When it comes to the performance of your ETF investments, exchange rate fluctuations can make a big difference. Most funds are exposed to some kind of currency risk if you're purchasing an asset outside of your country.

Step forward currency hedged ETFs. These ETFs remove the risk of a currency moving against you. They do this by using derivatives to offset the exchange rate movements.

And do they work?

Well, sort of. Yes, they largely do what they say on the tin and get rid of volatility caused by FX movements, but that means a hedged ETF will sometimes underperform its unhedged equivalent.

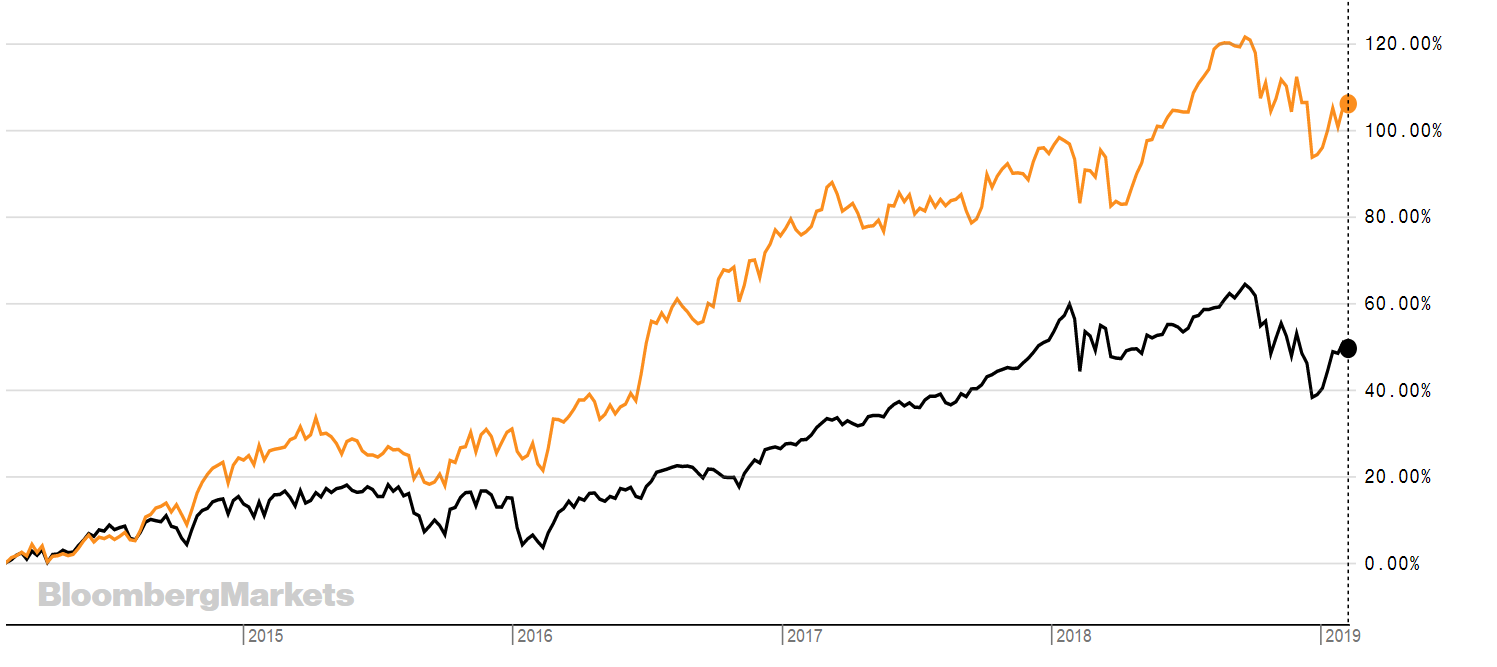

Look at this graph. It compares an unhedged US ETF with a hedged one for sterling investors. The ETFs are the iShares S&P 500 GBP hedged ETF (Acc) (IGUS) in black and the iShares Core S&P 500 ETF (Acc) (CSP1) in orange.

Source: Bloomberg

Over the last three years, the unhedged S&P ETF has clearly won out thanks to a rising dollar against the pound.

Here's the relative performance over three periods:

ETFYear-to-date1-year3-yearS&P 500 hedged (IGUS)9.63%3.64%13.95%S&P 500 unhedged (CSP1)9.61%14.07%20.44%

It's also worth noting that IGUS is more expensive with a 0.2% TER compared to a mere 0.07% for CSP1. Inevitably you have to pay a higher charge in return for the currency hedge.

