If thematic investing is about capturing structural shifts, then surely there ought to be an ETF targeting the reversal of the biggest economic event of the last century, via reshoring.

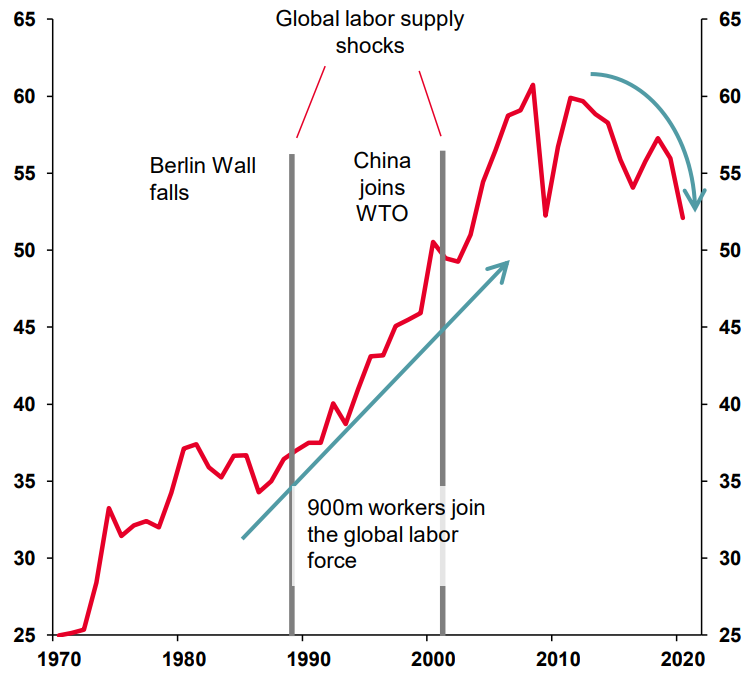

From post-WW2 alliance building to Bretton Woods, China’s ‘Great Leap Forward’ to the fall of the Berlin Wall and the IMF’s Structural Adjustment Programmes, the half-century construction of a global economic order is the miracle that has padded companies’ margins, supported consumer habits and opened up global opportunities for trade and investment.

However, our certainty in a Fukuyama-esque ‘end of history’ scenario has been rocked over the past decade, with Russia’s invasion of Crimea in 2014, escalation of US-China sanctions and a general shift towards populist isolationist politics in the west.

These events set the stage for the reshoring narrative to come of age during what historian Alan Tooze termed the ‘polycrisis’ that followed COVID-19. This started with supply chains being strained or completely overhauled by lockdowns and vaccine rollouts, before Russia’s invasion of Ukraine and China subsequently ramping up its Taiwan rhetoric placed a tangible question mark over the merits of global interdependence.

Far from a passing fancy among economists and journalists, the world’s largest asset manager, BlackRock, named reshoring its top theme to watch in itsThematic Outlook 2023, amid the convergence of demographic, technological and geopolitical change.

“Countries and businesses increasingly recognise the importance of more resilient supply chains as geopolitics potentially impacts key resources,” BlackRock said. “Businesses and policymakers have been working on creating more opportunities at home while remaining connected to the global economy.”

