US and European ETFs see huge gains

ETFs continued to gain ground in September, with big money flowing into passive products in both Europe and the US.

According to data from Ultumus, American ETFs brought in $26 billion in assets in September while European ones brought in $8bn. The difference in inflows has helped the US ETF market stay significantly larger than its European counterpart with $3.1 trillion total assets, to Europe's $738bn.

iShares comfortably wins in Europe and the US

Among ETF provider, iShares kept its crown in September, raking in more money on both continents by considerable margins. iShares brought in $16.4bn in the US and $4.6bn in Europe.

In the US the two other standout performers were the cost-cutter Charles Schwab, which brought in just under $2bn but coming off a much lower base. Schwab's quick appeal likely owes to the fact that its ETFs cost the least; in fact they're almost free.

Vanguard continued its strong gains bringing in $9.4bn. Vanguard, which is structured as a mutual rather than a corporation, is known for the brand loyalty that it draws.

Europe's other standout and only other ETF provider to hit the billion mark was Amundi, an ETF arm of French banks Crédit Agricole and Société Générale. Amundi brought in $1.4bn.

The biggest losers, by contrast, were State Street in the US. State Street's losses stem mostly from its famous S&P tracker SPY, which has struggled with price competition from iShares competitor product IVV. In Europe the biggest loser was commodities specialist ETF Securities due to investors exiting precious metals, especially gold.

Index providers: no clear trend in September

Indexes from British provider FTSE Russell proved popular among Americans, with FTSE-tracking indexes seeing more money come their way than any other index family. FTSE indexes brought in $7.5bn, two billion ahead of the second most popular index family, Bloomberg.

In Europe, however, STOXX and MSCI indexes were the clear favourites, with $2.65bn coming both their ways.

No obvious trend suggests itself in either market.

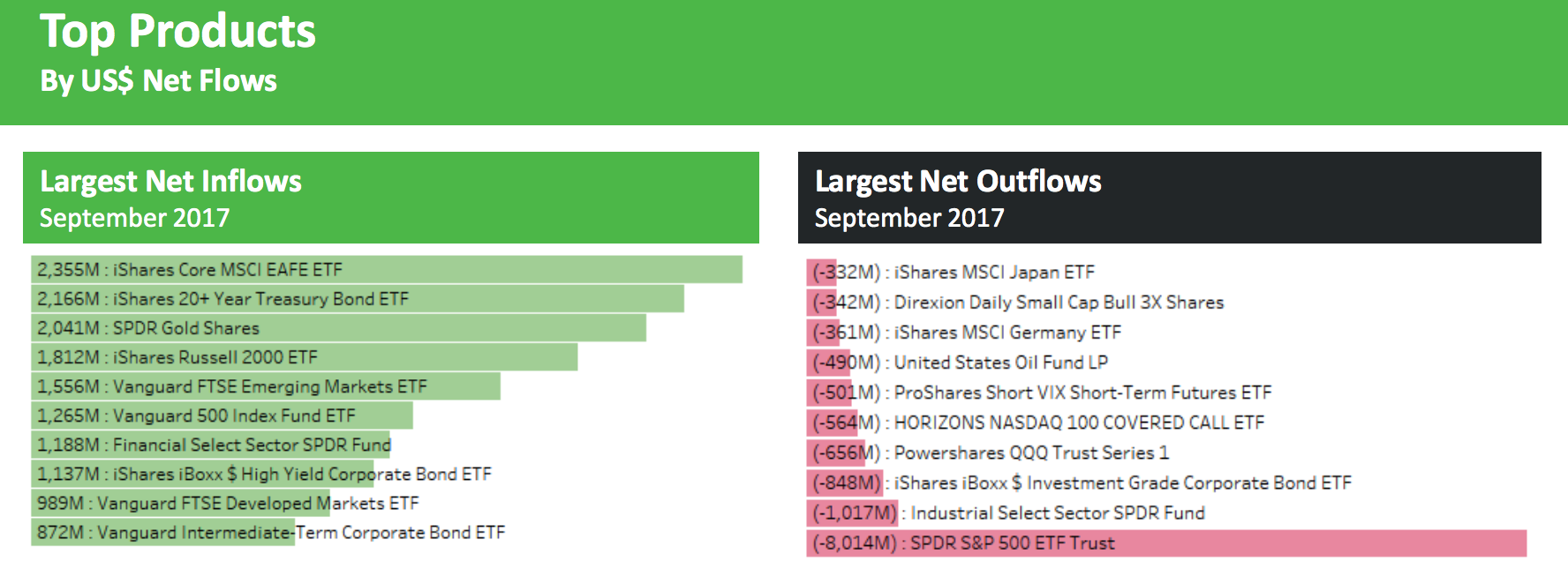

Products: ETFs invested overseas see most gains

Both European and US investors thought the grass was greener overseas and bought ETFs accordingly, with ETFs that track equity markets outside investors' home countries seeing the biggest inflows.

In the US, iShares Core MSCI EAFE ETF (IEFA) gathered the most with $2.4bn, followed closely by iShares 20+ Year Treasury Bond ETF (TLT).

In Europe, the Amundi ETF MSCI Emerging Markets UCITS ETF (AEEM) gathered the most with$796 million, followed by the iShares Core MSCI World UCITS ETF USD (SWDA) with $583mn.