Investors suffer significant performance drag when investing in flagship indices due to traders front-running the scheduled rebalanced dates, however, little is being done to address the issue by index providers.

According to research conducted by Solactive entitled Passive investing and the effects of reconstitution, the rapid growth of assets in index-tracking strategies has meant when indices rebalance, they can have a “considerable” impact on individual stocks.

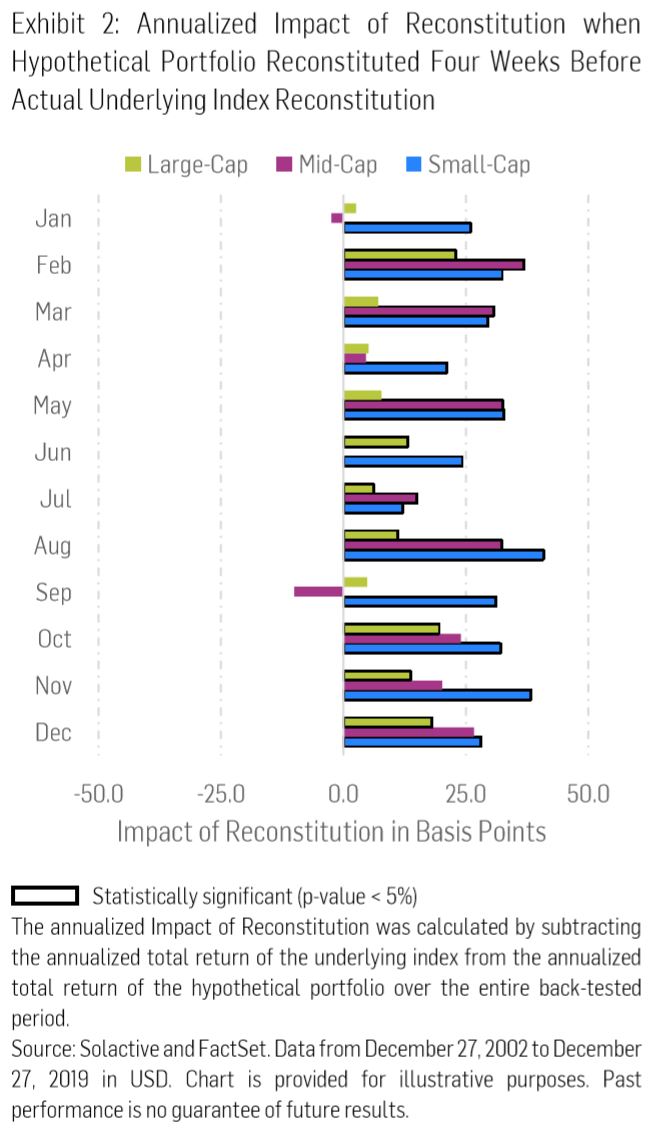

The research measured the impact of rebalancing by taking the universe of US stocks and splitting them into large, mid and small-cap companies.

They calculated the weekly returns of these three indices, which were rebalanced at the third week of each month, between December 2002 and December 2019.

They found: “The impact of reconstitution became statistically significant in the majority of months for all the size segments when the hypothetical portfolios reconstituted four weeks before the actual reconstitution of the underlying indices.”

In particular, the small-cap index suffered the biggest impact from scheduled rebalances while large caps saw the least.

“Therefore, market participants, who acted early, created a considerable impact on the reconstitutions.”

The findings support a recent research paper by René Kuil, senior investment manager at PGGM Investments, entitled The Index effect in factor benchmarks, which analysed the rebalances of the MSCI Minimum Volatility World index between 2011 and 2016.

The paper found investors tracking this index saw an annual performance drag of 0.44% due to the scheduled rebalances.

Why index providers were right to postpone rebalances

While this concept is widely understood as being part and parcel of investing in index-tracking products such as ETFs, little has been done to address the problem.

Solactive suggested index providers should look to spread rebalance dates over different periods while Kull argued they should look at rebalancing more frequently in order to lower the market impact of each rebalance or launch mirror indices with different rebalancing dates.

Furthermore, Kull said investors should either rebalance their portfolio out of sync with the index rebalance date in order to minimise the rebalance effect or look to gain exposure to a similar index with fewer assets tracking it.

He added: “The index provider should feel responsible to counter this as much as possible for two reasons: 1) it is in the direct interest of their current passive clients as it raises their portfolio returns and 2) it makes them more attractive for future investors, especially when other index providers do nothing to counter market impact.”