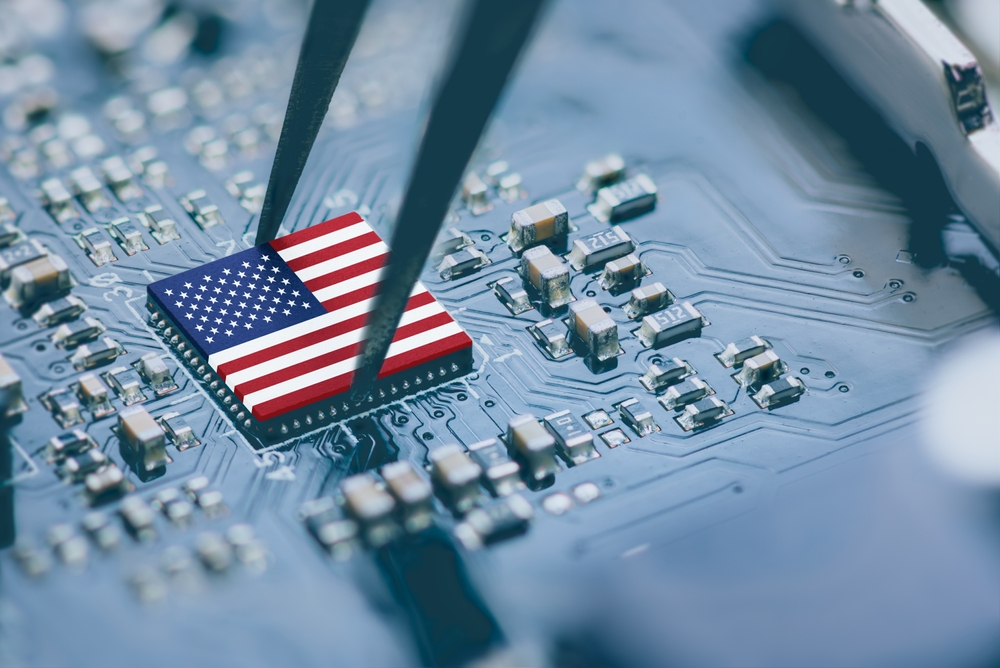

This theme also has statistical backing, as seen in a dedicated Société Générale Cross Asset Research paper, which estimates as many as 350,000 new jobs were created in the US last year because of reshored manufacturing.

Chart 1: Number of jobs announced arising from reshoring and foreign direct investment

Source: SocGen Cross Asset Research, Reshoring Initiative

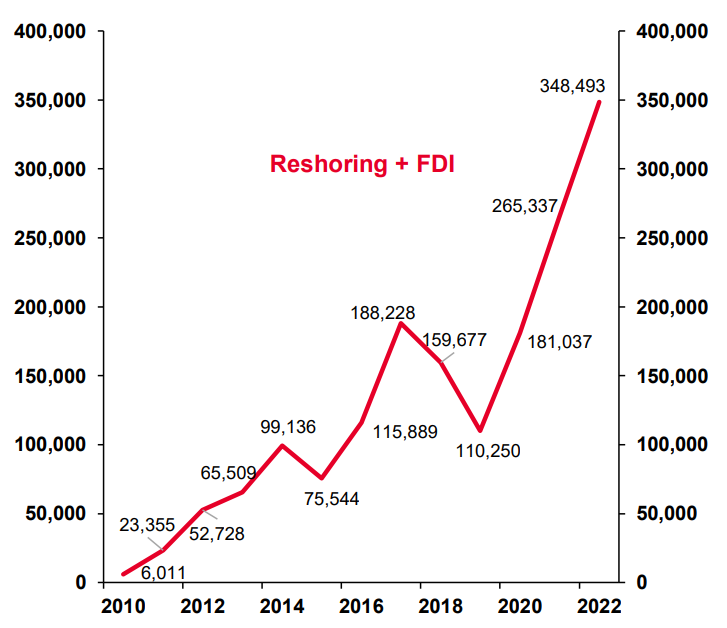

Interestingly, reshoring has also become more of a front-of-mind issue for companies over the past year than it was even during peak COVID-19 uncertainty in 2020. In mid-2022, reshoring, onshoring or nearshoring were mentioned in the quarterly earnings calls of around 180 US companies.

Chart 2: Mentions of onshoring and reshoring have increased in company earnings calls

