Frontier markets are those countries that are considered less mature than emerging markets, which - while riskier - also present high growth opportunities. Access is through synthetic ETFs and with a year-to-date return of nearly 9% from S&P’s frontier market BMI index, they could be worth reviewing.

That said, it’s a slightly nebulous sector – there’s no universal definition of a frontier market.

As Morningstar comments: "MSCI examines each country’s economic development, size, liquidity and market accessibility in order to be classified in a given investment universe.

"The World Bank focuses on a country's economy and, in particular, its relative level of wealth per capita. Countries with high levels of per capita income are classified as developed. Meanwhile those countries with low, middle, and upper-middle incomes per capita, relative to incomes in other countries around the globe, are classed as developing, or emerging."

There are currently 116 large- and mid-cap constituents from 29 countries that make up the MSCI frontier market, they are: Argentina, Bahrain, Bangladesh, Burkina Faso, Benin, Croatia, Estonia, Guinea-Bissau, Ivory Coast, Jordan, Kenya, Kuwait, Lebanon, Lithuania, Kazakhstan, Mauritius, Mali, Morocco, Niger, Nigeria, Oman, Romania, Serbia, Senegal, Slovenia, Sri Lanka, Togo, Tunisia and Vietnam.

Despite the uptick YTD frontier markets did appallingly in 2018. The MSCI frontier markets index was down -16.20%, despite a massively good year in 2017 when it returned 32.32% - Bloomberg analysis in February 2018 showed that frontier markets outperformed developed and emerging markets in terms of volatility-adjusted returns.

One of the problems for investors is that they are typically put off frontier markets because of their lack of liquidity which is reflected in the strong returns but also heavy losses.

As a result, investors typically tend to ignore frontier market countries in favour of emerging and developed stocks, as a result there are only two frontier market ETFs and two single frontier country ETFs available on the London Stock Exchange.

The first Kuwait ETF was launched in Europe recently after the Kuwait & Middle East Financial Investment Company (KMEFIC) teamed up with white-labelling platform HANetf to launch the ETF - (KUW8).

The launch came hot on the heels of FTSE Russell including Kuwait in its emerging markets index. ETF Stream reported that it is expected to bring as much as $800m of foreign direct investment.

The only other single frontier country ETF on offer on the London Stock Exchange – the Xtrackers X FTSE Vietnam ETF (XVTD).

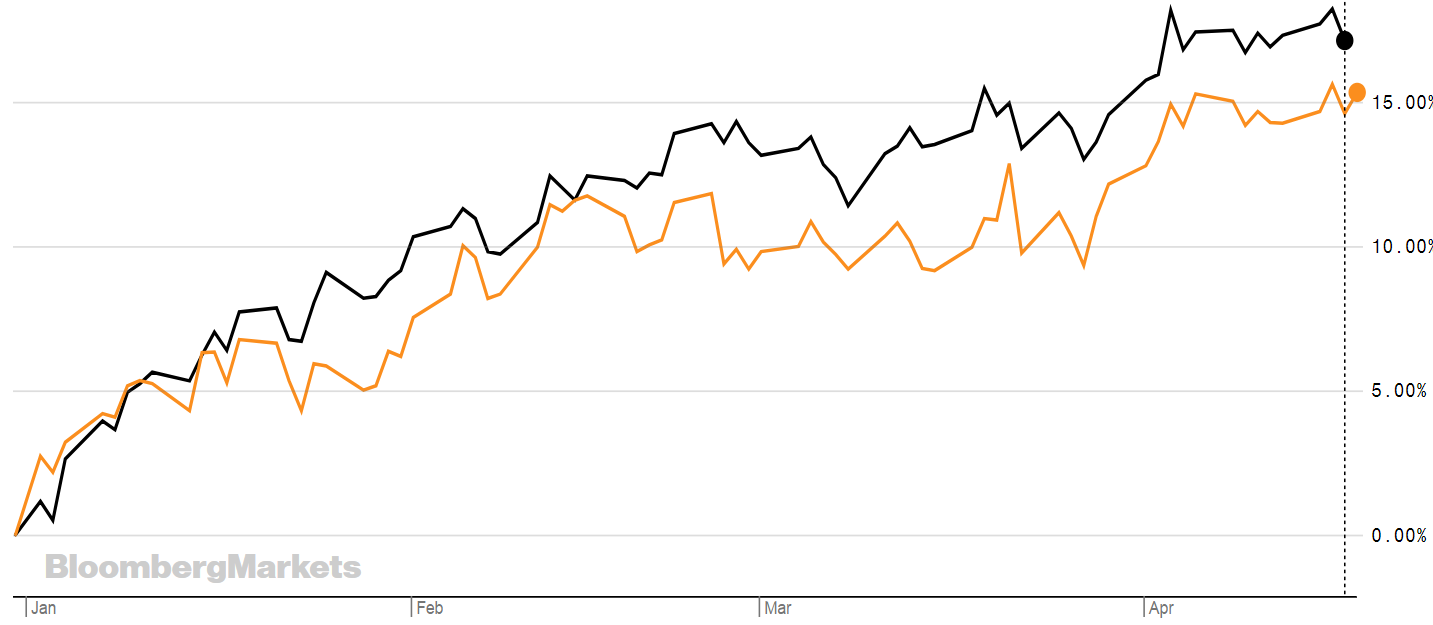

The only two ETFs on offer on the London Stock Exchange that access a larger sample of frontier markets are from Xtrackers and come in USD and GBP. But both have done well this year, as the graph below shows, with Xtrackers S&P Select Frontier Swap UCITS ETF (XSFD) in black and Xtrackers S&P Select Frontier Swap UCITS ETF (XSFR) in orange.

