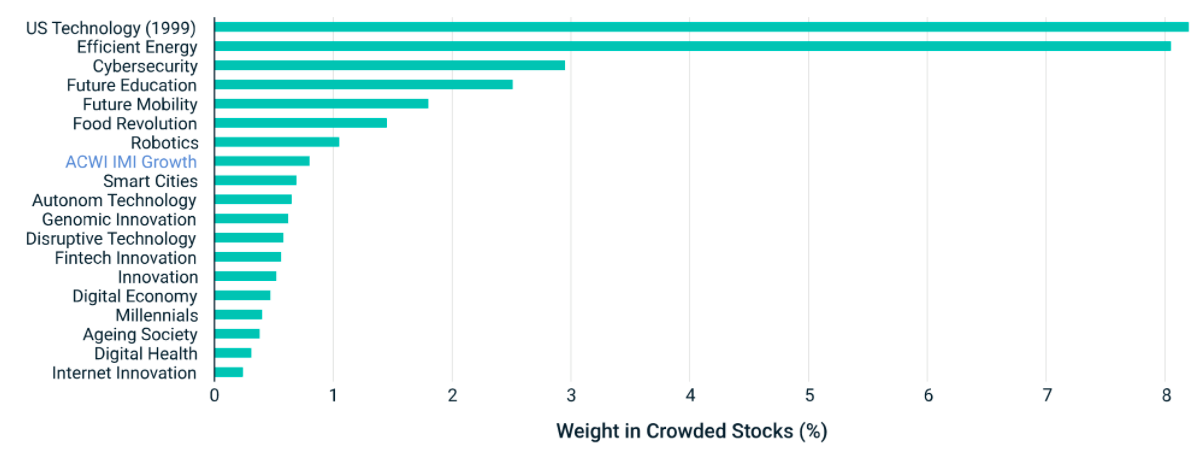

Clean energy stands out as a thematic exposure more at risk of stock over-crowding than any of its contemporaries, according to research conducted by MSCI.

The report, entitled The Pressure of the Crowd: Stress Testing Thematic Indexes, noted MSCI’s ACWI IMI Efficient Energy index had 8% crowded stocks by weight, versus the MSCI ACWI Investable Market Index (IMI) Growth index.

This is significantly more than the next-worst offender – the MSCI Cybersecurity index – which is 3% crowded, and resembles the crowding levels seen in smaller-cap US technology stocks in 1999, co-authors Anil Rao, executive director of equities solutions research at MSCI, and Thomas Verbraken, executive director of MSCI research, said.

Chart 1: Levels of crowding in thematic indices

Source: MSCI. USA Technology refers to the USA Small and Midcap Information Technology index as of April 1999. All other weights are as of March 2021 and use the MSCI integrated stock-crowding score.

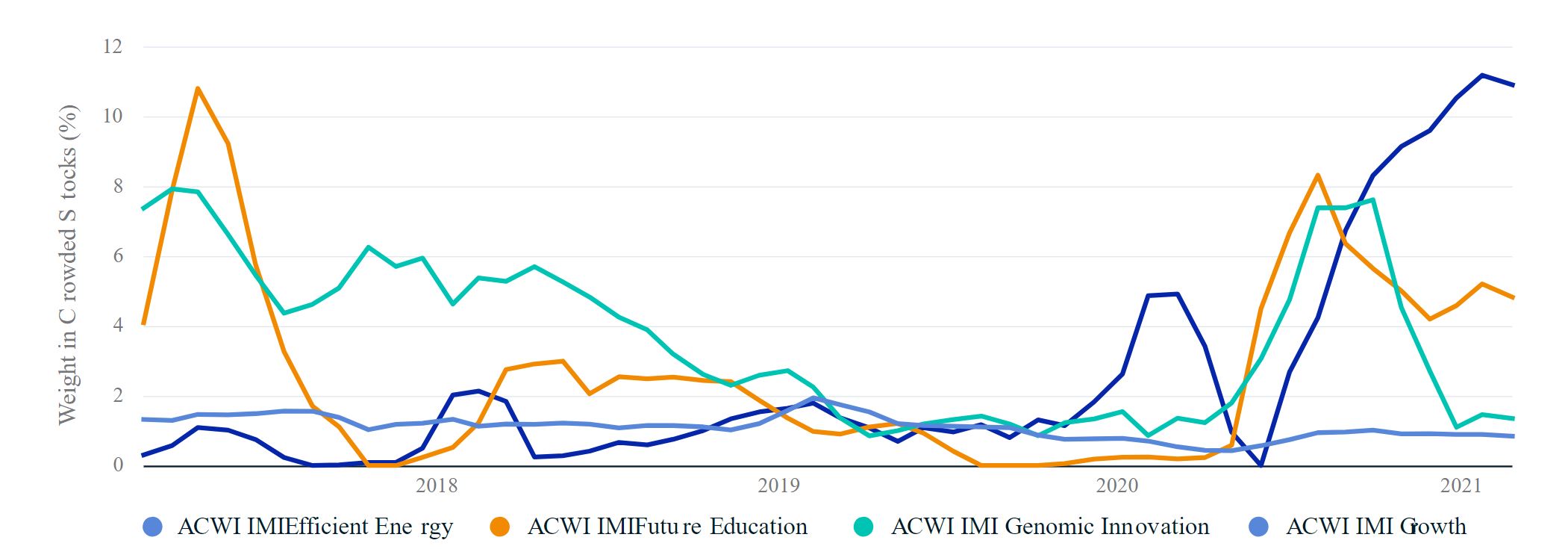

Based on stock valuations, trading volume, volatility, momentum and short interest, efficient energy’s crowding remained modest since 2017 but became progressively more crowded through 2020 as equity markets rebounded and clean energy stocks posted stellar returns.

Similar trajectories were seen in future education and genomic innovation themes until the end of 2020, with investors seeking exposure to companies involved in telepresence and gene sequencing. However, unlike clean energy, vaccine results saw these indices become less crowded towards the end of the year, while efficient energy maintained its trajectory.

Using its crowding data up to March, MSCI created returns forecasts for each theme under different market conditions, with optimistic, benign and severe scenarios representing reflation, overheated economy and stagflation, respectively.

Unsurprisingly, the efficient energy theme is the most volatile in each scenario and posts the most significant decline in the ‘severe’ scenario – underperforming the broad growth index by 10% and the ACWI IMI index core exposure by more than 20%.

Chart 2: The history of crowds

Source: MSCI. Weights are measured monthly and are shown from 2017 onwards, for thematic indices for which simulated history is available. Values shown are the rolling average over the trailing three months.

The company’s research finds this can largely be attributed to style factors, with momentum and volatility seen as the largest detractors during a severe scenario. Incidentally, the energy efficiency index has large positions in both the US and European high-momentum stocks offering solid returns in 2020.

The crowding warnings come after huge inflows into two BlackRock clean energy ETFs led to S&P Dow Jones Indices revamping the underlying index in order to avoid a potential liquidity shock.

According to data from Bloomberg Intelligence, clean energy ETFs in Europe alone have seen $5.3bn inflows since the start of 2020, as at 23 April, which has artificially driven up the price of many small-cap names directly involved with the theme.

MSCI concluded the pressure from crowding was real but the real impact of these scores divided opinion. At least in partially, efficient energy’s current drawdown might be explained by its relatively high level of crowding and resulting factor sensitivity.

“Investors in thematics face a challenge in balancing exposure to long-term trends such as renewable power generation given substantial recent inflows,” it added. “The current drawdown in the efficient-energy theme, however, could be explained, in part, by its elevated level of crowding and its factor sensitivity in the preceding months.”

Further reading