The Australian share market is usually thought to be a land of octane and adrenaline.

Fortunes rise and fall with stock charts. At lightning speeds, the ASX can turn millionaires into billionaires – and vice versa.

In this circus, real estate investment trusts (REITs) are sometimes thought to be a bit boring.

REITs – which are companies that buy, develop and manage property – are the tortoise and not the hare. Whereas tech companies like Tesla and Afterpay can generate returns of 100% in two months, REITs tend to plod along at 8% a year - much of which is dividends.

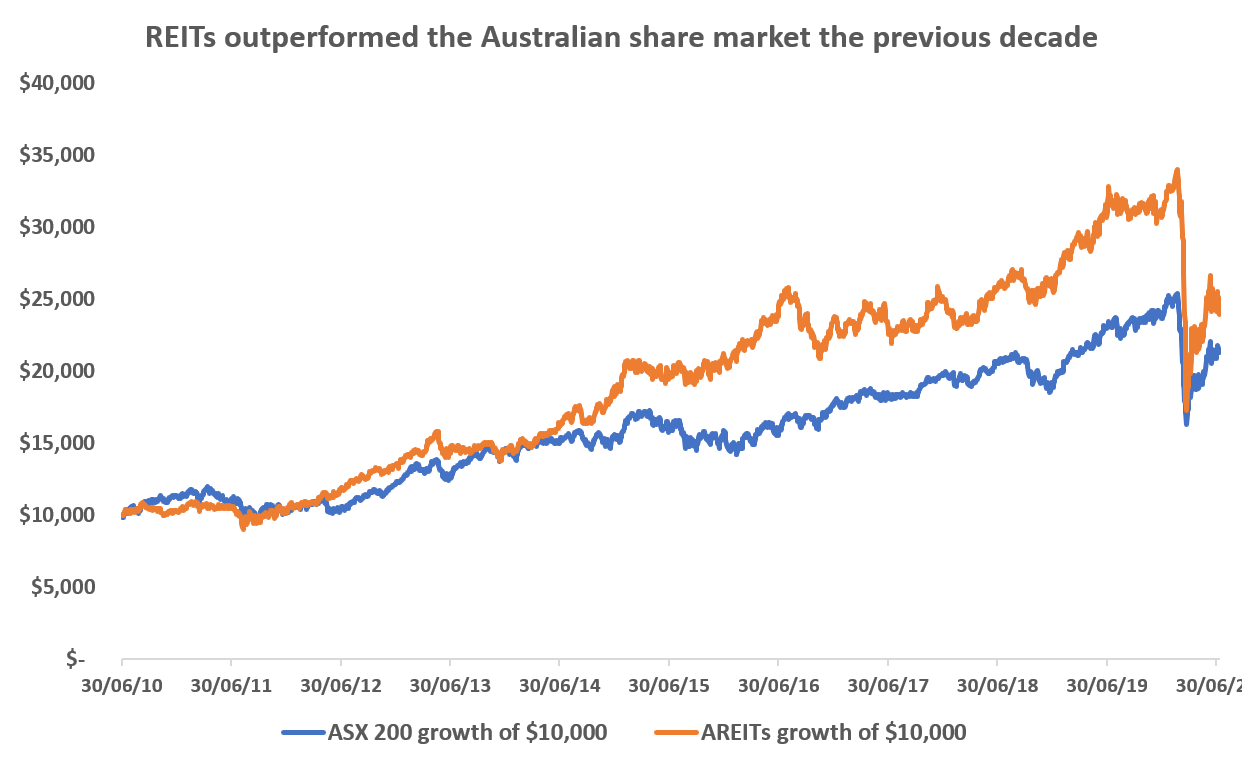

But for all their mundanity, REITs have been an engine room on the Australian share market, comfortably outperforming the past 10 years.

