In her book, The Shock Doctrine, activist Naomi Klein argues that governments use crises as excuses to ram through controversial policies. When publics get rocked by tragedies, governments exploit the moment to make political changes they would have struggled to get passed an attentive public.

Klein’s thesis is sometimes dismissed as “Marxist” or a “conspiracy theory”. But what investors often do during crises is not that different to the Shock Doctrine. When markets tank, investors make changes. Some are purely reactive, but just as often the changes are what they had in mind to do all along.

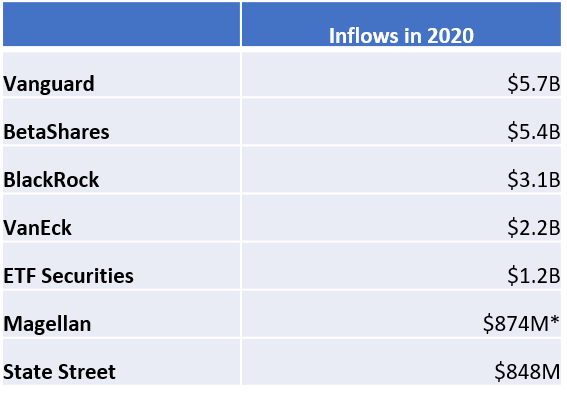

This all relates to Australian ETFs because the coronavirus crises has prompted a rush of money into the industry. Even during the darkest days of the sell-off in March, Australian ETFs saw inflows. Much of which is coming out of direct shares and active funds, suggesting investors took the crisis as a cue to migrate.

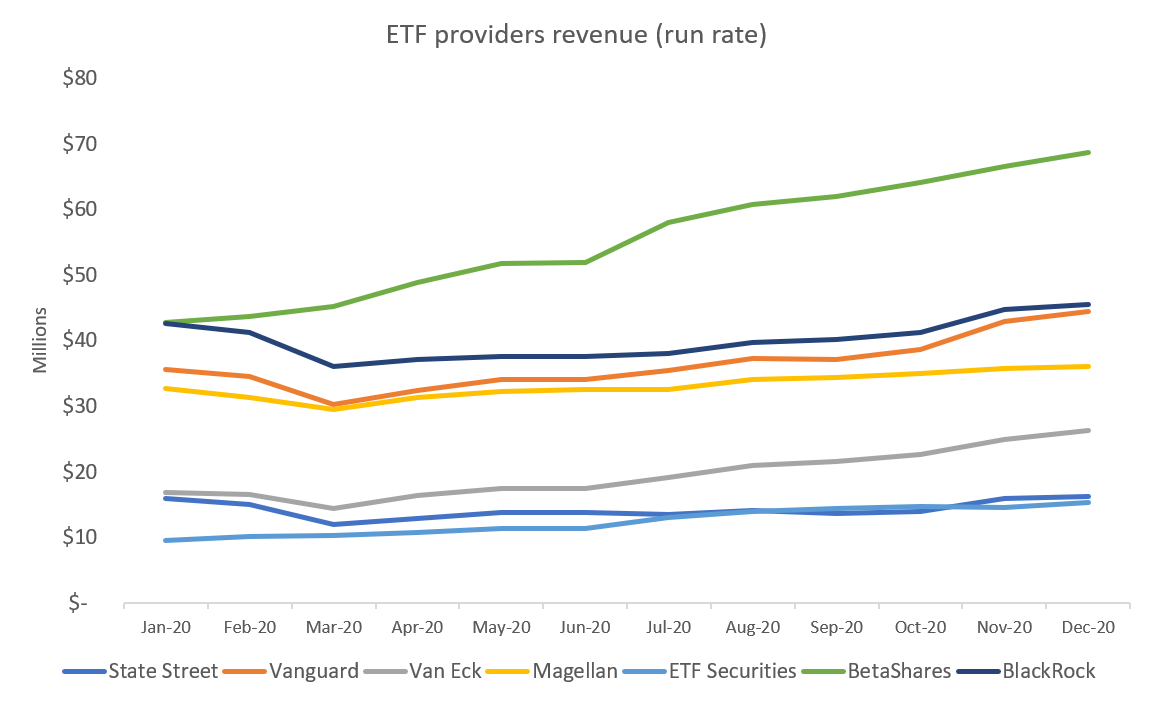

But while 2020 was the best and worst of times for the ETF industry, different providers had very different fates. We review the year below.

