The consumer staples sector performed badly in the first six months of the year amid increased competition and a lack of inflation. But in the last few months returns from US consumer staple companies have started to pick up, but what's driving the uptick and is it likely to continue?

Earlier in the year ETF.com wrote that "what has traditionally been one of the safest sectors of the stock market has been anything but safe this year…. Analysts say that the consumer staples sector—which comprises stocks of noncyclical companies that manufacture or sell essential consumer goods, such as beverages, tobacco products, household products and food products—has been battered and bruised by several key head winds."

The downturn was blamed on several factors, but Credit Suisse analysts reported earlier in the year that consumers increasingly have a growing preference for upstart and private brand products which is decreasing demand for the bigger, more established products that consumer staples companies are known for. To compete, the staples companies are being forced to innovate and invest more in research and development, which can be costly in the short term.

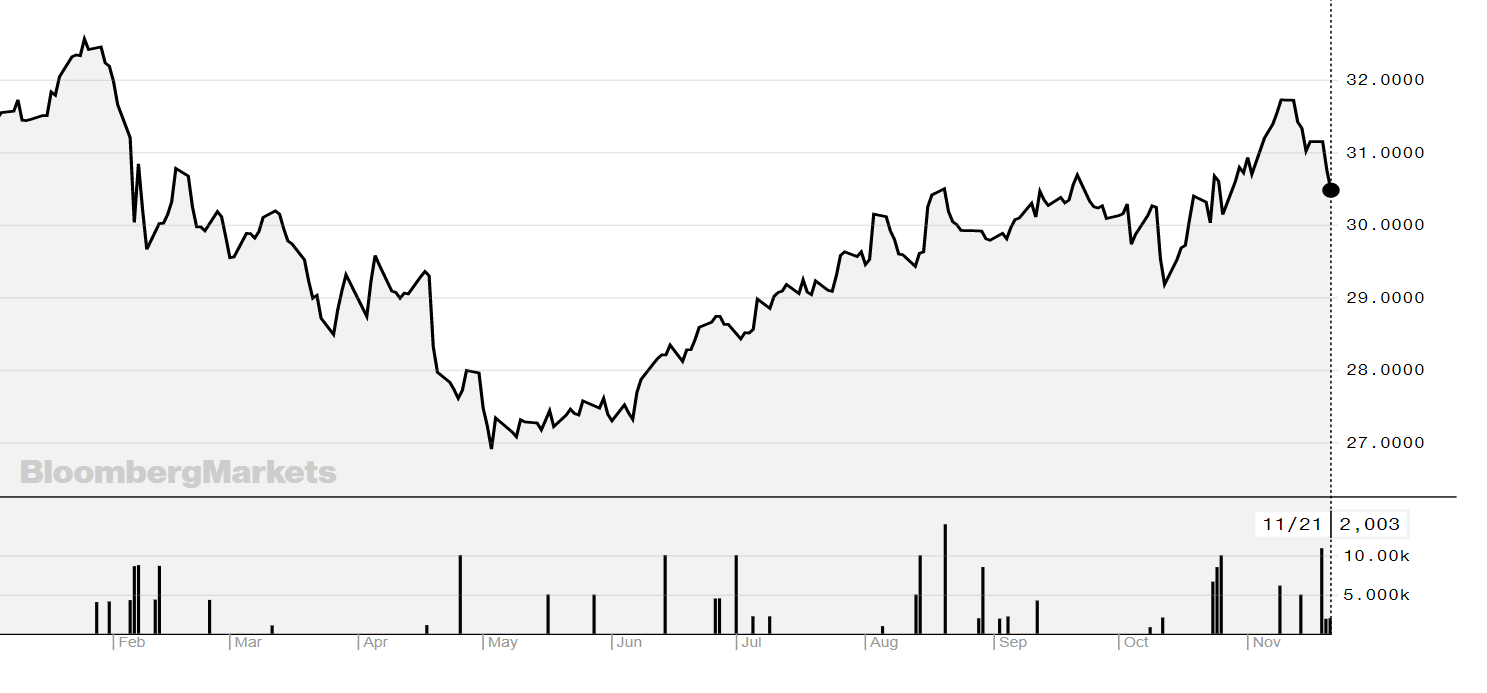

It has meant that year to date these consumer staples ETFs have had negative performance. For example, the Xtrackers MSCI USA Consumer Staples ETF (XUCS) is down -2.95% YTD (see below), but at its lowest point - on 27th April - it was down 14% from the start of the year.

