Cyber security is designed to reduce the risk of cyber attacks and protect against the exploitation of networks and technology. It’s intended to be a big part of the future, but should you be investing in it?

The sector has been growing at a fast pace in recent years with the advent of cloud technology and storage. However, ETF investors have only been given a choice in the area in the last year with four of the five ETFs offering access launched in the past twelve months.

It’s good news for investors as some of the companies included in the business have been doing well.

They include the likes of Akamai Technologies, which is an American content delivery network and cloud service provider. Its content delivery network is one of the world's largest distributed computing platforms, responsible for serving between 15% and 30% of all web traffic. Its one-year return is 21.7%.

Other companies include Symantec Corp, which again is a US based company specialising in software providing cybersecurity software and services. It’s also a Fortune 500 company and a member of the S&P 500 stock-market index. As an individual stock it has returned over 15% in the past year.

This is just a snapshot of what cyber security looks like and the good news is that if you want to invest in it, then ETFs are making this possible.

The increased use of cloud-based systems and services mean there is greater risk of cyber attacks.

The chart below from Accenture shows that no sectors are immune from potential cyber attacks and the impact financially is great.

Source: HANetf/Accenture

It states that: “cybercrime is likely to expand into robotics, artificial intelligence, 3D printing and industrial biology. The growth of the Internet of Things (IoT) allows nearly every car, airline, home appliance or office equipment to be virtually connected, exposing further critical loopholes for hackers to exploit.”

It finds that cybersecurity spending is rapidly rising, with spending on course to exceed US$124bn by 2019.

There are several ways to access cyber security.

There are two pure cyber security ETFs on offer on the London Stock Exchange from L&G. There are also several other cloud based ETFs that include companies operating in the cyber security field.

The HAN-GINS Global Innovative Technology UCITS ETF (ITEK) is one of these and is made up of eight so-called mega themes, one of which is cyber security.

The best performing of the pure cyber security exposure ETFs year-to-date is L&G’s cyber security ETF (ISPY).