BetaShares

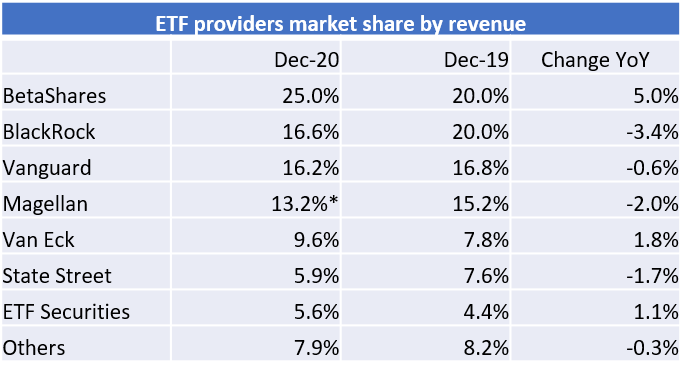

BetaShares continued to be the leading success story of Australian wealth management. At the start of 2020, BetaShares revenue was similar to iShares Australia, which is run by BlackRock. By the end of 2020, BetaShares revenue was more than 60% greater than iShares’.

The revenue growth owes partly to its higher fee “inverse” ETFs – i.e. BBOZ, BBUS – having their day in the sun. Partly also because its technology-focussed thematic and ethical ETFs – such as ASIA, CYBR, ETHI – reaping an abundant harvest from the coronavirus.

But most importantly it owes to founders’ willingness – like the kids in the Stanford marshmallow experiment – to delay gratification. Every time revenue grows, BetaShares founders continually re-invest: more products, more staff, bigger marketing machine. The result is that BetaShares keeps getting taller, while its competitors – whose top brass are often paid based on quarterly profitability (not revenue) targets – shrink.

VanEck

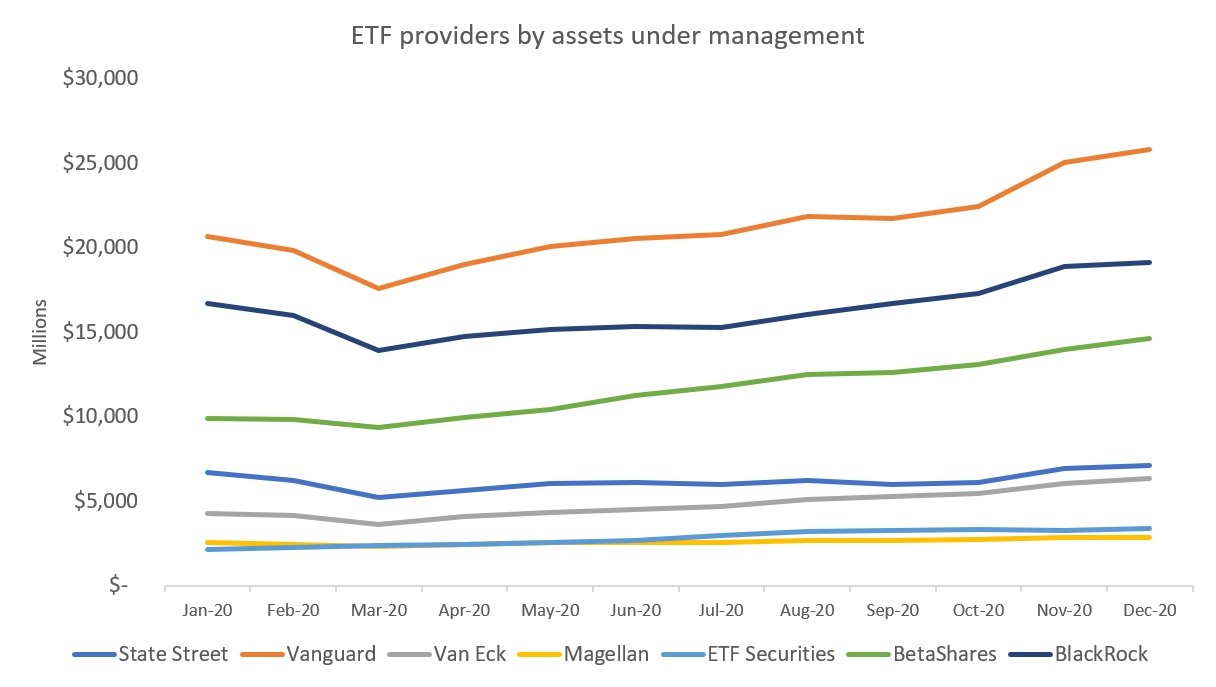

Jan Van Eck’s Australian subsidiary had another good year. AUM ticked up steadily and was relatively evenly spread across its fund line. Its duo – QUAL, MVW – continue to be the bread basket of the business.

