There is no stopping the rise of ESG with the investment industry facing a growing desire from consumers for their money to be ‘doing the right thing’.

Nowhere is this truer than in the passive investment space. But the accelerating levels of ESG-based popularity is now focusing its attention on how the key ratings agencies go about their business.

Such is the premise of a new paper from Research Affiliates which suggests that index providers are incorporating their own subjective views within their ratings and this is leading to very different portfolio outcomes.

The proliferation of ESG ratings is at the heart of the issue. According to the Research Affiliates team of Feifei Li and Ari Polychronopoulos, there are circa 70 different firms now working in this area including a number of ‘rate the raters’ providers.

In order to categorise this booming ecosystem, the team set about developing a three-tiered structure consisting of fundamental providers (working with publicly available data), comprehensive providers (utilising a combination of objective and subjective data) and finally specialist providers (working on specific ESG issues).

“Based on our study of current ESG ratings providers, the majority are in the comprehensive category. Some of these providers, such as MSCI, Sustainalytics, and Vigeo Eiris, rate companies globally, while others focus on comprehensive ESG ratings data for a specific country or region,” they point out.

ETF Insight: Consistent ESG data needed for sustainable investing to avoid greenwashing issues

The overall point is different data vendors’ rating systems can vary dramatically, leading to wildly differing outcomes for the same company. This subsequently feeds through to the investment outcome for investors.

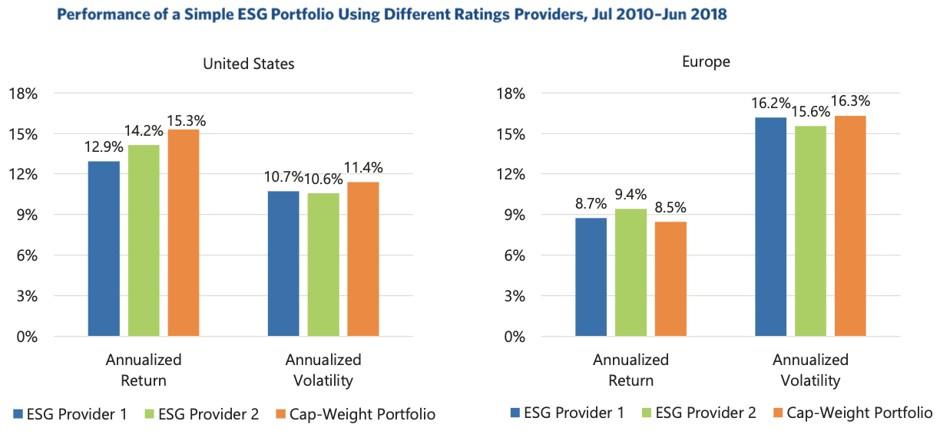

To illustrate this, the Research Affiliates team take two portfolios on offer from two popular comprehensive data vendors and compare it with a cap-weighted portfolio of their own construction.

Looking at the data for the period from July 2010 to June 2018, the team found the two provider portfolios had a performance dispersion of 70 basis points per year in Europe and 130 basis points a year in the US, translating into a cumulative performance difference of over 10% and 24% respectively. (See Chart 1)

Chart 1: Performance of simple ESG Portfolio Using Different Ratings Providers, Jul 2010-Jun 2018

Source: Research Affiliates

Analysing the difference

So, the basic question is why the difference in performance? Or as the Research Affiliates team put it, why do portfolios constructed on seemingly similar criteria have such lowly correlated or unrelated investment outcomes?

Li and Polychronopoulos point out that it comes down to the details of the individual metrics that are used for sorting and selecting the stocks. “Individual company ratings for ESG characteristics from the two different providers are quite different,” they write.

“ESG ratings consider hundreds of metrics, with many of them qualitative in nature. Because some metrics are included by one provider but not the other, translating a qualitative metric into a numerical quantity largely depends on the provider’s algorithm.”

ETF Insight: Are ETF and index providers taking ESG seriously?

A further consideration is there will be differences between how providers weight any given matric versus another. An example Li and Polychronopoulos highlight is Facebook where they point out that how vendors calculate the social media giant’s environmental score can place it either in the top decile of the universe of stocks on in the bottom half.

The chart below shows how the two providers differ in their approach to Facebook, and how this affects the outcome of each score for the company. (See Chart 2)

Chart 2: Facebook Environmental Rating Breakdown by provider as of Dec 31, 2017

Source: Research Affiliates

“The bottom line is that the two data vendors are including distinctively different sets of metrics to gauge the environmental characteristics of Facebook, assigning different weights and different evaluations of similar metrics, which results in Facebook being rated as a top firm by one provider and a below-average firm by the other provider,” they point out.

Indeed, each ratings provider takes a unique approach – it might well be a selling point – varying on both the particular metrics and varying how they categorise these metrics.

State Street: Five ESG trends to watch in 2020

“When assessing a ratings provider, investors must look beyond the basics of a provider’s coverage and history to examine the methodology the provider uses in its rating process as well as considering the methodology’s alignment with the investor’s own ESG preferences,” Li and Polychronopoulos conclude.