However, in keeping with the axiom 'what goes down must come up', they have started to pick up in the last few months, which - according to reports - comes as some investors are starting to add safer stocks to their portfolios.

Brad Sorensen, MD of market and sector analysis for Charles Schwab told ETF.com that "When market volatility picks up … the consumer staples sector is often viewed as a port in the storm…. Temporary increases in domestic political and geopolitical tensions could continue to help support the group for short periods going forward."

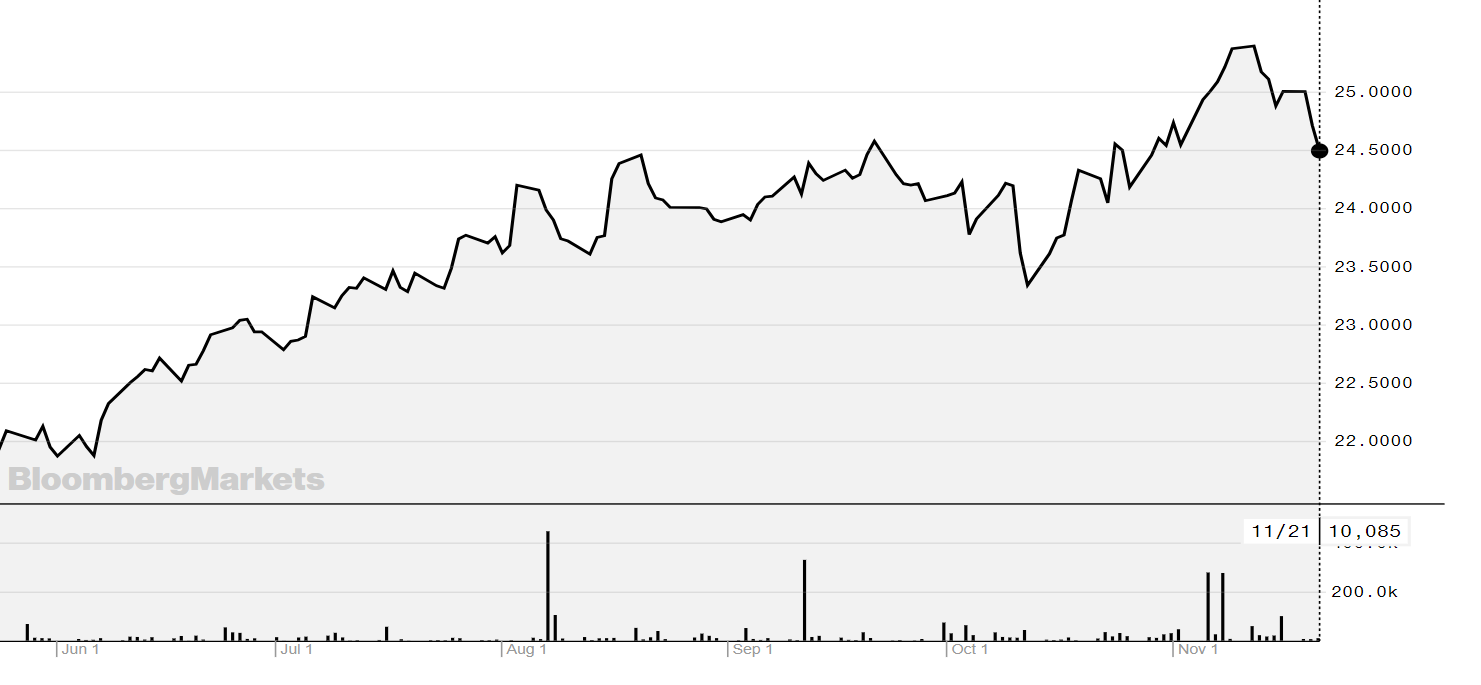

SPDR's S&P U.S. Consumer Staples Select Sector UCITS ETF (SXLP) ETF has been on an upward trajectory for the last few months, returning nearly 6% from the middle of August alone.