Van Eck has historically preferred smart beta ETFs as margins are higher, the clientele more institutional, and there is no direct competition from the Vanguard alpha male. But in 2020 it pivoted to thematics with the successful launch of the video games ETF.

For me, the highlight for 2020 was probably the fact that CNEW began to take off. Australia needs good quality China ETFs that invest directly in A-Shares, rather than H shares or going via the US. Van Eck provided one and in 2020 got the rewards.

ETF Securities

The Swiss watch company Audemars Piguet is known for making the mistake of becoming a one product company. Audemars hit major success in the 1970s with an elegant octagonal wristwatch called the Royal Oak, which became a best seller. But the company could never replicate the Royal Oak’s success.

The danger for ETF Securities was similar with its GOLD ETF—that it would have one successful product but nothing else.

But 2020 ended that fear.

The gold price continued to power higher in 2020, helping propel ETF Securities over $3 billion. But the bigger story was that its non-GOLD ETFs collectively hit $1 billion. Their growth owed largely to performance: all five of its thematic ETFs – FANG, CURE, ROBO, ACDC, TECH – outperformed. As well as growing brand awareness in the retail market.

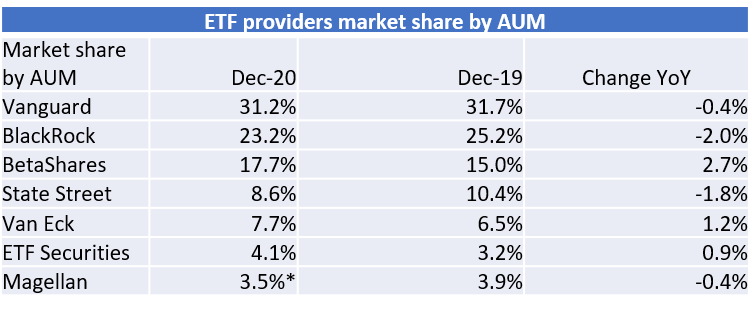

Vanguard

Vanguard had a mixed 2020. While AUM grew, its market share remained the same. The flatlining market share came despite Vanguard having the highest staff count, cheapest funds, deepest pockets and strongest brand of any provider. (Vanguard occupies nine stories of a Southbank skyscraper. By contrast Van Eck Australia has fewer than 20 staff). And came despite its major competitors State Street and Blackrock stepping away from the Australian market.

The lower-than-expected growth comes partly because the volatile market favoured providers with alternative products. But also because the group has been focussed on other things, such as its investor centre and superannuation moves.

Signs are already suggesting than 2021 may be a better year for Vanguard though.

BlackRock (iShares Australia)

iShares had a good year in some respects. During the coronavirus it proved that its bond ETFs were the best on the market, and most immune to pricing dislocations.

However iShares market share fell in 2020. From an outsiders perspective, the decline seems to be a resource thing. iShares is not hiring new staff or launching new ETFs in the way that some of its competitors are. BlackRock stopped growing iShares headcount after its share price took a hit some years back.

