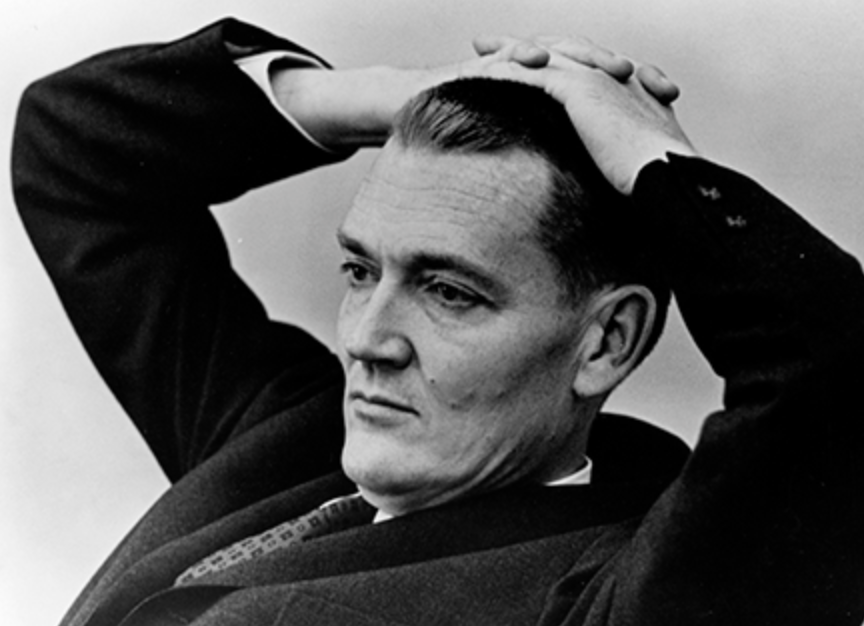

The late Jack Bogle is often taken as the founder of index investing. Many interpret this as meaning Bogle endorsed ETFs, the vast majority of which are index tracking.

But Bogle's views on ETFs were more nuanced than some of the commentary makes out. While Bogle was not wholly opposed to ETFs, he was never a fan either. Below we break down some of his opinions on the ETF industry.

Bogle rejected the chance to list the world's first ETF

America's first ETF was listed by State Street in 1993. (The world's first was listed in Canada three years earlier). But the inventor of the US ETF, Nathan Most, first approach Vanguard - and Jack Bogle in particular - hoping that they would list it.

Bogle rejected Most and turned down the chance to list the first US ETF. As he explains in his Little Book of Common Sense Investing:

"The late Nathan Most, a fine man, initially offered to partner with Vanguard, using our S&P 500 Index fund as the trading vehicle. Since I see trading as a loser's game for investors and a winner's game for brokers, I declined his offer. But we parted friends."

Bogle hated trading, and thought ETFs promoted it

Bogle hated trading and sometimes cast shade on ETFs, thinking they were mostly a trading tool.

"During the past decade, the principles of the traditional index fund have been challenged by a sort of wolf in sheep's clothing, the exchange-traded fund," Bogle wrote.

"But let me be clear. There is nothing wrong with investing in those indexed ETFs that track the broad stock market, just so long as you don't trade them. [emphasis his]"

Bogle wanted nothing to do with trading, as he thought it was a mechanism by which Wall St ripped off investors. Why? Because trading, for Bogle, was a zero-sum game. For any trade to succeed, two parties must take equal and opposite position on a given security.

But after fees, he thought trading was a negative sum game. Meaning that, in aggregate, the more trading occurs the more investors lose. He believed that if ETFs facilitated trading, the major beneficiaries of the ETF industry would be "Wall St croupiers" (brokers, trading desks, market makers, exchanges, etc.)

He thought open ended mutual funds were superior to ETFs

Bogle thought open ended mutual funds had unassailable advantages over ETFs.

First, open ended mutual funds are only priced at the close of the trading. This means that investors are always guaranteed to get in and out at NAV. ETFs, by contrast, typically trade at premiums, because authorised participants, who create and redeem ETFs with the issuer, pass on the costs of financing creation baskets. ETFs - bond ETFs especially - can also trade on discounts in some markets. These discounts have in certain markets been quite substantial -- if short lived.

Second, open ended mutual funds cost nothing to move in and out of. (Vanguard waived its entry and exit fees on its flagship mutual funds). ETFs, by contrast, always cost money to enter and exit, because brokers and market makers always charge spreads.

Bogle did not see the need for intraday pricing and intraday liquidity.

Bogle had little interest in the liquidity ETFs provide

Liquidity is often totemised by finance professionals. But Bogle had less interest in it. He began working in finance in the 1960s, when market turnover was around 25% a year. He never believed that capital markets needed ever-greater liquidity, nor really much intra-day liquidity for that matter.

While he wrote little about it, his views echoed those of John Kay, the Scottish economics professor, who wrote:

"Nothing illustrates the self-referential nature of the dialogue in modern financial markets more clearly than this constant repetition of the mantra of liquidity. End users of finance - households, non-financial businesses, governments - do have a requirement for liquidity. But these end users have very modest requirements for liquidity…But these needs could be met in almost all cases if markets opened once a week - perhaps once a year ... The need for extreme liquidity, the capacity to trade in volume (or at least trade) every millisecond, is not a need transmitted to markets from the demands of the final users of these markets."

Bogle thought smart beta ETFs were contemptible

Bogle had little time for smart beta index investing, which he held in three-fold contempt. Firstly, he thought it was an oxymoron: if investors want a beta product, what's smarter than a low cost total stock market fund?

Second, he thought they were "closet trackers" - i.e. funds that talked a big game but ultimately just tracked the index anyway. (Bogle was mostly correct on this, our analysis of US smart beta ETFs has led us to believe).

Third, he thought they were simply another "siren song" by which asset managers played the same old game of charging higher fees while underperforming.