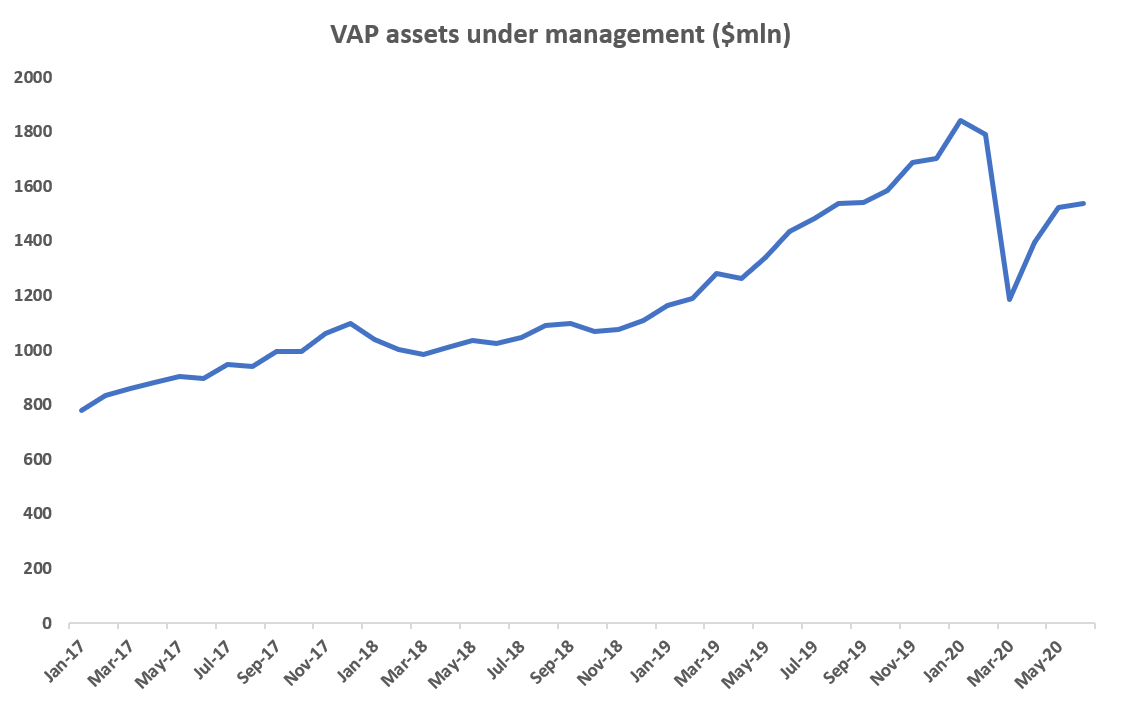

For the Australian ETF industry, REITs have also performed wonders, helping lure in $2 billion of investor money. The most popular by far - the Vanguard Australian Property ETF (VAP) - houses over $1.5 billion in investor cash.

VAP – Australia’s largest REIT ETF - alone has $1.6 billion under management

Yet with the never-ending run of the coronavirus, this important sector now stands at a crossroads. Thanks to the coronavirus, fundamental questions are being raised about the prospects of property. And the virus has forced questions about whether buying a REIT ETF like VAP is the right way to go.

