For all the criticism, keeping STW's fees at 19 basis points is a sensible decision.

State Street's ASX 200 tracker STW is a thing of legend in Australia's ETF industry. Launched way back in 2001, with $3.8bn assets it is the largest ETF in Australia by far, outstripping the second biggest, Vanguard's VAS which has $2.7bn assets, by a margin of almost 30%.

Making things even better for State Street, STW maintains the highest fee of any plain vanilla ETF, charging 19 basis points - compared to 14bps charged by VAS and the mere 7bps charged by BetaShares A200.

The high fee and sizeable assets mean STW generates around $7.2 million in annual revenue (assuming no rebates) almost all of which is profit, making it Australia's most profitable ETF by far. The second most profitable, BlackRock's IOO, makes $5.7m in annual revenue.

But as the fee war in plain vanilla ETFs has slowly but surely made its way to Australia, many are now wondering how long State Street can keep STW's fees this high. And many are wondering how long State Street can keep BlackRock, Vanguard and BetaShares - all of whom are offering the same exposure at a lower price - at the gates.

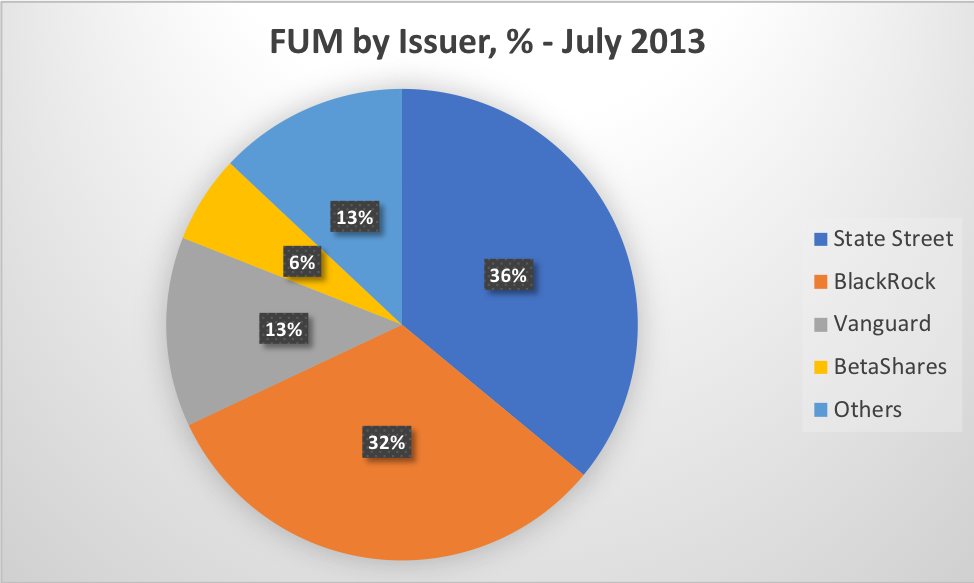

The predicament is made clearest when looked at from a market share perspective. In July 2013, when FOFA was first introduced, State Street's total market share by funds managed was 36%, according to ASX data. Yet in June 2018 its market share had fallen to around 15%.

[caption id="attachment_4076" align="alignnone" width="407"] Source: ASX[/caption]

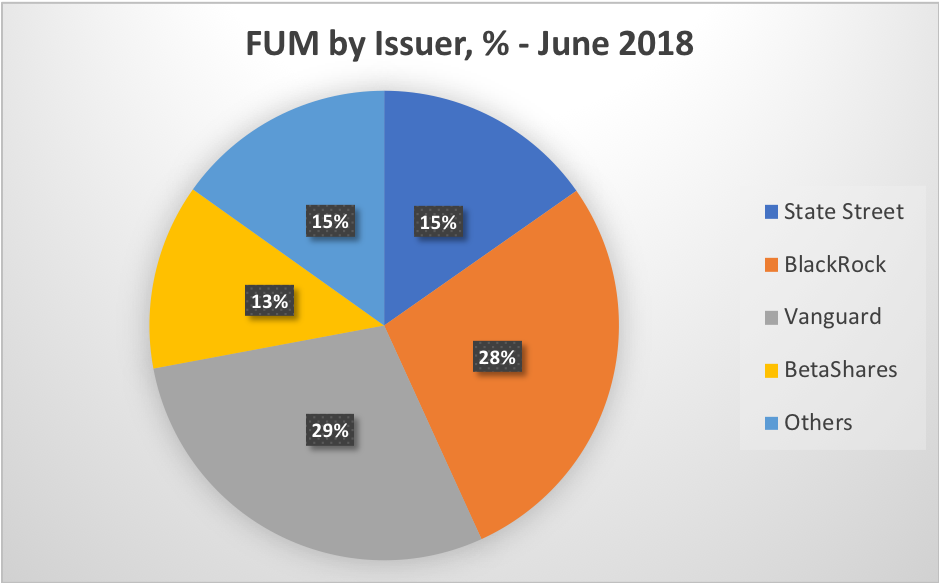

To be sure, the decline in market share is partly a result of changes outside State Street's control. In 2013, the Australian ETF market was a different place. BetaShares had only just got going. ETF Securities was contemplating its future with ANZ. VanEck was not quite a feature. Vanguard was not committing major resources to ETFs.

