While the leading technology stocks have been rallying as a result of recent events in 2020, their inclusions in environmental, social and governance (ESG) ETFs have been put into question because of their energy consumptions and working environments.

A report by asset manager Alquity, entitled Are we ignoring the environmental and social impact of the internet?, analysed two of the pillars for the largest technology stocks from the US and China that are dominating ESG ETFs.

The report highlighted how data servers are the biggest energy consumers, accounting for 1-2% of the global energy consumption. Furthermore, the water consumption needed to cool these servers also pose significant environmental risks. In fact, modern computing is responsible for roughly 3% of all carbon dioxide emissions which is equal to the entire aviation industry.

China’s electricity demand is powered by coal-fired power stations with estimates that tech giants Baidu, Alibaba and Tencent (BAT) sourced two-thirds of their energy from coal in 2017.

Alibaba, which has a market cap of $823.6bn, is included in numerous ESG ETFs including the iShares MSCI EM ESG Enhanced UCITS ETF with a weighting of 8.9% and the Amundi MSCI Emerging ESG Leaders UCITS ETF with a weighting of 5.7%.

It is a similar story in the US. Alquity argued some of the leading technology stocks in the US should be probed for their inclusion in sustainable funds.

The report said: “Given the potential for major environmental impact, we believe that internet companies should face scrutiny by all ESG and sustainable investors, especially as many ESG & sustainability funds have large weightings in the FAANGM stocks (Facebook, Amazon, Apple, Netflix, Google and Microsoft).”

‘Dirty little secret’: Exxon inclusion in ESG ETFs highlights carbon emissions issue

Since 2015, Alibaba and Tencent have nearly doubled their market share in leading emerging market indices while the FAAMGs stocks have seen their weighting in the S&P 500 grow from 10.2% to 24%.

Earlier this year, research from StoneX Group stressed that the ETF industry was "overwhelmingly” allocating capital to giant tech stocks which ran the risk of creating a “self-reinforcing loop of market losses and outflows” if sentiment reversed.

Apple, Microsoft and Amazon are the three largest holdings in the UBS S&P 500 ESG UCITS ETF (S5SG) accounting for 8.6%, 7.7% and 6.4%, respectively, despite scoring poorly in some environmental metrics.

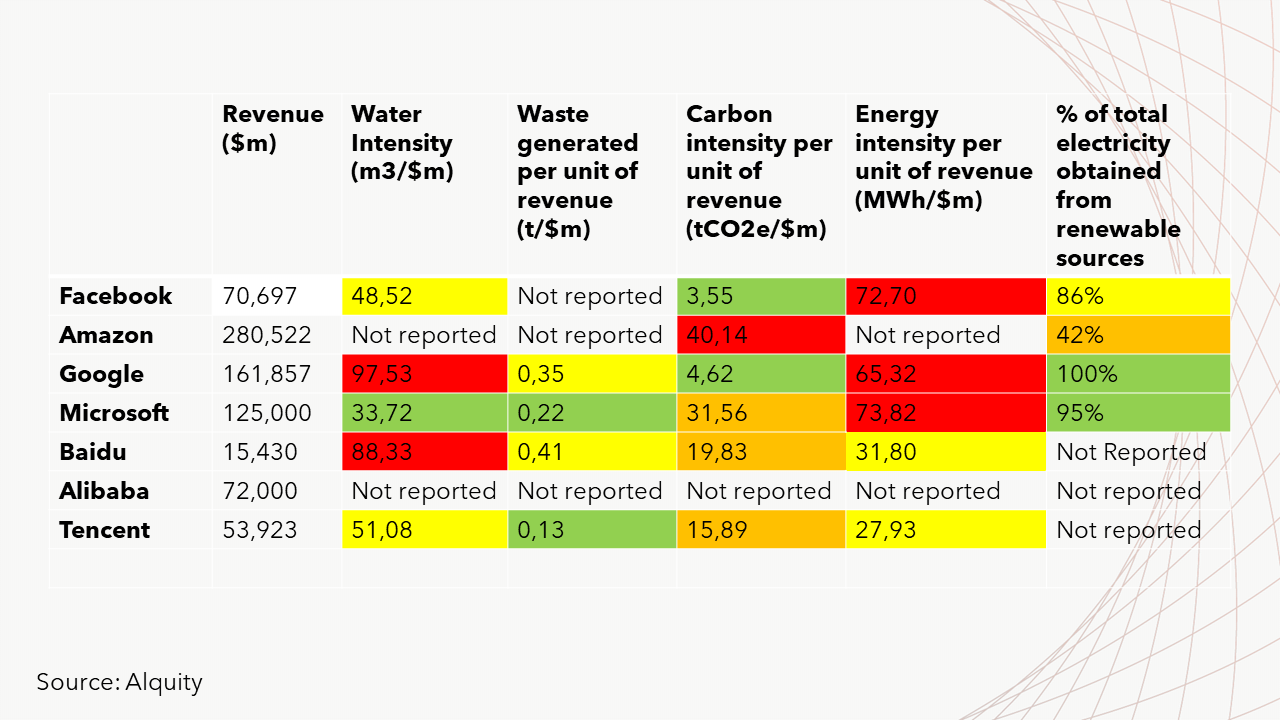

Microsoft is shown to have stronger metrics from the sample above having made commitments to reducing its environmental impact. This is seen by its lower water and waste intensity while 93% of its energy is from a renewable source.

However, Amazon and Alibaba disclose little to no data on these metrics but Amazon has pledged to have net-zero carbon emissions by 2040 and to derive 100% of its energy from renewable sources by 2030.

Alibaba on the other hand has only just started measuring ESG scores, according to Alquity. The e-commerce giant only started releasing its ESG report in 2018.

Alquity said it does not include Alibaba in its portfolio for this reason as well as its governance issues. The firm suggested that shareholders should engage with Alibaba to improve their data transparency, as well as influencing the company to use less coal and more renewable energy sources.

ETF investors divided over FAAMG concentration risks

Moving onto the social pillar, Amazon and Alibaba are also highlighted for needing to improve employee welfare. Amazon is reported to have a toxic work culture in its warehouses while Jack Ma, founder of Alibaba, said he supported a 72-hour work week for the firm’s employees.

Facebook’s involvement in the recent Cambridge Analytica scandal is criticised for the unwilling release of its users’ data for directed political advertising. Data breaches in the US in general have been on a steady climb over the past decade, from 662 in 2010 to 1,473 in 2019.

Alquity encouraged investors to oversee the economical growth that the previously mentioned technology companies have made in recent years and start considering their environmental and social impacts.