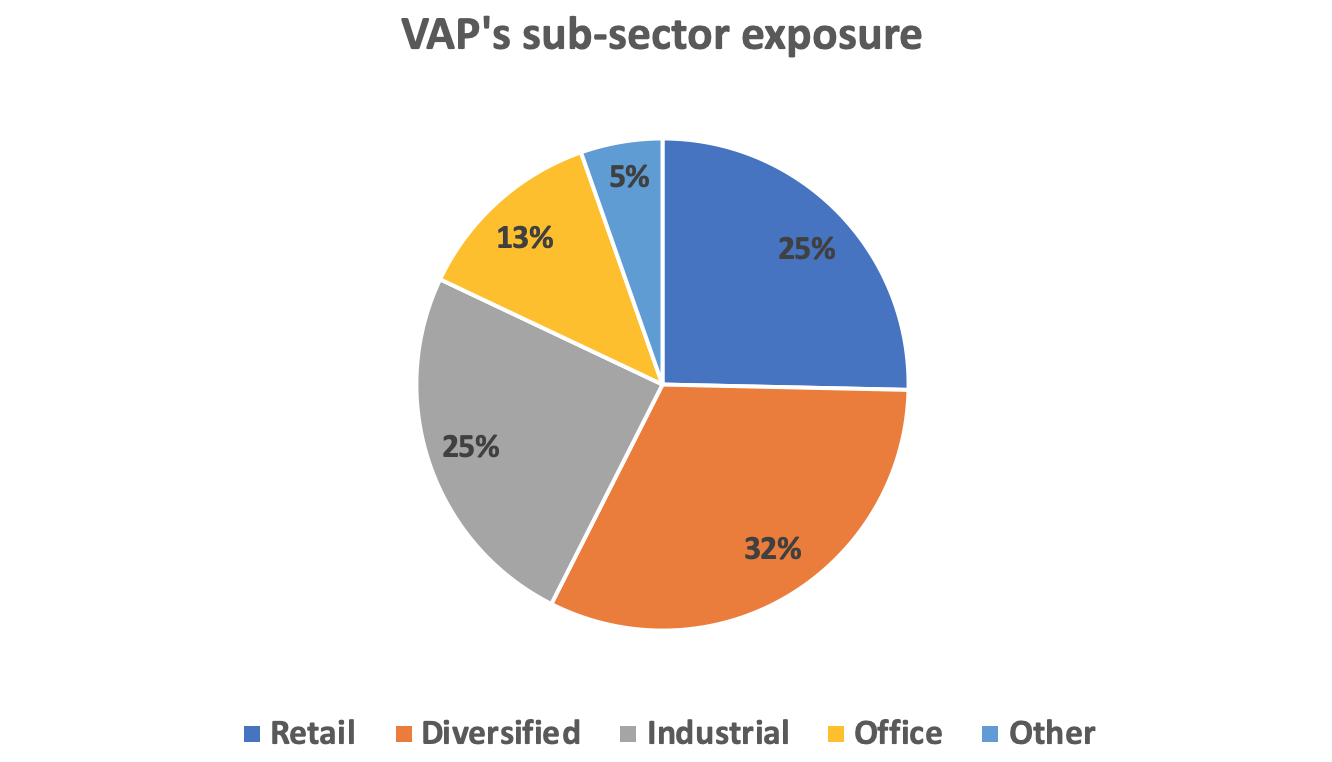

Retail REITs – shopping centres – take a large chunk of Australia’s property index

While Australian REITs are a varied bunch, they tend to focus on shopping, or “retail”. According to data from Vanguard, retail REITs take one quarter of the fund.

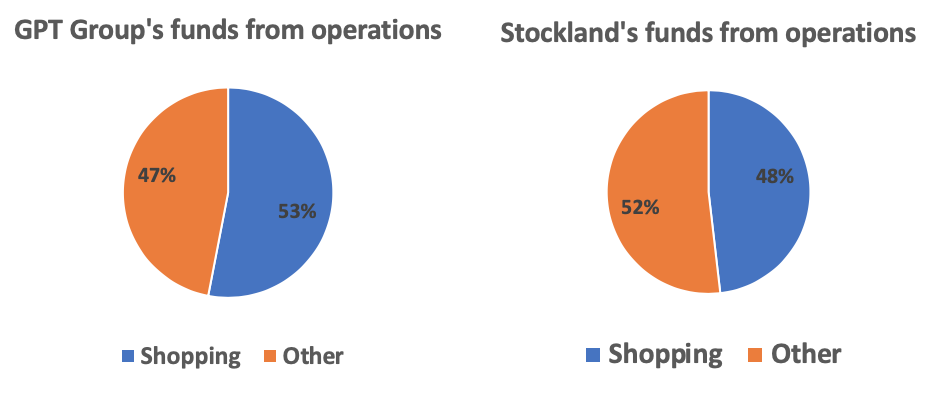

Making the shopping tilt more pronounced is the fact that many REITs officially classified as “diversified” are in fact mostly shopping centres. To take some examples: GPT Group and Stockland – two of Australia’s largest REITs which together hog 15% of VAP’s portfolio – get half their earnings from shopping centres.