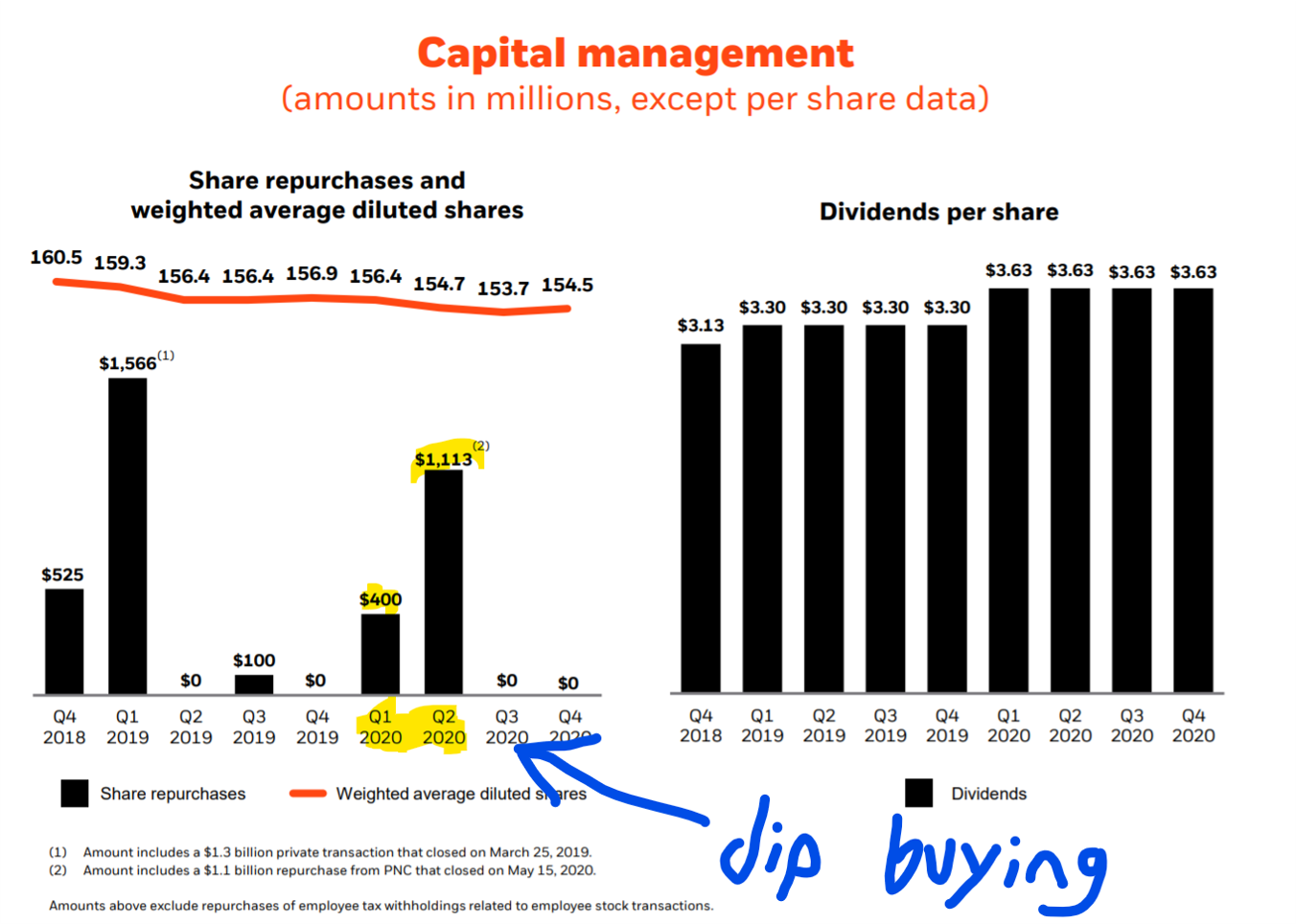

BlackRock’s share price is at all-time highs now – thanks to the way that BlackRock cleverly buys the dip on its own shares (above from BlackRock's quarterly report). However, there is no indication that iShares global headcount will grow in the near future. The company has increased its dividend payout and allocated more capital to buybacks.

There’s plenty of room for a big and aggressive iShares in Australia. For my own part, I hope that iShares lists an ESG ETF. We’ll see how things go.

Magellan

It was a great year for Magellan chief executive Brett Cairns. Thanks to an ingenious product innovation, Cairns enabled Magellan’s mutual fund and ETF investors to switch back and forth between each type of fund. Allowing them to sell out on exchange like an ETF, or directly with the fund like a mutual fund.

*(For our purposes, we’ve only included Magellan’s ETF AUM up to November, prior to the change).

But in 2020, the group also made mistakes. Magellan’s flagship actively manged global equities fund made a big bet on Alibaba, making its shares one of the biggest holdings in the fund. Hamish Douglass, Magellan CIO, publicly talked-up Alibaba's shares.

But after Jack Ma opened his big mouth, giving an obnoxious oration to regulators (English trans here), Alibaba's share price fell by one-third. It dented Magellan's fund's performance.

But more importantly, Magellan sold assets and pivoted to cash during the worst of the coronavirus sell-off across Magellan’s major funds. This caused them to miss the stock market rebound in the second quarter. The result of these two decisions is that inflows have slowed and Magellan’s share price has stalled.

The question for 2021 will be whether Magellan can defy the odds and outperform once more, knowing that no active manager outperforms forever.

State Street Global Advisors

State Street Global Advisors (SSGA) continued falling in 2020. It has been falling globally for several years.

A lot of people have puzzled over SSGA’s ETF decline. And wondered why the firm that founded the $8trn industry has vacated it.

My own explanation is that top brass at asset managers are compensated based on short term profitability targets. And building an ETF issuer – capital intensive and low margin at the best of times – requires a long term view.

******

Pictured, from top left to bottom right: Hamish Douglass, Christian Obrist, Kanish Chugh, Frank Kolimago, Evan Reedman, Arian Neiron, Alex Vynokur, Meaghan Victor, Ilan Israelstam