Private equity keeps growing and growing but it's a difficult sector to break into if you don't have a huge amount of money.

If you don't know what private equity is, it's investing in companies that aren't listed on stock markets. Normally, sizeable private equity funds buy stakes in private companies or own them outright. It's a relatively opaque market and investors' cash is usually tied up for several years.

On the plus side though, it's a sector that's delivered good returns as well as weathering the recession fairly well.

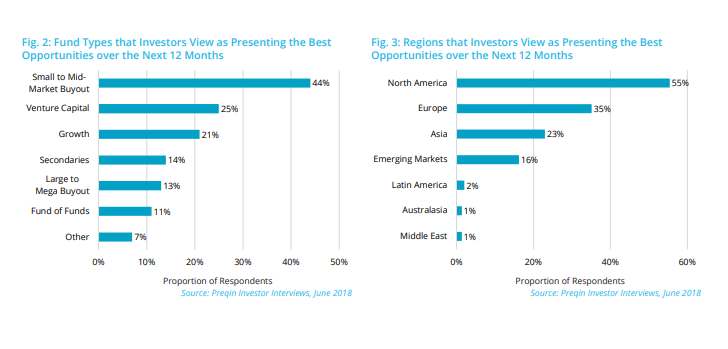

A survey by Preqin found that 86% of surveyed institutional investors planned to maintain or increase their investments in private equity. Small to mid-market buyout funds continue to present the best opportunities, according to the 44% of respondents. The deal market is also considered competitive because there are more businesses in the lower middle market meaning there is more choice. The chart below shows the types of fund and regions where investors think the best opportunities will be in private equity.

Source: Preqin

There are other reasons to look to private equity. A recent research paper from the Kellogg School of Management (KSM) at Northwestern Univserity found that private equity companies are able to manage recessions better than many other asset classes.

Filippo Mezzanotti, a professor of finance at Kellogg School, Shai Bernstein of Stanford University and Josh Lerner of Harvard University, did a study looking at private-equity-backed firms in the United Kingdom. The team analysed income reports and balance sheets of nearly 500 private equity-backed firms in and around the time of the global financial crisis. At the same time they matched non-private equity companies that were similar in size and financial profiles.

They found that while all the firms in both of their samples cut their investments sharply during the crisis, private equity-backed firms did so much less than non-private equityfirms. In fact, the private equity firms spent 5.9% more than the non-private equity ones.

"If they were more fragile, we should expect that they're cutting investment more" than non-private equity firms, Mezzanotti says. "This activity happened right away in 2008, and it seems to be relatively persistent in the following years."

One lawyer I spoke to added that another recession is inevitable, however unlike the last one - which was not anticipated widely - this one will be (to a large degree) and therefore plans are in place.

They add: "Typically PE [private equity] firms want to have raised as much as possible beforehand to ensure steady fee flow through the tough initial years, but also to preserve dry powder to buy cheapened assets. PE is pretty robust in recessions/down turns, if only because the term of their funds are typically 10 years which allows them to be patient with deployment of capital and management of assets."

Interest rates going up are unlikely to impact private equity, other than they may see some additional (negligible) return for cash drawn from investors but yet to be invested and held in short term investment accounts (eg. money market funds).

One way investors can get in on this exposure is through ETFs, which track listed private equity. This is where private equity investment companies have listed on the exchanges and include the likes of 3i Group, Apollo, Global Management, Blackstone Group and KKR.

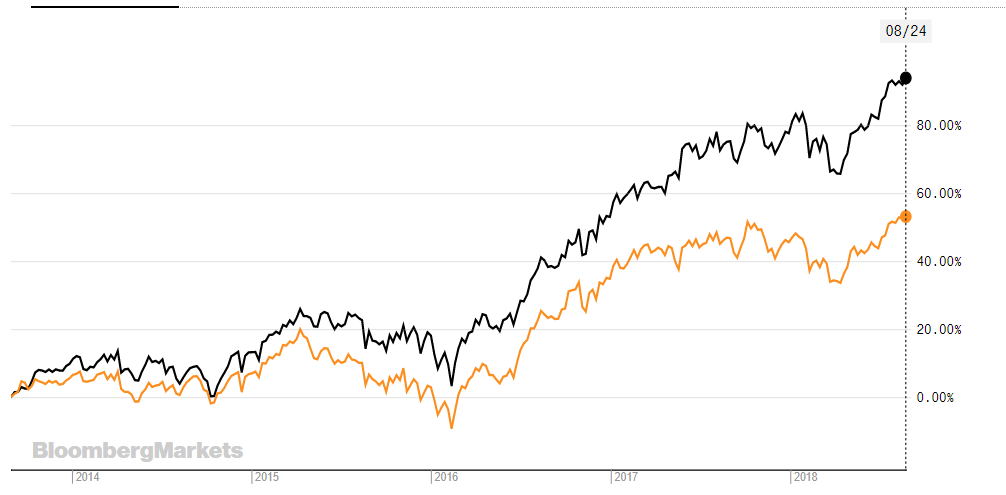

Source: Bloomberg

On the London Stock Exchange, there are only three ETFs on offer. iShares Listed Private Equity UCITS ETF GBP (IPRV) is shown above in orange against Xtrackers LPX Private Equity Swap UCITS ETF GBP (XLPE) in black. The third ETF is the dollar version of IPRV which has the IDPE ticket.

IDPE and IPRV are the oldest of the three having been launched in 2007. They track the S&P Listed Private Equity Index. IDPE has returned 2.82% this year, 9.71% over one year and 12.04% over three years. However, the sterling version (IRPV) has done better returning 7% this year, 9.33% over one year and 18.50% over three years. Both cost 0.75% a year. Assets under management are $429 million.

The Xtrackers ETF (XLPE), has been around since 2008 and has done the best this year returning 8.5%. It is pricey though with a management fee of 0.50% and an expense ratio of 0.7%. It is also synthetic, which means the ETF uses a swap to get exposure to the index rather than buying stakes in companies. We write more about this here and here. The ETF tracks the LPX Major Market Total Return Index, which offers exposure to Listed Private Equity. The ETF is smaller than its iShares counterparts with only €181m in AUM.

XLPE

0.7% (expense ratio)

(IDPE)

(IPRV)

ETFTERYTD RTNIndexXtrackers LPX Private Equity Swap UCITS ETF0.50% (m'ment fee)8.50%LPX Major Market Total Return IndexiShares Listed Private Equity UCITS ETF USD Dist0.75%2.82%S&P Listed Private Equity IndexiShares Listed Private Equity UCITS ETF USD Dist0.75%7%S&P Listed Private Equity Index

Source: Bloomberg & LSE