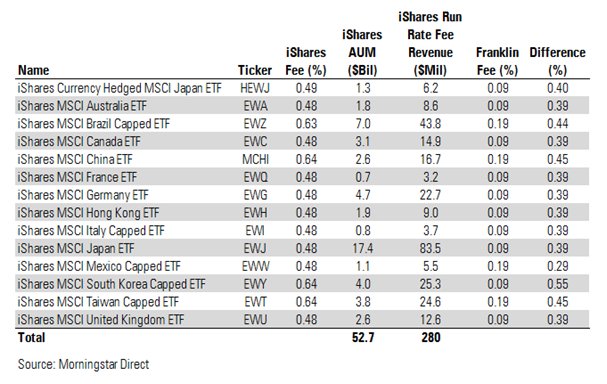

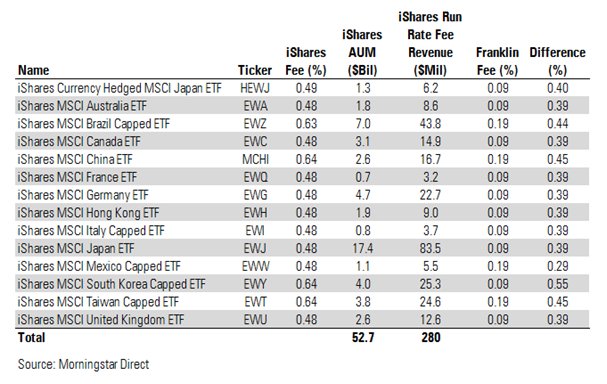

The ETF fee wars have had the ante raised this week, with Franklin Templeton unveiling a suite of country funds, which track the biggest companies in the world's richest countries as well as the BRICs.

Franklin's new funds are the cheapest of their kind, with all but four charging 9 basis points. The four exceptions - Taiwan, China, Brazil and Mexico - charge 19.

[caption id="attachment_1637" align="alignnone" width="607"]Source: Morningstar, via Ben Johnson[/caption]

In listing these ETFs at these prices, Franklin will very probably have its eyes on BlackRock, whose market-leading country-specific ETFs hold billions in AUM, but under a higher headline fee of almost 50 basis points.

That Franklin has made these listings at these prices is significant.

The $750bn Californian money manager is traditionally an active mutual funds manager. That at a company of its size and influence in is moving into ETFs this quickly shows how far-reaching the migration from active management to passive, and from mutual funds to ETFs has become.

And Franklin is not alone among large US money managers.

Fidelity, the $2.1tr Boston money manager, has also started listing ETFs at some of the lowest prices in the world. Meanwhile its CEO Abigail Johnson has said that active managers need a "fundamental rethink" of their fees. She recommends moving towards a "fulcrum" model, where fees rise and fall with performance.

Another traditionally active manager to enter the fray has been Charles Schwab - whose plays in the fee war have been decisive and aggressive.

Last month, Schwab launched an ETF that tracks the biggest 1,000 companies in the US, the Schwab 1000 Index ETF (SCHK). The fund charges 5 basis points, one third of 15 basis point fee charged by its rival, the $21bn iShares Russell 1000 ETF (IWB).

One reason that issuers are lowering the cost of their ETFs is that inflows inversely correlate with fees. Data compiled by Bloomberg shows that the majority of new money coming into ETFs goes into plain vanilla funds that charge less than 10 basis points. Funds that charge more than this attract lower inflows.

Another reason is that many investors feel that there is little to distinguish between ETFs that track the same benchmark in the same way, and therefore generate similar returns. ETF owners, for the most part, do not have personal relationships with issuers in the way that actively managed funds do - meaning there can be less of a personal relationship for investors to be loyal to.

As such, many investors are left to discriminate between ETFs based on cost. And everyone likes a bargain.

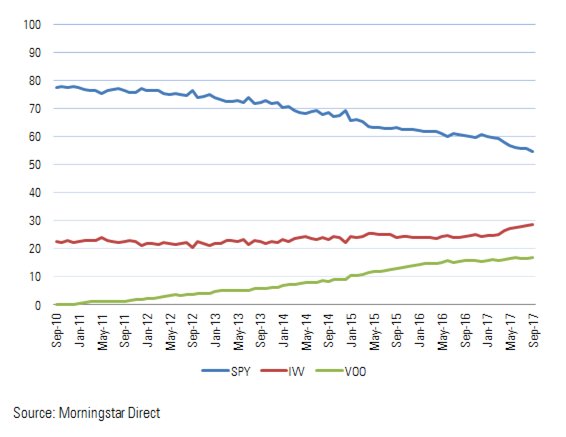

[caption id="attachment_1638" align="alignnone" width="566"]Source: Morningstar via Ben Johnson[/caption]

Issuers that fail to lower their fees can be punished for it. Some analysts have blamed the entrance of Vanguard into the S&P 500 tracking space (VOO) in 2010 as well as iShares lowering the fees on its S&P tracker (IVV) for reducing State Street's legendary SPY's market share. SPY charges 9 basis points compared to the 3 basis points charged by VOO.