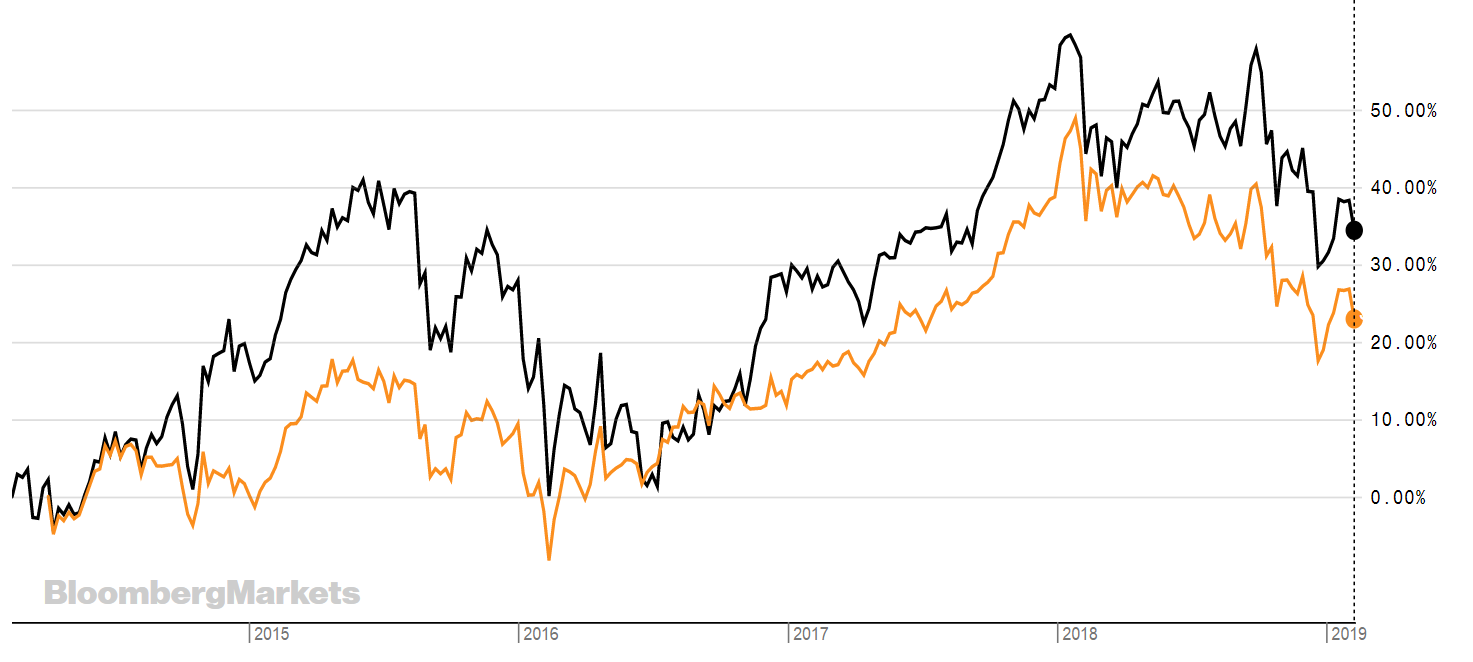

Of course, sometimes the hedged ETFs win out and that's happened over the last three years with Japan ETFs. This graph compares the MSCI Japan USD Hedged ETF (IJPD) in black with the ishares MSCI Japan ETF (CJPU) in orange.

Source: Bloomberg

So, does it really pay to hedge out all the volatility in exchange rate fluctuations?

Yes and no.

Peter Sleep, senior portfolio manager at 7IM, says: "The consensus thinking is that it is worth hedging your fixed income but not necessarily your equity. Fixed income is a low volatility investment, but diversifying into high grade global fixed income adds a lot of volatility due to currency movements. If you are a conservative fixed income investor you do not necessarily want that currency volatility, so hedge it away."

