A lot of people talk about the expansion of the ETF industry. But an aspect that gets less attention is the growing numbers of ETFs that are dying off and getting liquidated.

A good example of ETFs dying off in recent times has been novelty ETFs.

In 2017 novelty ETFs were all the rage and coming to life like wildfire. We saw all manner of funds pop up that promised all kinds of weird and wonderful exposures. Including: sports fans, iconic brands, Republican and Democratic party policies, Quincy Jones, millennials spending habits, obesity - and more.

But all good things must end. And 2018 seems to be a year the novelty ETF died. Showing just how short some cycles can be.

Liquidation data for 2018 shows that many of the funds sent to the graveyard in 2018 were novelty ETFs. These include:

Global X Iconic U.S. Brands ETF

Democratic Policies Fund

Republican Policies Fund

Direxion iBillionaire Index ETF

Nashville Area ETF

In some cases they were listed for less than 12 months before being closed.

For my part, I think it's a shame that some of these funds were closed, as many of them gave colour to the industry. Some of them also had good evidence behind their investment strategies. For example, a Republican policies ETF: research shows that companies with closer political ties to incumbent governments do indeed reap benefits.

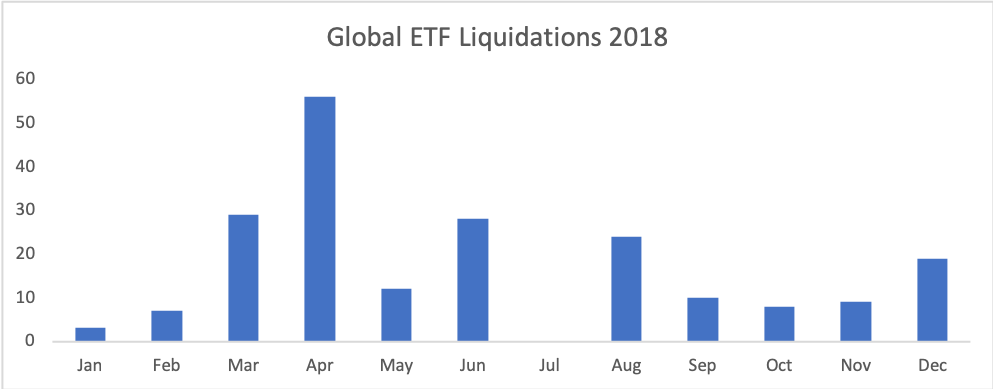

But the data also tells a story on why these funds were closed and closed so quickly at that.

First, many novelty ETFs were listed by smaller ETF providers with less cash to burn. This means that if the fund doesn't hit - or head towards - break even assets quite quickly the ETF provider can run out of money. Breakeven AUM for an ETF is usually around $50M.

Second, new and riskier types of asset exposures tend to be the first to get whacked when the bear comes out of the woods. As 2017 was one of the strongest bull runs in history, investors may have been more willing to punt on novel exposures. Thundering bull runs, after all, can make investors feel invincible, feel richer and feel more inclined to take a punt. We saw this most visibly with digital assets like cryptocurrencies in November 2017.

But in the 2018 bear market, with volatility high and equity performance low, investors were less willing to take a punt. A risk-off mood can make selling a novelty ETF as a small ETF provider - with less track record and less brand recognition - a lot harder.

Thirdly, and relatedly is that many of the novelty ETFs, alas, failed to perform while they were alive. Investing, as we all know, requires discipline and patience. Yet, as we also all know, performance chasing in the asset management industry is endemic. Advisors and institutional allocators know they shouldn't chase performance, yet all too often they do so anyway.

I have no idea what the next trend will be. But in 2019, it seems safe to say that the book has closed on novelty funds.