The underlying holdings in two clean energy ETFs face concentration and liquidity risks following record demand over the past 12 months, according to research conducted by Société Générale, even causing the index provider, S&P Dow Jones Indices (SPDJI), to launch a market consultation.

Two BlackRock strategies track the S&P Global Clean Energy index, the iShares Global Clean Energy UCITS ETF (INRG) and the US-listed iShares Global Clean Energy ETF (ICLN).

The two ETFs have seen a combined $7.5bn inflows over the past 12 months, as at 22 January, according to data from ETFLogic, driven by US President Joe Biden’s US-election pledge to commit $2trn to climate-related infrastructure projects.

Despite the strong inflows, SocGen analysts warned the index design has the potential to cause liquidity issues in the underlying constituents.

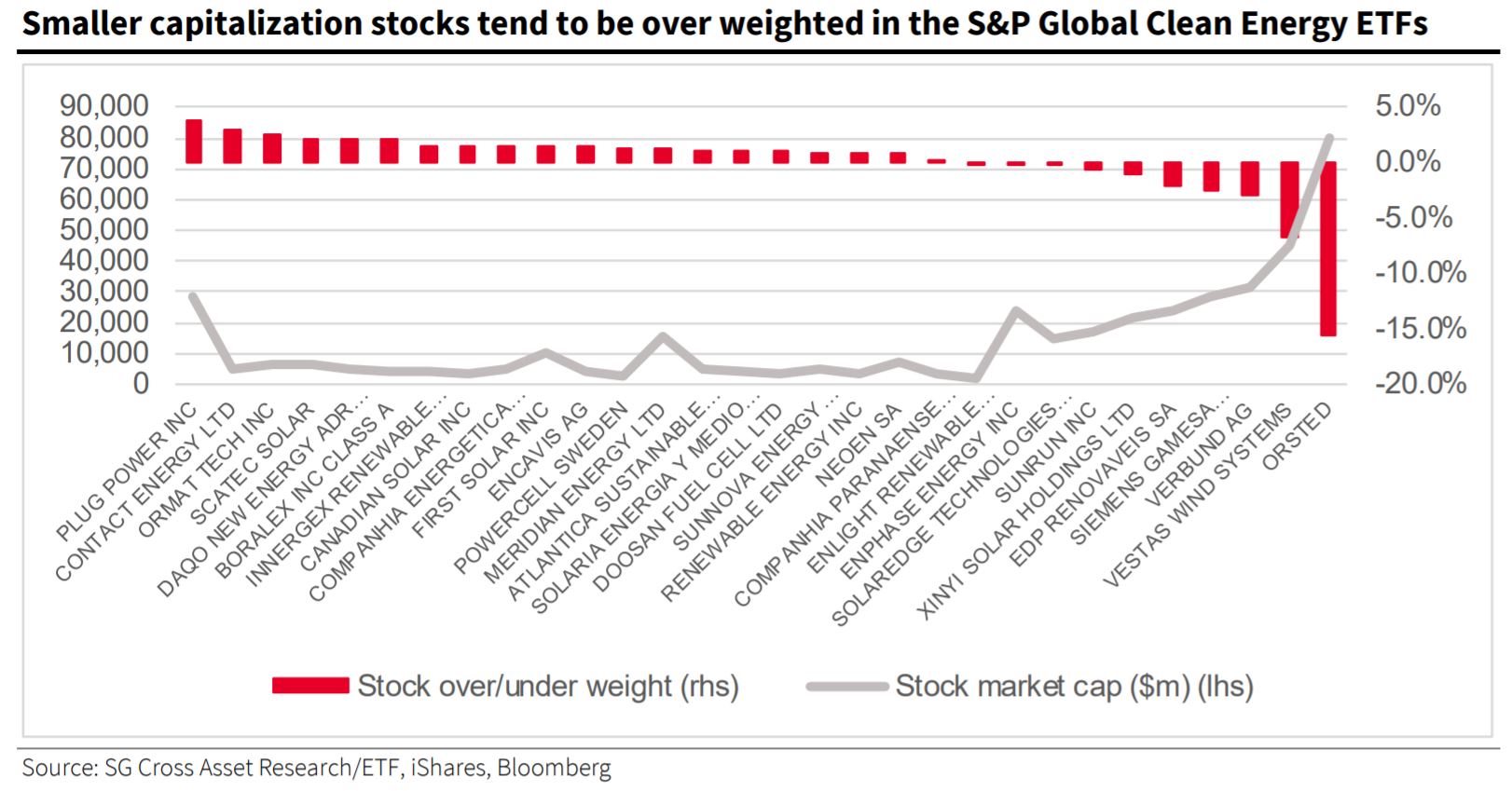

Rebalanced semi-annually, the S&P Global Clean Energy index tracks the performance of 30 companies exposed to the clean energy revolution and is weighted by market cap but has a single constituent weight cap of 4.5%.

