Fixed income investors have long worried about a bonds rout, prompted by a sudden reversal in central bank monetary policies. Now equity investors are starting to catch the bearish bug, with many worrying what might happen to stocks if bonds do start to sell off. European equity analysts at US bank Morgan Stanley joined this chorus last week in a weekly note to investors.

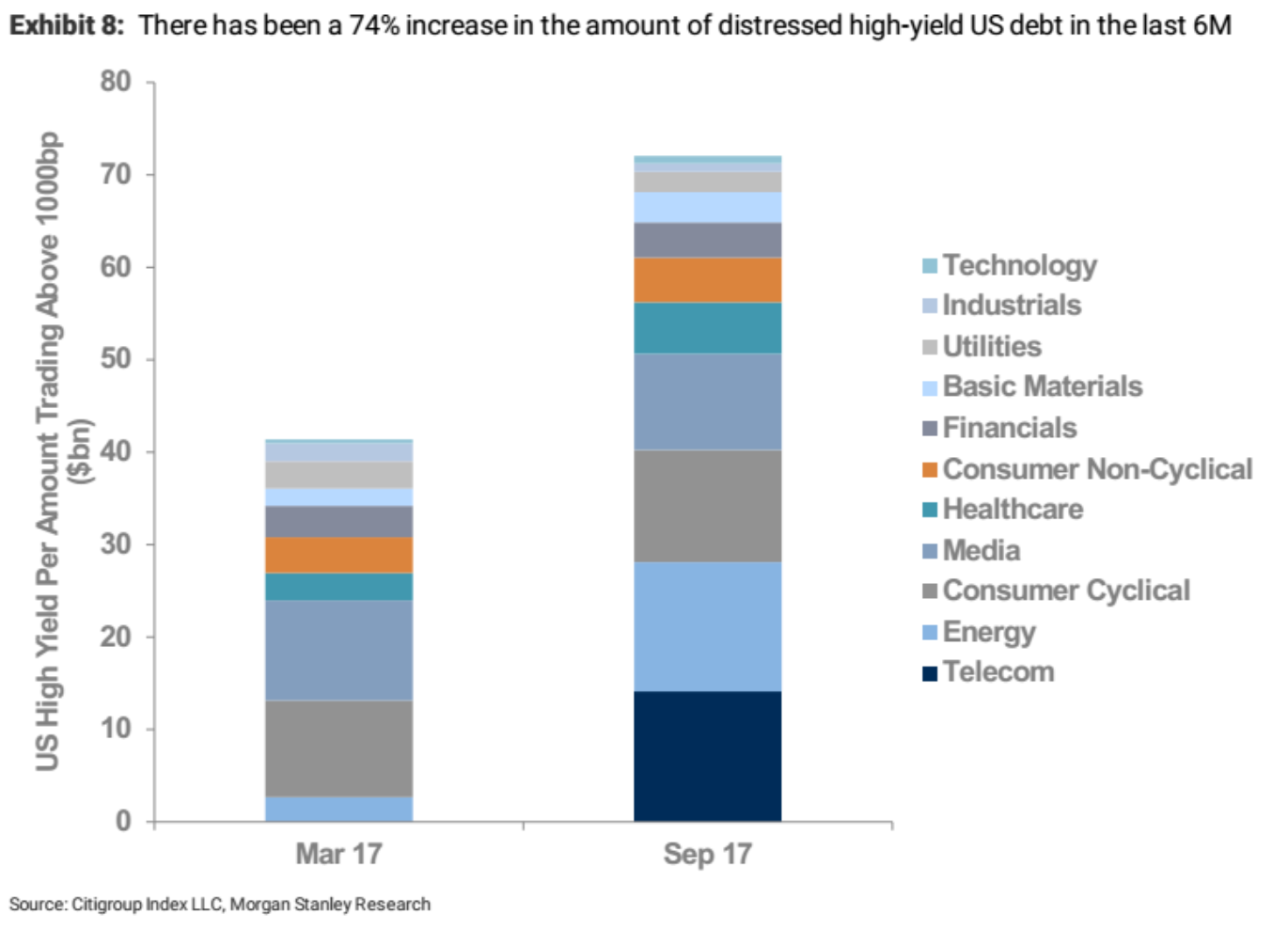

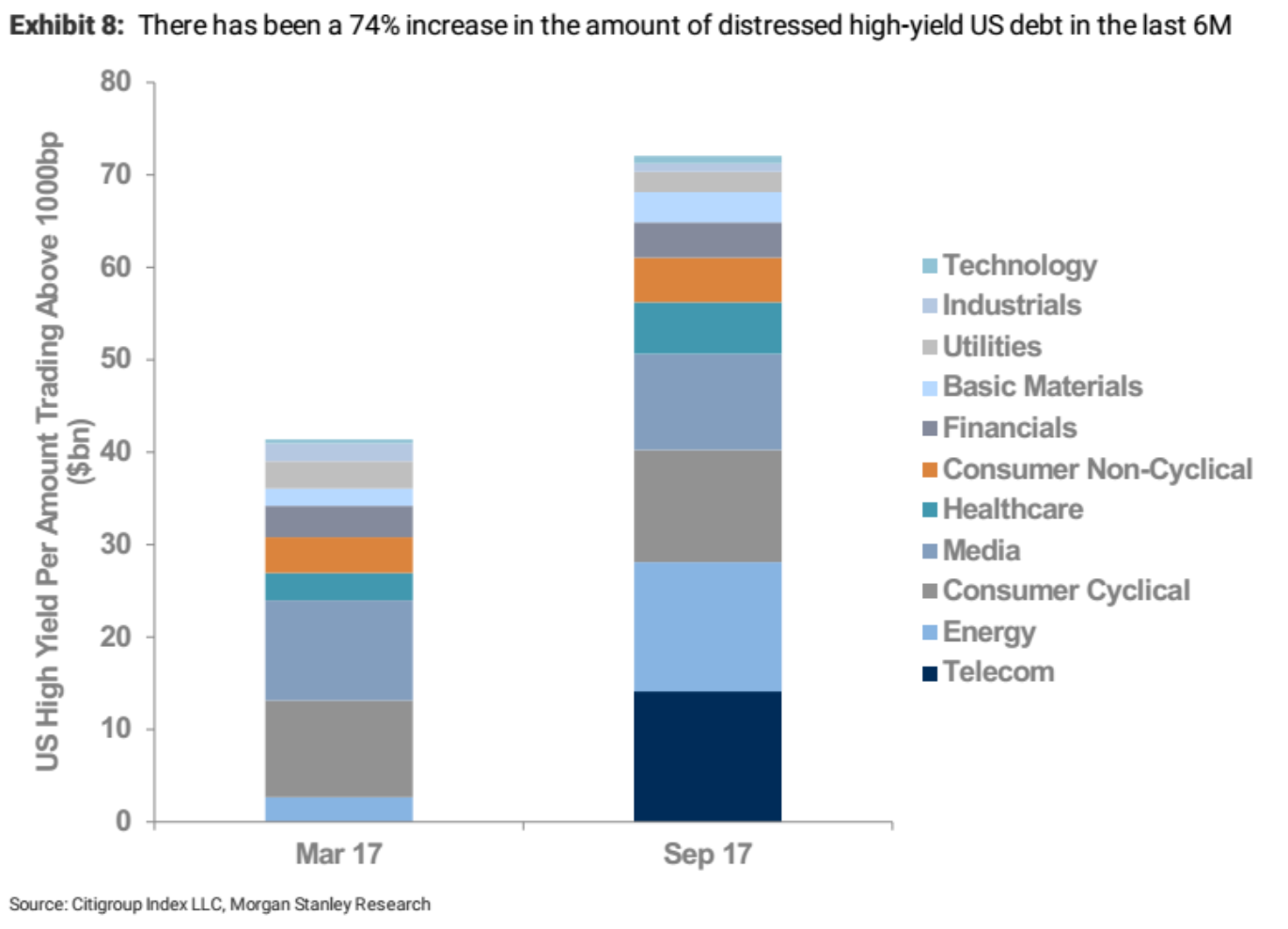

Their short analysis highlights US high yield bonds - a popular asset class for many yield hungry investors. In particular they draw attention to to the fact that loans and bonds in distress has now increased by 74% in the last six months.

According to the Morgan Stanley analysts "in contrast to two years ago when Energy was far and away the largest driver of the upturn distressed debt, the sector composition of distressed US high yield debt is reasonably broad", as can be seen from the graphic below.

Worryingly the London-based analysts also suggest that credit quality has been deteriorating in Europe as well. "There hasn't been the same degree of distress in European credit markets, and in general leverage has been declining for European corporates, in contrast to the US. However, there have been some signs of a deterioration in credit quality in Europe. The proportion of BBB debt in EUR non-financial IG markets has now reached 59%, a record high, while duration risk has also increased as companies have pushed out the maturity of issuance. Similarly in the proportion of covenant-lite loans in the European Leverage Loan Index has reached a record high of 67% year-to-date."