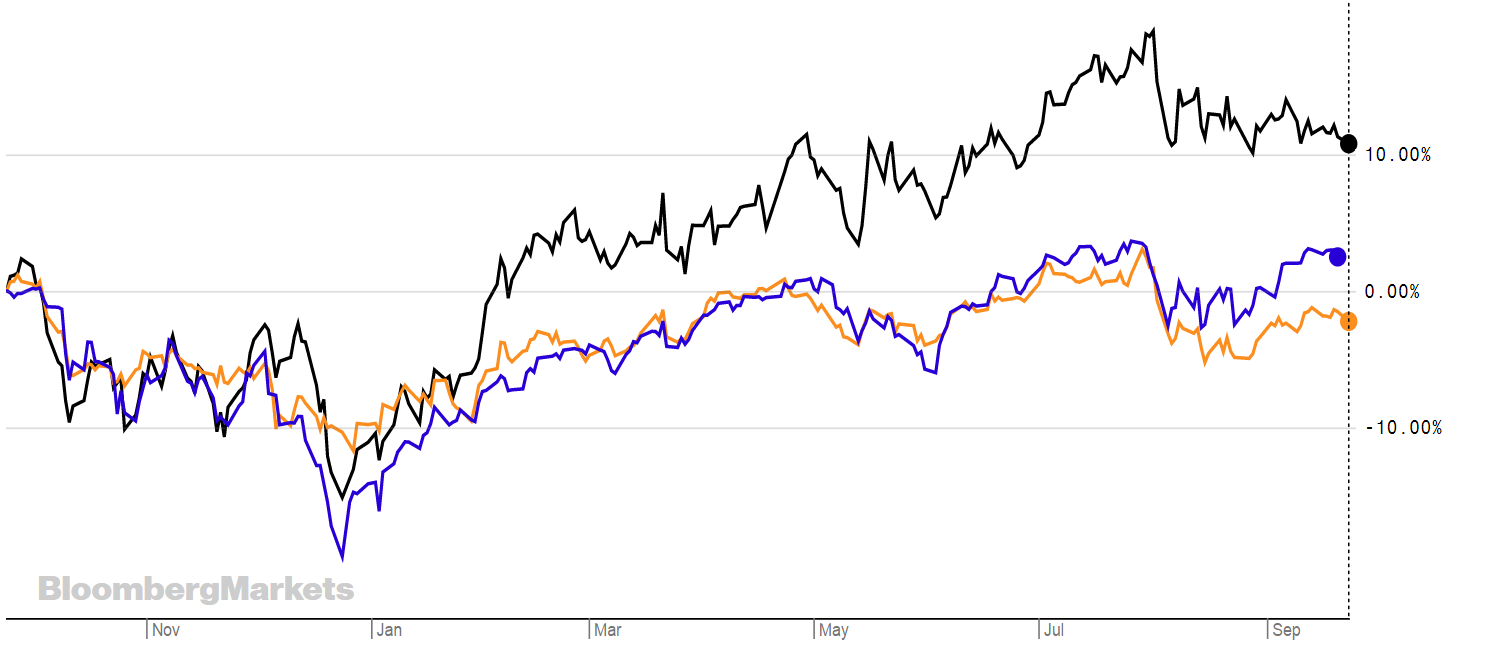

The graph below shows L&G’s cyber security ETF (ISPY) in black over the past year along side the FTSE 100 in orange and the S&P 500 in purple. It’s one-year returns is 12.4%, but it’s year-to-date return is 24.60%.

Source: Bloomberg

Hector McNeil, co-founder and co-CEO of HANetf, said: "A lot of ‘mega themes’ are converging."

ITEK tracks an index of leading companies that are driving innovation through the provision of disruptive technologies. Technology sectors include robotics and automation, cloud computing and Big Data, cyber security, future cars, genomics, social media and blockchain. These are also known as so-called ‘mega trends’.

It’s worth investing in because with more industries relying on automated systems, cyber security is becoming an enormous deal. This is converging with cloud as well as with more businesses seeing this as the best way to manage their hardware and software needs.”

“Existing products are OK but AI data scraping is getting better, while I think improvements can be made in some of the indexes available, they are still good,” he says. “The space will only grow. Automation is generally booming, as well all the mega themes, so it can only expand.”

There are five ETFs available on the London Stock Exchange with exposure to cloud services and include cyber security stocks. Of these four were launched in the last year.

Despite the potential for the asset class investors have been slow to move into these ETFs. Assets between them stand at around $970m.

The table below lists a number of the ETFs available to investors.

The best performing of all of these this year is the HAN-GINS Cloud Technology UCITS ETF (SKYP), which has returned 28.37% at the time of writing. It tracks the Solactive Cloud Technology index which includes stocks such as Alphabet, but also Fortinet, which is a cybersecurity firm.

The list below includes some of the ETFs that touch on cyber security.

RTN

ISPY

USPY

SKYY

SKYP

SKYU

KLWD

FSKY

WCLD

ITEK

ETFYTD TERINDEXL&G Cyber Security UCITS ETF25.15%0.75%ISE Cyber Security IndexL&G Cyber Security UCITS ETF21.80%0.75%ISE Cyber Security IndexHAN-GINS Cloud Technology UCITS ETF24.91%0.75%Solactive Cloud Technology IndexHAN-GINS Cloud Technology UCITS ETF28.37%0.75%Solactive Cloud Technology IndexFirst Trust Cloud Computing UCITS ETF21.80%0.60%ISE Cloud Computing IndexWisdomTree Cloud Computing UCITS ETFn/a0.40%BVP Nasdaq Emerging Cloud NTR IndexFirst Trust Cloud Computing UCITS ETF23.64%0.60%ISE Cloud Computing IndexWisdomTree Cloud Computing UCITS ETFn/a0.40%BVP Nasdaq Emerging Cloud NTR IndexHAN-GINS Innovative Technologies UCITS ETF19.61%0.75%