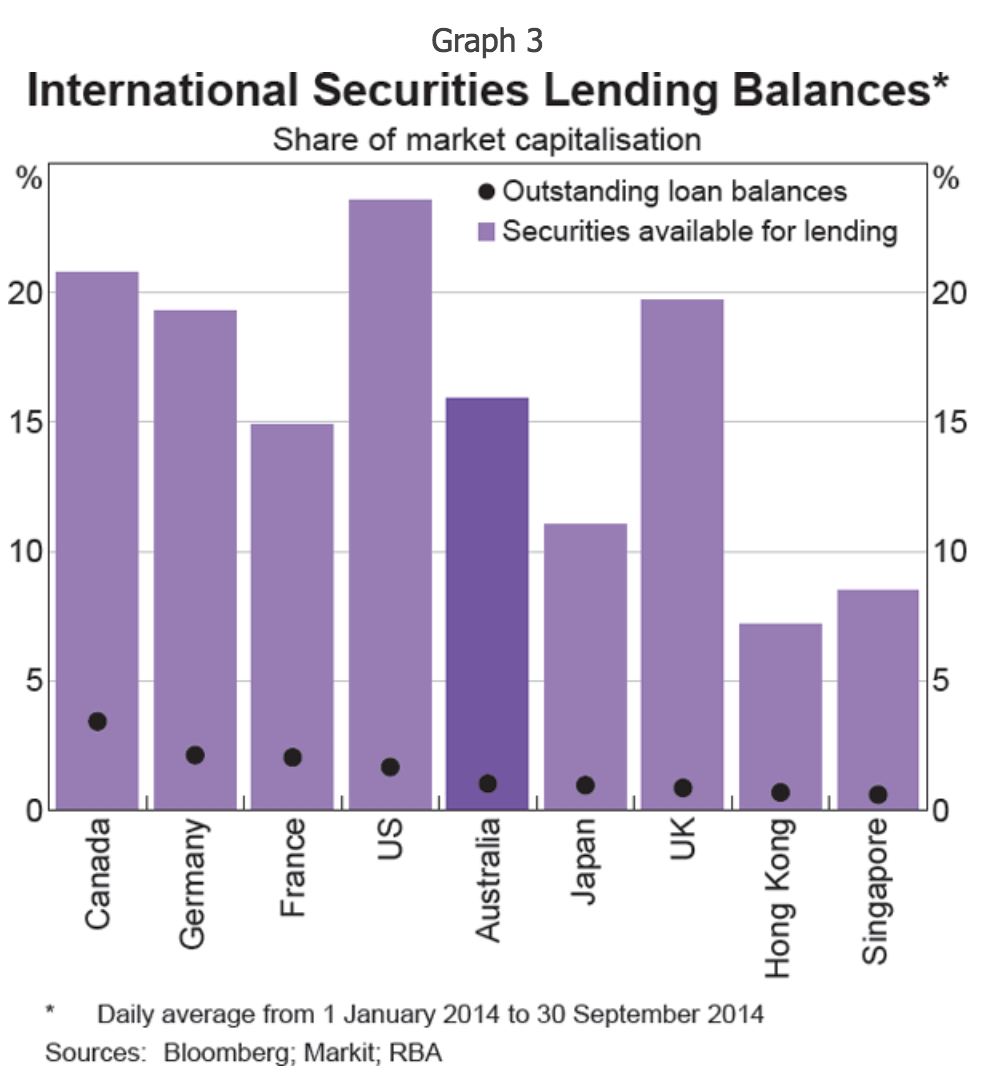

There is a sophisticated securities lending market in Australia that superannuation funds dominate. Aussie ETF issuers have said they're not securities lending right now - but they could change their mind. So we keep an eye on it.

Some issuers have said the securities lending market isn't developed enough.

That's wrong. It's very developed and competitive - roughly $15 to $25 billion by value. ETF issuers don't do it because they can't make much money off it and it might cause reputational damage due to public perceptions around short selling.

Returning to your question, we also look at the reputation and track record of issuers themselves. Some have a long-term commitment to lowering fees and to transparency. Other issuers have done the opposite, and not fully disclosed fees and costs--

--some have hidden fees?

This is something that's come out since ASIC put out RG 97 last year, which requires more disclosure and transparency on fees. There has been a lot of pushback on RG 97, which is a shame because it's a good thing for consumers and has led to huge differences in fee disclosure. But which issuers are being transparent about total costs and fees is something we keep an eye on.

The last thing we look at is having proven process and index. Some ETFs are coming out that follow new indices with no track record that are getting designed purely for the ETF issuers. Index providers are commercial beasts, so it makes sense for them to build new indexes for ETF issuers. But there is a value in having rigour and processes that have stood the test of time - and a clear separation between index providers and ETF issuers or else conflicts may arise.

What do you make of some of the new product innovation like smart beta and thematic ETFs?

I think a lot of it is just marketing fluff piggybacking off the ETF trend. They often work backwards: either p-hacking to find something that works retrospectively and claim this should always work; or they find things that have worked only recently and take advantage of people's recency bias.

Factors are typically not persistent, they're cyclical. Those cycles can be very short or they can be long. Nobody can really predict when the factor returns will shift. Ultimately it's just a form of active management - it comes with good story-telling but I don't think it adds any value to the end investor.

There's also the fact that if there is alpha to be harvested in the stock market, then it's likely that more sophisticated investors will beat ETFs to it and arbitrage away any benefit. So I'm sceptical.

Are you worried about ETF issuers launching their own robo-advisors?

My perspective is there needs to be a difference between the person you're getting product advice from, and the person providing the product. Otherwise what you're getting is product sales - not advice. This is one of the things coming out of the ongoing Hayne Royal Commission.

The robo-advisors that North American ETF issuers have rolled out only contain their own products. For those North American ETF issuers, a robo-advisor is a sales channel - not a fiduciary advice channel. ETF issuer-owned advisors are not in a position to give impartial advice.

In Australia the laws are strict: you can only provide personal recommendations that are in the best interests of the client. In Australia if ETF manufacturers start to come out with their own robo-advisors it's unlikely they will meet best interest duties.

Are customer acquisition costs for B2C robo-advisors too high?

The most useful acquisition channel for us is word of mouth - which is, in absolute cash terms, free. We are getting 50% of customers through word of mouth.

If you rely on digital marketing, it can be expensive and there are a lot of variables out of your control. In online advertising, keyword pricing gyrates, competitors change and the platforms are constantly tweaking their algorithms - that can really impact the costs of getting discovered.

How do you get rich people to use robo-advisors? In the US, Sally Krawcheck is bringing in private wealth managers to lure rich women onto Ellevest. Do you see something similar happening in Australia?

I don't think there's one answer. We see clients investing $1m-plus not wanting to speak to anyone. Yet there are also people that are putting in a lot of money that want to speak to someone - especially at the start when they're learning about ETFs.

There is quite a range of requests people have. But we have a client care and advice team that chat to people and everyone can take advantage of that.