This three-part report, co-written with Chen Xin'er and Yu Maoping, is designed to provide foreign investors interested in the Chinese ETF and equity markets a basic overview of the investment opportunities.

The article provides a brief review of China's ETF markets, which are listed on the Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE). Both were established in 1990 and remain under the supervision of China Securities Regulation Commission (CSRC).

The second article will explore the history and current state of play of ETFs in China, including statistics about market size, number of ETFs, different types of ETFs and their performance.

The third article will look at ETF issuers. There are 34 issuers in the market and 161 ETFs. The largest issuer is GF Fund Management they hold up to 17 ETFs.

Review on China's ETF Markets

There are two stock exchanges in mainland China: the Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE), with a current daily trading volume of more than $75 billion.

The Shanghai Stock Exchange was established on 26 November 1990 and started operation on 19 December 1990. It is directly administrated by the China Securities Regulation Commission (CSRC). 1367 stocks are traded on Shanghai Stock Exchange on a daily basis with a total stock market capitalization of $4.7 trillion and $35bn turnover. The Shanghai Stock Exchange trades in T+1 model, which means you cannot change your position until next trading day.

Individual foreigners cannot invest directly in Shanghai Stock Exchange.

Source: Wind Database

This graph displayed the overall stock performance of SSE, with the peak of 6092 reached on October 16, 2007.

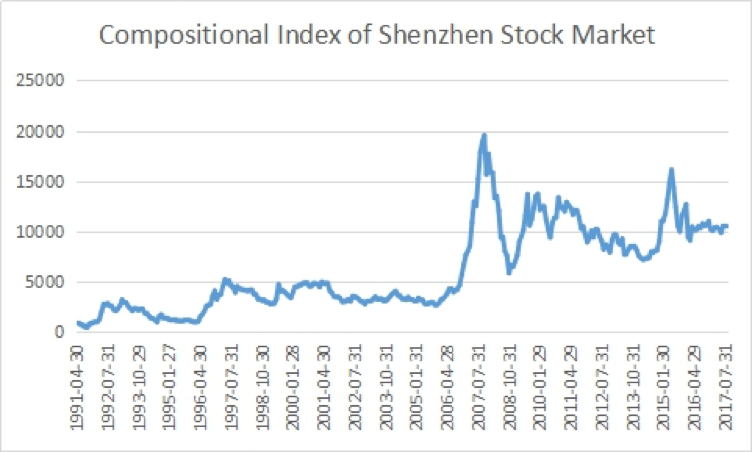

Source: Wind Database

Shenzhen Stock Exchange (SZSE) was established on 1 December 1990 and supervised by China Securities Regulatory Commission (CSRC). It has more than 2000 stocks with a trading value of more than $38 billion. The stock market value is $ 3.3 trillion.

The currency used in SZSE is RMB. SZSE also uses the T+1 trading method. According to the QFII, only institutional investors of fund management companies and securities companies are entitled to invest in SZSE.