Amid

, one sector seemed to stand strong and receive majority of investors' attention for the month: Telecoms. The sector's ETFs around the globe saw inflows upwards of $1bn, 20% of its Assets Under Management, according to Societ Generale's flow reports.

Whilst $1.02bn worth of Telecom ETFs were bought in January, only $2m was for European listed funds. The remainder was for US-listed ETFs which now holds nearly $6.5bn in Assets Under Management.

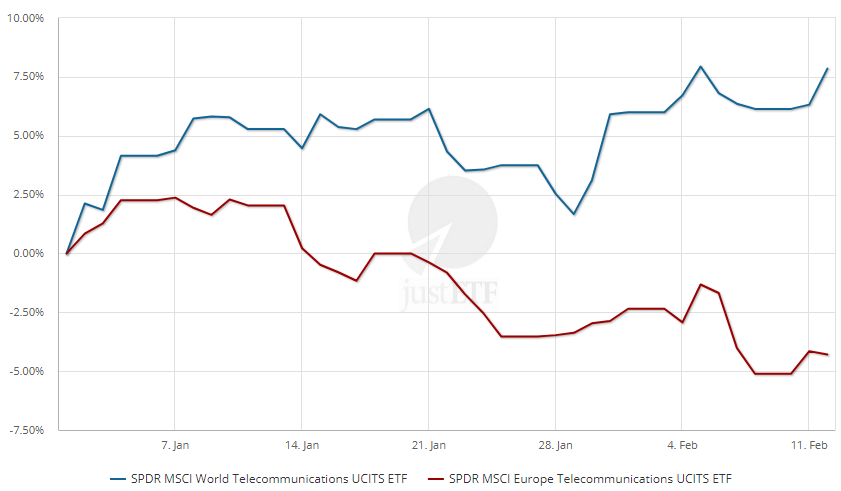

When it comes to telecommunication ETFs there is a clear divide in performances between MSCI World ETFs and MSCI Europe ETFs. For the month of January, the MSCI World Telecom ETFs listed in Europe have shown returns upwards of 5% whereas the MSCI Europe Telecom ETFs have produced negative returns, according to data from JustETF.

The SPDR MSCI World Telecommunications UCITS ETF (WTEL), tracking the MSCI World Communication Services Index, saw returns of 5.91% for January. The SPDR MSCI Europe Telecommunications UCITS ETF (TELE), which tracks the MSCI Europe Communication Services Index produced a loss of 2.87% for the same period.

WTEL and TELE YTD Returns

Source: JustETF

How do the ETFs differ?

The companies which comprise the benchmark indices for the ETFs and their performance differ quite significantly. The MSCI World Communication Services Index include market giants Facebook (25.9% share price change YTD), Netflix (34.5%) and Alphabet (7.9%) as well as leading mobile phone network provider AT&T (4.4%).

The European index is comprised with the likes of Deutsche Telekom (-5.4%), Vodafone (-9.1%) and BT Group (-4.6%).

The companies named are some of the top holdings for their respective funds and therefore have significant impact on the ETF's net asset value.

Currently there is only one telecoms ETF with AUM in excess of £100m. The Xtrackers MSCI World Telecom Services Index UCITS ETF (XWTS) currently has £103m in AUM, significantly higher than the WTEL and TELE which have £6m and £9m in assets, respectively.