Source: SocGen Cross Asset Research, Bloomberg

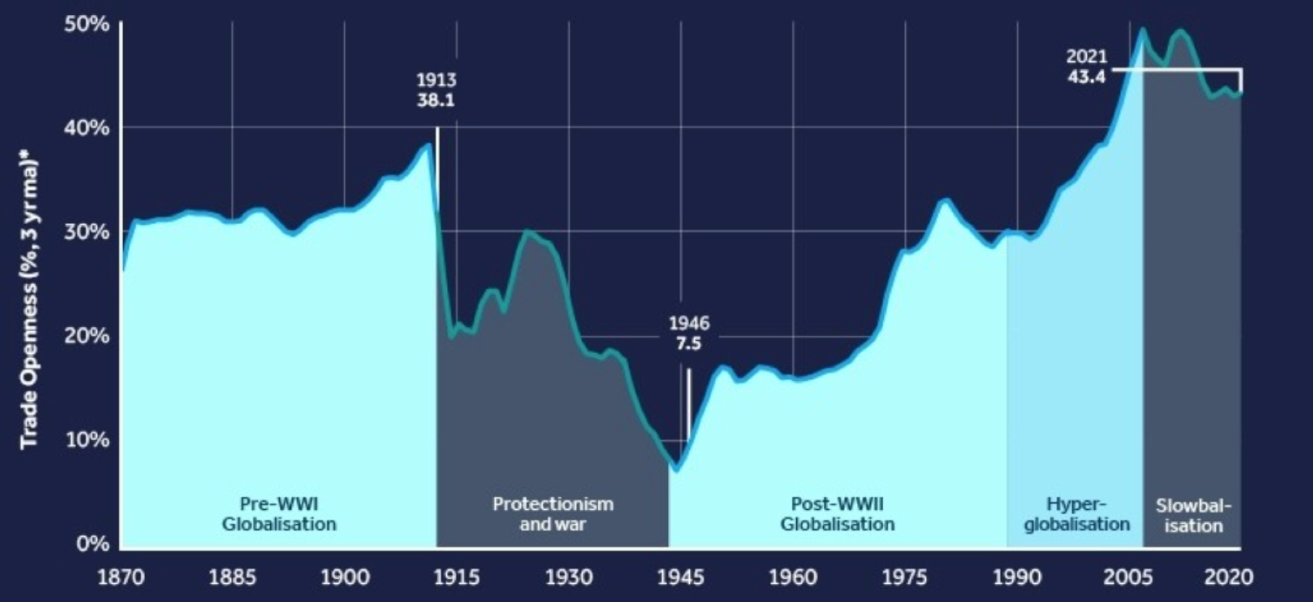

Whether convinced by the reshoring argument or not, investors should at least be mindful that companies are looking closer to home. Job reshoring is gathering pace while the share of the global economy made up by international trade is moving consistently downward at a pace not seen in at least five decades.

Chart 3: US reshoring job announcements per year

Source: Wall Street Journal, BlackRock

Chart 4: Global trade as a percentage of GDP

Source: SocGen Cross Asset Research, World Bank

Investable reshoring opportunities for ETFs

Interestingly, while reshoring has only recently come into vogue in the mainstream, there have been ETFs looking to capitalise on the theme for years including the First Trust RBA American Industrial Renaissance ETF (AIRR).

Having launched in 2014 and tracking the Richard Bernstein Advisors American Industrial Renaissance index, AIRR captures 49 US industrial and related infrastructure companies deriving no more than 25% of their revenues from outside of the US, as well as domestically-focused banks based in states considered ‘manufacturing hubs’.

As part of its research, SocGen also created an investable US onshoring index of 28 stocks including industrial REIT Prologis, rail freight company Union Pacific, industrial firm Honeywell and defence specialist Raytheon Technologies.

Outside of manufacturing, there are other, existing ETF themes that stand to benefit from the broader strategic shift to reshoring all parts of countries’ overseas dependencies.

One example is the dozens of clean energy ETFs and tens of billions of dollars tracking them. As gas prices hit 15-year highs following the invasion of Ukraine last year, the US committed $369bn via the Inflation Reduction Act and the EU €210bn through RePowerEU to investments and tax credits for expanding domestic clean energy capacity.