Source: Bloomberg

They both track the S&P Select Frontier Markets index, which has returned nearly 16% this year so far.

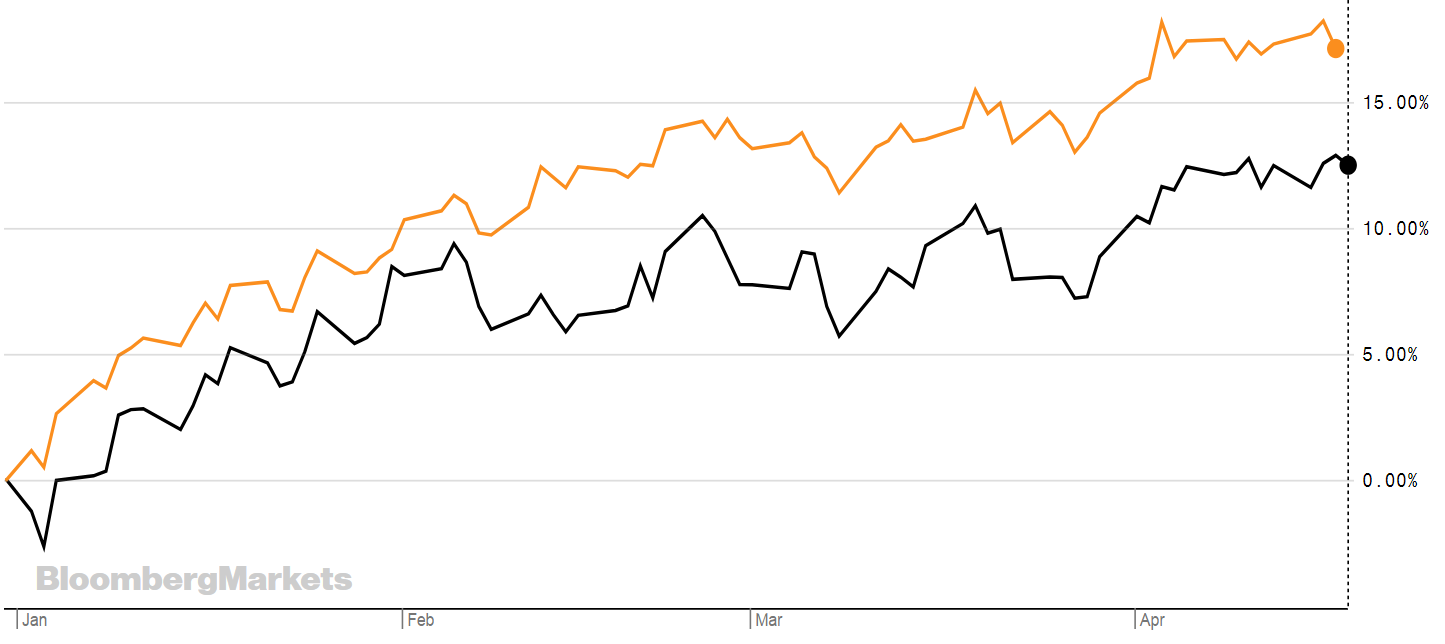

They are even starting to catch emerging markets.

Below is the performance of Xtrackers emerging markets ETF (XMMD) in black and XSFD in orange YTD.

Source: Bloomberg

This year the tide seems to be turning and frontier markets are putting on a good performance offering up returns of nearly 9% from S&Ps frontier markets BMI index and 7% from MSCI’s frontier markets.

So, why are frontier markets doing well now?

According to an article from International Banker; “Frontier markets tend to experience higher economic growth rates on average than their emerging and developed counterparts, moreover, which is partly indicative of the spare capacity such economies have at their disposal to accommodate significant development. This untapped potential in itself can encourage investors to get involved in frontier markets, which according to Perth Tolle, founder of Life + Liberty Indexes and emerging-markets expert, are 'like deep value investing, as they’re coming from an often abysmally low base, they have the greatest potential for growth'.”

For example, the World Bank describes Vietnam’s development over the past 30 years as ‘remarkable’, transforming Vietnam “from one of the world’s poorest nations to a lower middle-income country.”

Vietnam’s real gross domestic product (GDP) is projected to expand by 6.8% in 2018 before moderating to 6.6% in 2019 and 6.5% in 2020 due to the envisaged cyclical moderation of global demand.

Similarly, Kuwait is also expected to grow. The World Bank reports: “Growth is expected to rebound to 1.5% in 2018 as oil output and exports increase, and higher government spending supports the non-oil sector.”

Frontier markets also benefit from being weakly correlated to developed markets so can add an element of diversification in investor portfolios. Despite all this, there are still risks and these countries can be volatile.

If you want access though there is only the Xtrackers option on the London Stock Exchange and this is a synthetic ETF, meaning it uses a swap to get the exposure. While this method of access has historically had a lot of criticism, which we’ve written about before, it’s the most cost effective and efficient way of accessing these markets.

XSFD

$

TER: 0.95%

XSFR

£

ETFYTD RTNTERINDEXXtrackers S&P Select Frontier Swap UCITS ETF16.72%M’ment fee: 0.75%S&P Select Frontier IndexXtrackers S&P Select Frontier Swap UCITS ETF15.32%S&P Select Frontier Index