"Diversified” GPT and Stockland got half their 2019 earnings from shopping centres.

By ETF Stream’s calculations, more than 40% of VAP’s underlying 2019 earnings came from retail. This means that any purchase of VAP is also in effect, a sector bet on Australian shops.

Shopping addiction goes online

Yet thanks to the internet, shopping centres increasingly look like they are at a point of no return.

Top holdings in VAP's portfolio

TickerCompanySub-sectorWeight in VAPPE ratioGMGGoodman GroupIndustrial REITs23.26%20.4SCGScentre GroupRetail REITs10.84%9.1DXSDexusOffice REITs9.66%5.9MGRMirvac GroupDiversified REITs8.22%8.1GPTGPT GroupDiversified REITs7.82%8.3SGPStocklandDiversified REITs7.60%14.7VCXVicinity CentresRetail REITs5.36%13.9CHCCharter Hall GroupDiversified REITs4.34%11.8SCPShopping Centres Australasia Property GroupRetail REITs2.25%12.4

Source: Vanguard, Bloomberg

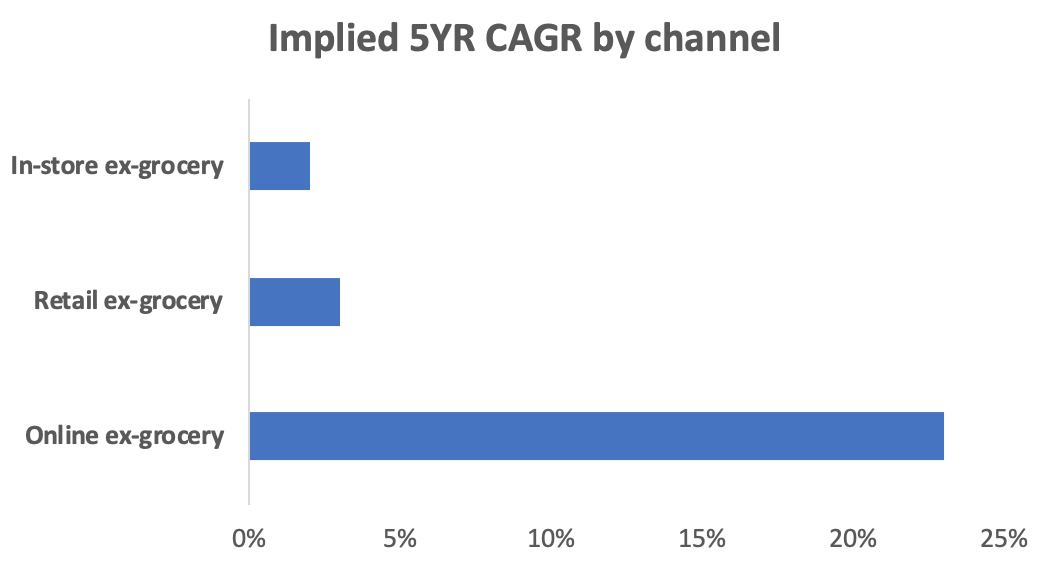

Before the coronavirus came along, things looked bad for shopkeepers. Data from UBS suggests that non-grocery shopkeeping is a zero-growth industry in Australia. This compares unfavourably with online shopping, which UBS found was growing at 23% a year.

And what’s bad for shop keepers is bad for their REIT landlords. A study from the Reserve Bank of Australia indicates that shopkeepers have been successfully pushing back on their landlords for three years, forcing them to make concessions on rent.