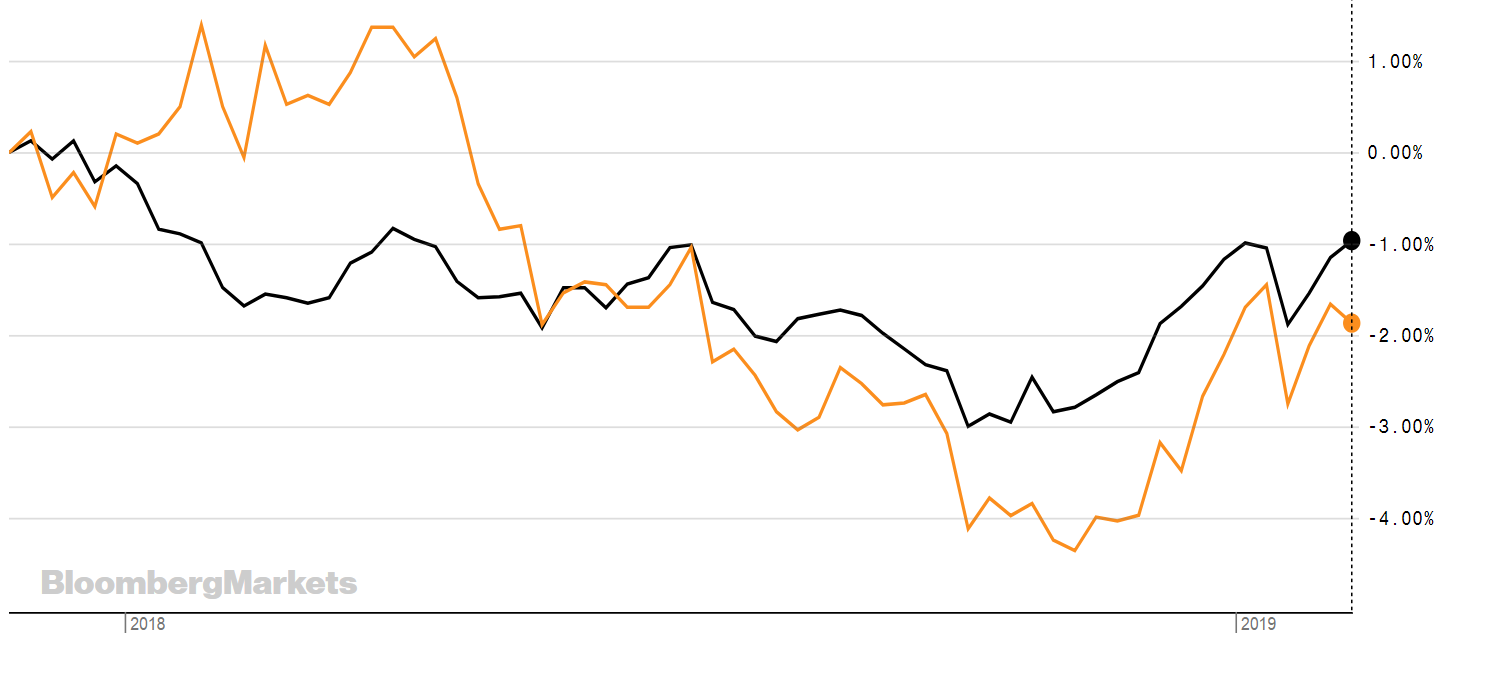

In the fixed income space hedged ETFs appear to have had more success. The graph below compares the performance of iShares Core Global Aggregate Bond ETF GBP hedged (AGBP) in black which has returns of 1.06% YTD and 2.39% over the last year compared with iShares Core Global Aggregate Bond ETF (AGGG) in orange (which isn't hedged) which has returned 0.68% YTD and -0.91% in the past year. They both cost the same at 0.10%.

Source: Bloomberg

Sleep points out however that global equity is a high volatility investment.

"Currency hedging equities does not reduce that volatility. In fact, you could lose important diversification benefits. For instance, when there is an equity bear market sterling tends to fall against the USD, CHF and JPY. Having US, Swiss and Japanese equity unhedged may help to mitigate your losses. In 2008, for instance, the FTSE World dropped by 42%, but if you were an unhedged sterling investor you would have lost only 21% because sterling fell markedly against the USD, CHF, JPY and other currencies. Unhedged investors also did very well when sterling fell out of bed following the Brexit vote," he says.

With Brexit looming and sterling being weak (despite briefly ticking up in the first few weeks of this year) the question is how you'd want to be positioned should it rally.

It is worth taking into account the cost you pay for employing a hedging strategy and the returns you're likely to get.

Below is a non-exhaustive list of the available currency hedged ETFs on the London Stock Exchange. The focus of the list below is fixed income, but you can find more equity hedged ETFs here, from when we previously wrote about them last year (returns will have changed).

HEDGED

AGGU

AGBP

AGGH

CRPU

CRHG

CRPH

FLOE

LQEE

ETFFXTER1 YR RTNINDEXISH GLOBAL AGG BOND ETF USD HEDGEDUSD0.10%4.11%The ETF aims to give investors a total return by tracking the Bloomberg Barclays Capital Global Aggregate Bond IndexiShares GLOBAL AGG BOND ETF GBP HEDGEDGBP0.10%2.39%The ETF aims to give investors a total return by tracking the Bloomberg Barclays Capital Global Aggregate Bond IndexiShares GLOBAL AGG BOND ETF EUR HEDGEDEUR0.10%1.19%The ETF aims to give investors a total return by tracking the Bloomberg Barclays Capital Global Aggregate Bond IndexiShares GLOBAL CRP BND ETF USD HEDGEDUSD0.25%2.98%The Fund aims to track the performance of the Bloomberg Barclays Global Aggregate Corporate Bond IndexiShares GLOBAL CRP BND ETF GBP HEDGEDGBP0.25%YTD 2.24%The Fund aims to track the performance of the Bloomberg Barclays Global Aggregate Corporate Bond IndexiShares GLOBAL CRP BND ETF EUR HEDGEDEUR0.25%-0.01%The Fund aims to track the performance of the Bloomberg Barclays Global Aggregate Corporate Index (EUR hedged)iShares USD Floating Rate Bond UCITS ETFEUR0.12%-0.84%The fund aims to track the performances of the Bloomberg Barclays US Floating Rate Note <5 Years Index.iShares USD Corp Bond UCITS ETFEUR0.25%0.02%The index offers exposure to the most liquid, US Dollar denominated, investment grade corporate bonds