But it is also partly a result of State Street's choice to keep fees higher than its competitors.

[caption id="attachment_4077" align="alignnone" width="409"] Source: ASX[/caption]

Market share is a function of fees

Data across the board is showing that asset growth is increasingly determined by fees. To cite two sources,

have found an increasingly clear correlation between inflows and fees, with 90% of inflows into US ETFs in 2017 going to those with fees below 10bps. They blame correlation on advisors, who have moved away from commissions to fee-based business models.

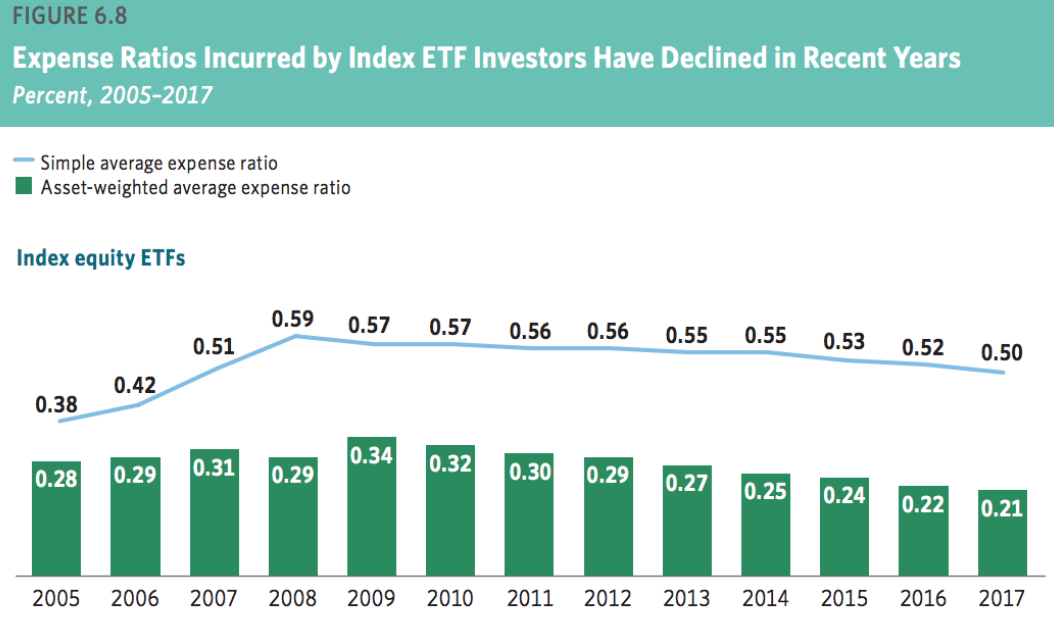

More evidence comes from the Investment Company Institute, a Washington-based research house, which found that the fees investors were willing to wear are trending ever downward. In 2017, the average fee a US investor was willing to pay on an ETF was only 21bps, down from the mid-30s a decade before.

[caption id="attachment_4078" align="alignnone" width="479"] Source: Investment Company Institute[/caption]

State Street knows all this, one suspects. Yet the company has chosen to keep the fees on its Aussie ETFs high anyway.

The decision to prioritise profits over growth has drawn criticism. For some, it means that the company will likely suffer a lower growth rate. For others, it amounts to a voluntary decision to relinquish market share.

State Street is right to keep fees up

But there is good reason to think State Street is in the right. And good reason to think keeping STW's fees higher than its competitors is a sensible decision, even if it does cost State Street market share. Why?

Firstly and most obviously, there are a clutch of commercial reasons to keep fees high. STW is still growing its assets, albeit more slowly than VAS. If assets are growing there is no obvious need to lower fees. If you're a business (which Vanguard isn't, strictly) there is no point giving up profits if you don't have to.

In a similar vein, gutting fees does not guarantee growth - as is sometimes implied in the criticism. It does, however, guarantee lower profit margins. In the event of any fee cut, it is entirely conceivable that revenue could be forfeited while growth, like Godot, never arrives.

Secondly, there are real ways in which STW is cheaper than its competitors. Crucially, this concerns liquidity. As anyone that has tried selling an ETF will attest, would-be investors always ask about liquidity.

Yet liquidity isn't something that one pays for per se: it is more of a cost one suffers in its absence. STW is more liquid than its competitor products and its higher fee can be construed as a cost one pays for greater liquidity.

Contacted for comment by ETF Stream, Meaghan Victor, boss of State Street's ETF arm, said the company wanted to avoid getting dragged into a fee war but was open to lowering fees in the future.

"[W]e believe it is important to avoid the race to the bottom when it comes to fees… [we] regularly review the fees associated with all products. We always seek feedback from our clients to ensure we are offering the best possible outcomes while remaining competitive in the market."

What State Street does with its fees going forward we'll have to wait and see. But for any interested spectator, STW's fee will be something to watch.

***

Headline photo: Meaghan Victor. Source: supplied.