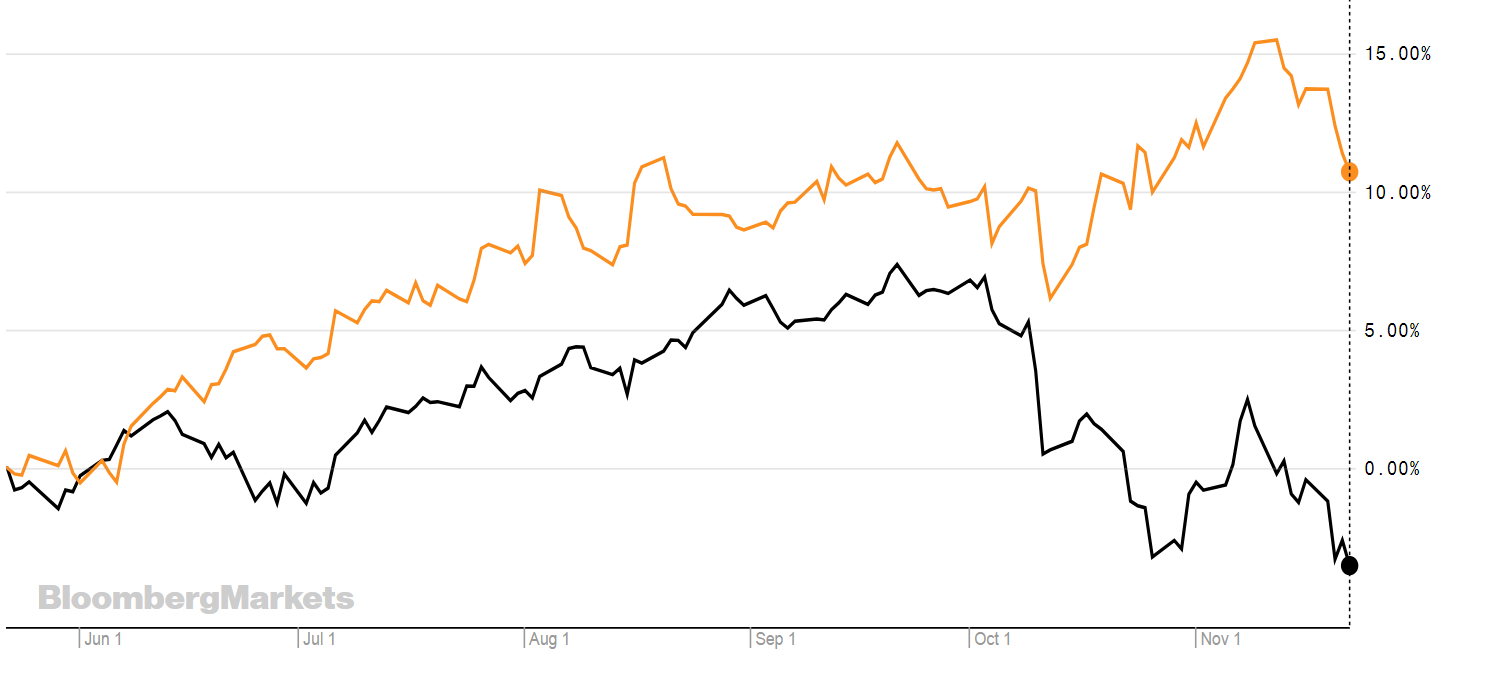

The Motley Fool also reports that the S&P 500 is in danger of finishing in the red for the whole of 2018. But in the past three months, the consumer staples sector has outperformed all other sectors, a clear signal that institutional and retail investors are rotating some of their holdings into quality names.

In comparison to the S&P 500 there is clear outperformance. See below, SXLP in orange and SPY5 in black.

The consumer staples sector has traditionally been made up of defensive stocks; stocks that are essential and will always be needed/bought by people regardless of financial situation.

It includes companies such as Procter & Gamble, Coca-Cola, Pepsi, Colgate-Palmolive and many more. The sector was given a boost in October when Proctor& Gamble - one of the largest securities in the consumer staples sector - announced its biggest quarterly sales gain in five years.