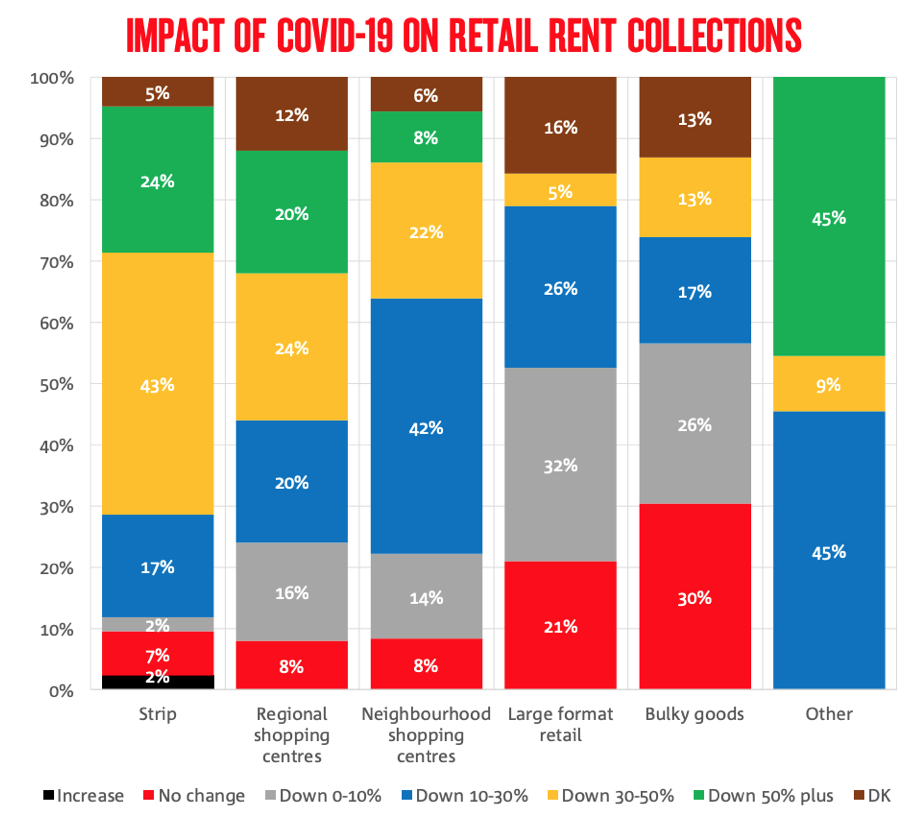

Yet after the coronavirus, things looked truly dire. According to a survey by the shopping centre industry lobby, the Shopping Centre Council of Australia, more than 150 rent waivers are being handed out per day to small and medium-sized shopkeepers. And over 45% of shopkeepers are discussing rents with their landlords.

Source: NAB. NAB’s survey of experts found significant rent declines were expected this year.

