This is the first part of a two-part series

Some say ETFs are in a bubble; others say tech companies are.

If either of these claims is true then ETF issuers, which have trolleys in both aisles, are in for trouble. ETF issuers are tech companies because they use computers to run their products in the place of people. They're also ETF companies.

An obvious question - or at least, consideration - to fall out of this is: are ETF issuers, and the price that is paid for them, in a bubble?

Invesco, the world's fourth-largest ETF issuer, made headlines recently when it bought out Guggenheim's ETF arm for $1.2 billion.

Much of the commentary, and there has been much of it, has focussed on palace intrigue at Guggenheim: its divided sales team, its executives' personal lives, its failed attempt to sell its whole retail business, and so on.

But less attention has been given to the more important point: the actual sale.

$1.2 billion is a lot of money. The sale of a world-leading ETF provider is rare enough. The sale of one major US provider to another is rarer still. But again, the question stalks: is this part of a bubble?

ETF issuers M&A: a two-year history

There have been many acquisitions of ETF providers the past two years.

A brief survey reveals that sales of ETF providers are common and occur worldwide, but pricing details are rarely made public. (Perhaps because buyers do not want to be viewed as overpaying, nor do sellers wish to be viewed as underselling.)

From the publicly available data ETF Stream can find - plus some careful discussions off the record with industry insiders - we've been able to piece together the list of acquisitions plus some prices ranging from the very large issuers to the very smallest.

One of the few instances of a small issuer being bought out for a publicly stated price was Index Wealth, an ETF provider based in Alberta, Canada. It was acquired for C$2.25 million in 2016. This might seem like a small price, but it appears that Index Wealth, which had only C$120 million under management at the time of acquisition, was not that far off from being a startup

On the other end of the spectrum, a major purchase came when Invesco bought London ETF provider Source. The price paid was not made public, but sources contacted by ETF Stream said the price paid was around $200 million. Warburg Pincus, the company that sold Source, originally wanted up to $400 - 500 million press reports indicate.

So, is this a bubble?

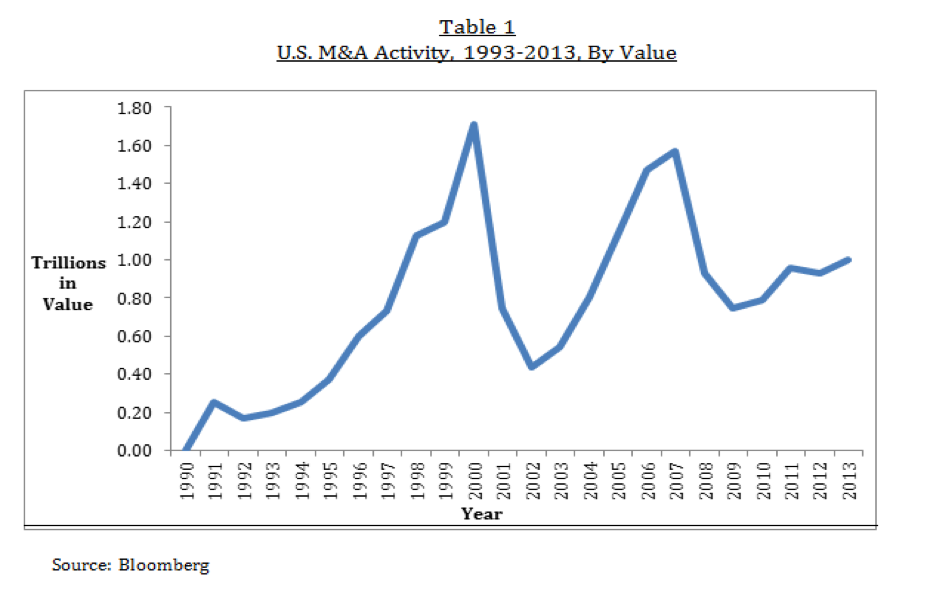

Lots of acquisitions in a short period of time can suggest a bubble. "Each of the last six great merger waves on record ended with a precipitous decline in equity prices," wrote Harvard professor Mathew Rhodes-Kropf, one of the world's top experts on corporate mergers.

This was the case during the dotcom boom, where startups lightyears from profitability were gobbled up quickly. The M&A spike in the build-up to the 2008 financial crisis has also been well noted. But is that what's going on with ETF providers like Guggenheim?

A $1.2bn sale price means Invesco will pay more than 10 times run-rate revenue for Guggenheim. This might seem expensive but there are some important qualifiers.

The first is what's called a "tax shield", which is a peculiarity of US tax law and quite specific to this deal. According to an Invesco presentation to investors, the tax shield made up $360mn of the purchase price, meaning that the net price Invesco paid for Guggenheim was $840mn.

Another important point is that Guggenheim ETF was highly profitable. According to the Financial Times, its operating profit margins of around 85 percent. Higher profit margins tend to attract higher sales prices.

The final qualifier - and perhaps the most important - is that Invesco had good reasons to buy Guggenheim. It is this that will be the subject of the next article.