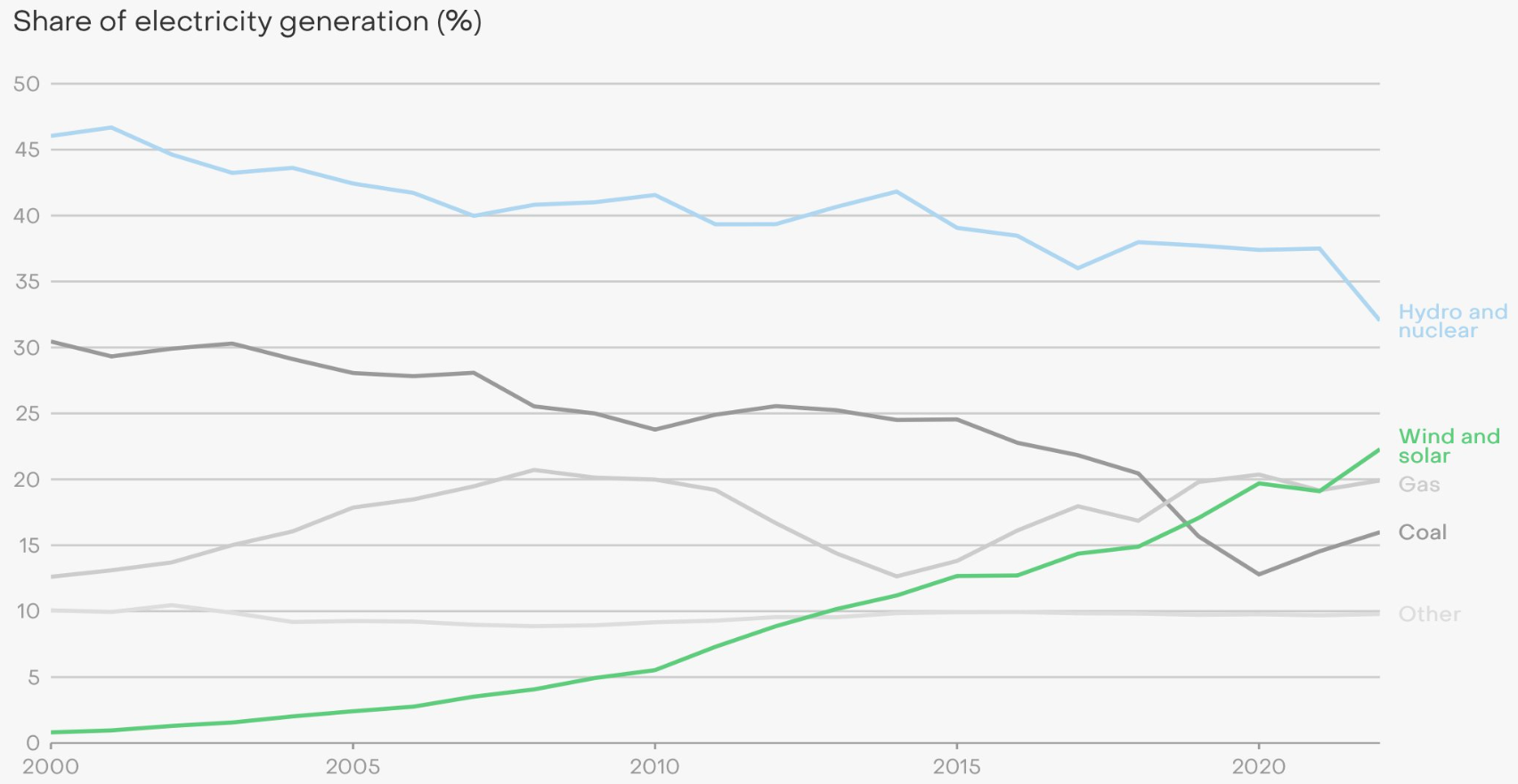

Over the past 12 months, the $6.1bn iShares Global Clean Energy UCITS ETF (INRG) posted some of the strongest returns of any Europe-listed thematic ETF, up 14.5%. In 2022, wind and solar combined accounted for a greater portion of EU power generation than gas for the first time ever, according to energy think-tank Ember.

Chart 5: EU power generation from wind and solar surpassed gas for the first time

Source: Ember

A second direct beneficiary could be semiconductor ETFs, which are exposed to a vital component in the US-China race for tech dominance.

Last July, US lawmakers passed the $280bn Chips and Science Act with the aim of supporting R&D and onshore production of semiconductors including a dedicated $52.7bn for research, manufacturing and workforce training and a 25% tax credit for investments in semiconductor manufacturing.

The US then implemented a new round of sanctions in October, limiting the sale of chip-making equipment to China.

“Only 12% of semiconductor chips are manufactured in the US today, down from 37% in 1990. The US sees a need to decrease its reliance on other regions,” SocGen said. “In the wake of a shift in geopolitics and increased focus in the US on fiscal policy, global companies have announced investments of more than $350bn since the incorporation of Chips and Science Act, 2022.”

Finally, the automation theme could stand to benefit from companies looking to protect their margins from the impact of reshoring labour and the added wage pressures that accompany this.

Not the end of history?

However, it bears remembering that globalisation is not a process that can be undone overnight, nor is the US or any other country planning to uncouple from the outside world.

Though we may continue to see a moderation in the pace of globalisation, Alan Tooze posited this will reflect a ‘slowbalisation’ rather than full-on industrial isolationism.

Chart 6: Globalisation through recent history

Source: Jorda-Shularick-Taylor Macrohistory Database

BlackRock agreed, stating the absence of any new pressures could see companies opt for the ‘business-as-usual’ or inertia approach to their current supply chains.

“While there are a number of factors driving companies to build greater resilience in their operations and supply chains, a reduction in geopolitical risk could see pressures for companies to act in the near-term lessen,” it said.

Investors should also remember the difficulty companies have already had in moving manufacturing away from China. While Apple began shifting its production away from China in 2020, Counterpoint Research estimates it will still produce 90% of each of its hardware devices in the country in 2024.

Speaking toETF Stream, David Henry, investment manager at Quilter Cheviot, said on the end of zero-COVID policy: “China, the world’s factory, is reopening and some people said the world is becoming a less global place.

“I do not buy that. When companies are trying to maximise margins, they will crawl over broken glass to find efficiencies and if that means outsourcing and going global, then so be it.”

China’s reopening will offer welcome relief to the supply of goods, not to mention its central role in materials such as rare earths. However, should conflicts such as Russia-Ukraine continue, or Sino-US relations sour, reshoring will be a theme with a compelling investment case – and perhaps one that deserves an ETF in Europe.

Related articles