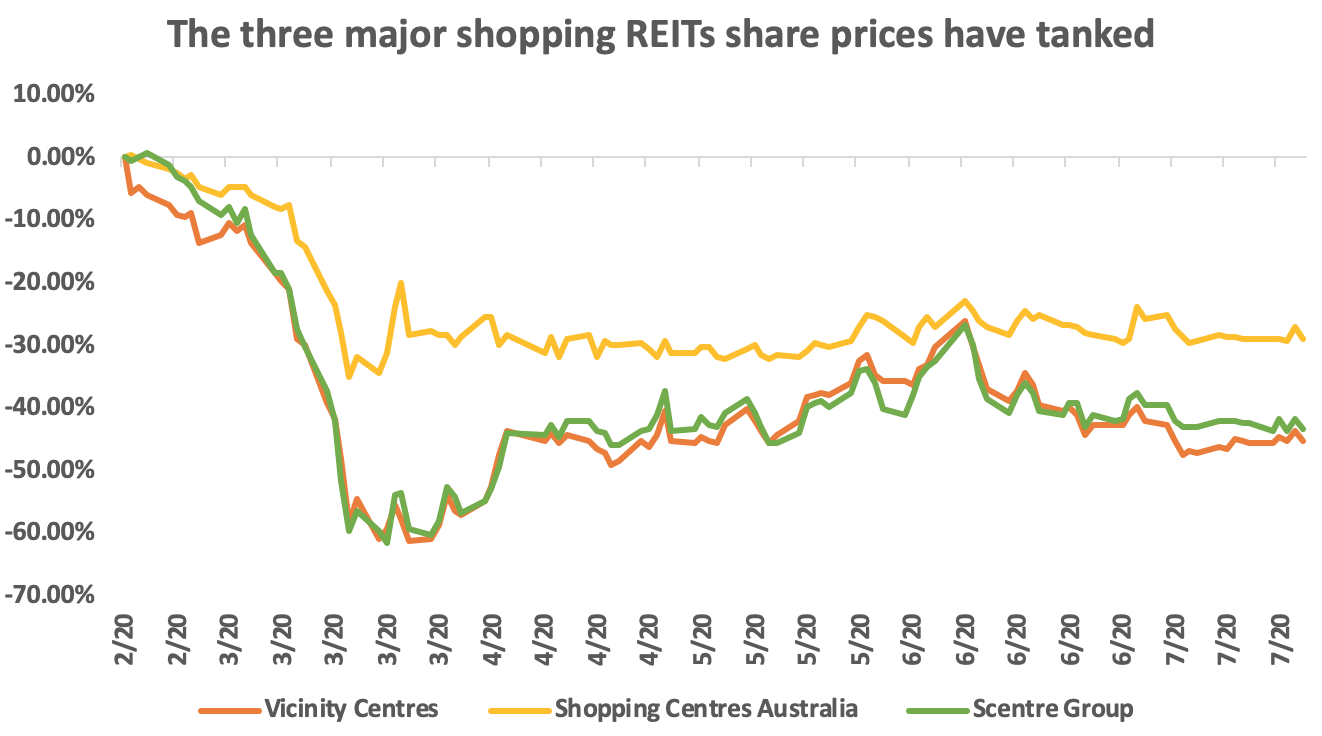

But perhaps the best evidence that retail REITs are falling into the abyss comes from what the founders of these businesses are doing.

Frank Lowy, billionaire founder of Scentre Group, Australia’s largest shopping REIT, sold out of Scentre Group completely last year. John Gandel, owner of the famous Chadstone mall, sold out of Charter Hall Retail completely last year too. While Brett Blundy, another retail tycoon, sold down part of his stake in shopping centre business Aventus last year as well.

To be sure, some retail founders are holding firm. But the overall trend among founders is clear.

So, given the concentration in retail, is there any merit in the index approach taken by VAP?

Out of the ashes

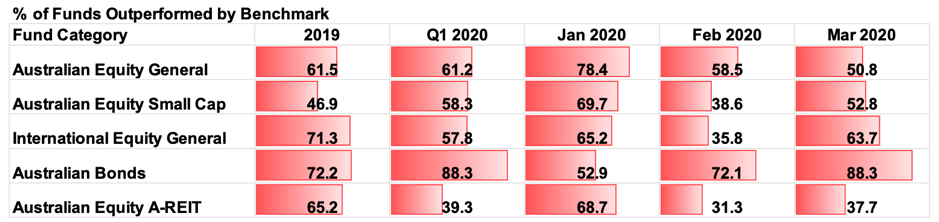

The heavy concentration in retail is a clear weakness of VAP. This may weigh in favour of stock picking. By picking specific REITs, one can weed out the shopping landlords, which look an awful lot like “value traps”. In this way, investors can focus more on other kinds of real estate – such as logistics centres and ecommerce warehouses – that are getting supported not disrupted by the internet.

And indeed, according to S&P Global, active Australian REIT fund managers have outperformed VAP since the coronavirus hit (pictured above).

That being said, there are advantages to the VAP approach – even now.

One is being able to sleep at night. Picking stocks in any meaningful quantity is always a stressful exercise. Buying stocks requires being right three times: right about which stock to pick, right about when to buy and right again about when to sell. By buying the index – and accepting the average return in a market – you can dodge the stress.

But the clearest advantage for the ETF is diversification. While shopping centres will, in all likelihood, never completely recover, other parts of the property market will. By buying the ETF you get exposure to the full shebang.

Sign up to ETF Stream’s weekly email here.