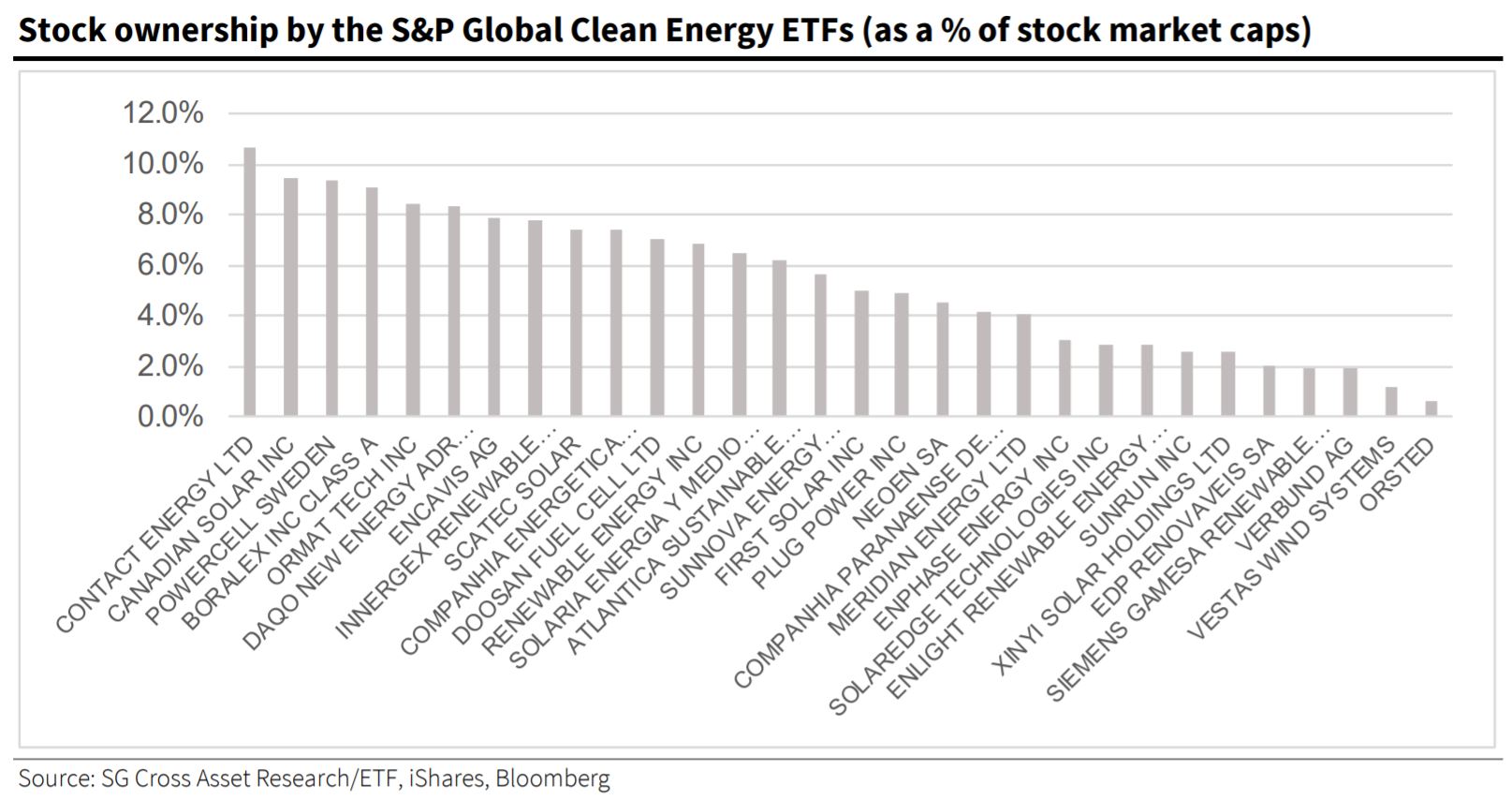

This 4.5% cap leads to a natural bias towards the smaller sized companies in the index meaning the huge inflows has seen BlackRock’s stock ownership increase dramatically in those companies, in particular.

Highlighting this, the two ETFs combined hold more than 8% of the market cap of six companies including Contact Energy, Canadian Solar, PowerCell Sweden, Boralex, Ormat Technologies and Daqo New Energy.

Sébastien Lemaire, head of ETF research at SocGen, and co-author of the report said: “These large holdings might have contributed to some buying pressures on the related stocks and, conversely, could lead to selling pressures if the ETFs were to offload all or a large portion of their holdings owing to index composition changes and/or ETF outflows.”

With some stocks currently above the 4.5% cap, the report stressed the semi-annual rebalance could lead to “significant” buying or selling pressure.

To highlight the potential liquidity risks resulting from a rebalance, the analysts conducted a theoretical rebalance from the index.

The report found Contact Energy, which has a $5bn market cap, would suffer $182m outflows if the two ETFs rebalanced now. Taking its 20-day average daily volumes, this would require 13.2 days to execute.

In other words, at its share price current price of $6.6, 27.5 million shares would need to be sold when its average daily volume is 1.8m, running the risk of huge liquidity issues and share price pressure.

In response to the potential risks involved, SPDJI launched a consultation with the market on potential changes to the index.

In particular, the index provider wants to reduce constituent concentration and liquidity issues by potentially modifying the weight capping methodology, increasing the constituents to 35 and adjusting the liquidity screen.

New Zealand government big winner from BlackRock's clean energy ETF push

The report concluded: “This illustrates the potential crowding issues that can sometimes emerge in the ETF/fund space when investors start to massively invest in some non-free-float market cap weighted and/or concentrated indices.

“Single stocks materially owned by ETFs are exposed to the risk that ETF holdings change or adjust rapidly due to index composition change and large ETF creations/redemptions. This can result in potential market risk if stock liquidity turns out to be low or insufficient.”