Strategists at French bank Societe Generale are also warning that the debt markets might be moving into a dangerous phase. Well known uber bear Albert Edwards' latest weekly strategy update "BoE leads the way in monetary schizophrenia" warns that the "US Fed and BoE are once again presiding over a credit bubble, with the BoE in particular suffering a painful episode of cognitive dissonance in an effort to shift the blame elsewhere. The credit bubble is everyone's fault but theirs".

Edwards argues that the current biggest problem lies in unsecured credit, the growth of which has exploded above 10% in both the US and the UK….. we are in a QE, zero interest rate world, where central banks are effectively force-feeding debt down borrowers' throats. They did it in 2003-2007 and they are doing it again.

Most of the liquidity merely swirls around financial markets, but there is certainly compelling evidence now of a consumer credit bubble in both the UK and US (as well as a corporate credit bubble in the US). …The simple fact is monetary policy is way too loose in the UK as well as in the US, and let us not forget the BoE cut rates in the immediate aftermath of last July's Brexit vote. Bubbles are appearing in areas like consumer credit because interest rates are far too low and need to be raised.

And yes, when interest rates are excessively low, both borrowers and lenders do stupid things. But to ignore their own role in creating debt misery for millions, the BoE can only deal with its own cognitive dissonance by blaming someone else. When this debt bubble blows, I suspect citizens' rage will be directed where it belongs"