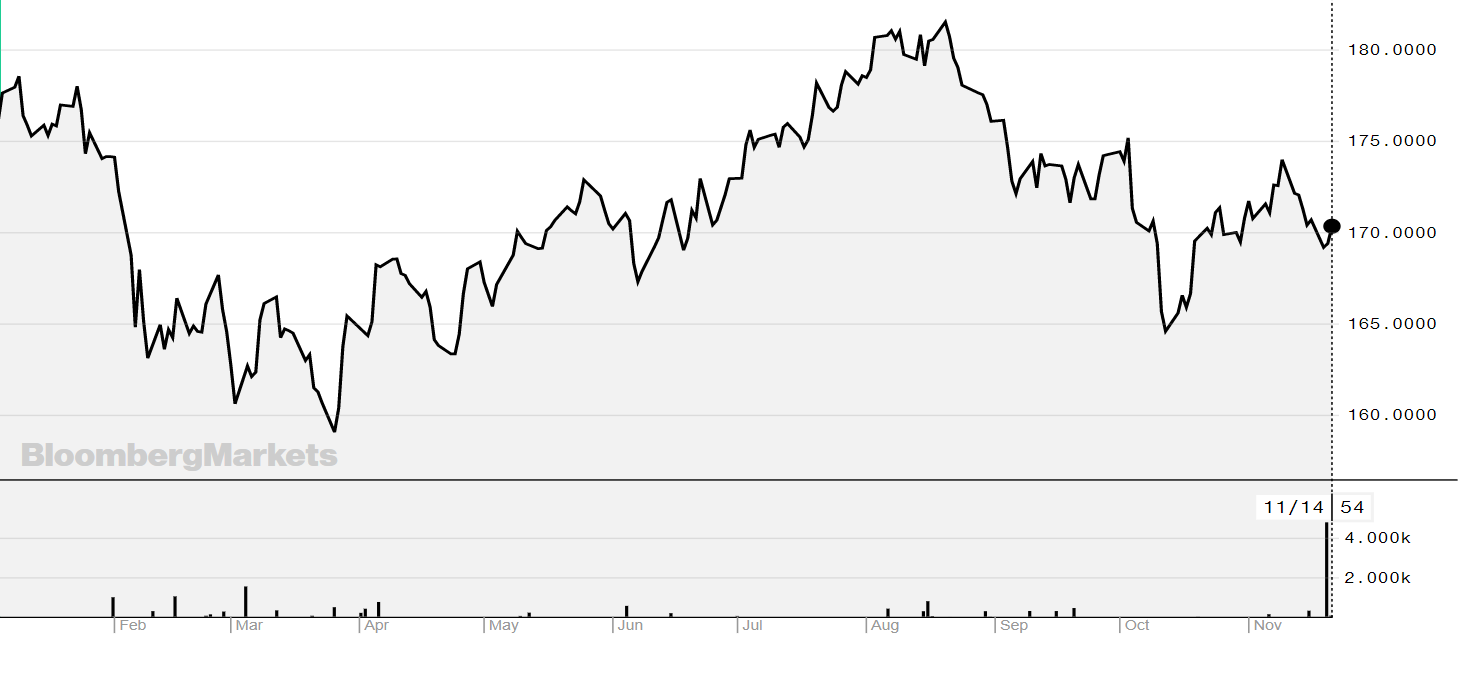

Despite this pick up in performance not all consumer staples sectors around the globe have had the same fortune. The European consumer staples market that has yet to come back up and remains in negative territory for the past few months and year.

The below chart shows SPDR MSCI Europe Consumer Staples UCITS ETF (CSTP), which YTD is down 4.19%, according to Bloomberg.

Market watchers are split on whether consumer staples are a good buy right now with some arguing that they are trading way above its forward earnings and others maintaining that they continue to be a well-known safe-haven stock and if a downturn is coming then they can be helpful.

Fortunately, access to them is easy with a number of ETFs listed on the London Stock Exchange. Listed below are five of these. The cheapest of these is Xtrackers XUCS, which was only launched in September 2017. One of the oldest is Amundi's Europe Consumer Staples ETF, which was launched in 2008 and has a three-star rating from Morningstar.

RTN

(SXLP)

(CSTP)

XDWS

(XUCS)

(CS5)

ETFYTDTERINDEXSPDR's S&P U.S. Consumer Staples Select Sector UCITS ETF-2.90%0.15%The ETF tracks the performance of large sized U.S. consumer staples companies in the S&P 500 IndexSPDR MSCI Europe Consumer Staples UCITS ETF-4.19%0.30%The ETF tracks the performance of the European consumer goods market as measured by the MSCI Europe Consumer Staples IndexXtrackers MSCI World Consumer Staples UCITS ETF-5.06%0.18%MSCI World Consumer Staples Net Total Return IndexXtrackers MSCI USA Consumer Staples ETF-2.95%0.14%MSCI USA Consumer Staples Net Total Return USD IndexAmundi ETF MSCI Europe Consumer Staples UCITS ETF-3.72%0.25%MSCI Europe Consumer Staples index