If it was not already, inflation will have shot to the top of investors’ agendas recently as predictions about where it might land are laid bare. While the rise in inflation was anticipated, its upward trajectory has continued to surprise.

The US Consumer Price Index (CPI) grew 7% year-on-year in December, a 40-year high, while the UK’s CPI came out at 5.4% for the month, its highest level in 30 years, challenging the earlier consensus that any rise would be transitory.

Research conducted by ETF Stream and Amundi last December highlights just how tricky it is to get a grip on the inflationary landscape. The survey of 105 investors across Europe found 44% believe inflation would be “transitory” while 41% are forecasting a regime change and 15% were “unsure”.

The idea that 2022 would be the year of inflation was in no doubt, with 81% anticipating this to be the case. This has given policymakers a headache on both sides of the Atlantic as they walk the tightrope of tightening monetary policy. Acting too fast could send markets into a spin while too slowly could cause the economy to overheat.

Meanwhile, investors’ hedged portfolios are being tested as they continue to anticipate how the central banks will react. The Federal Reserve has already pivoted its monetary policy significantly as inflation proves to be stickier than expected, causing a massive sell-off in high growth areas of the market as it prices in at least four rate hikes in 2022.

Furthermore, the Bank of England rose interest rates by 15 basis points to 0.25% in December and are expected to increase rates by a further 1% during 2022.

While inflation is anticipated to cool over the second half of the year as supply chain bottlenecks ease – the Fed expects inflation to fade to 2.6% by the end of the year – there is a growing unease among investors about where it might land.

Where will inflation settle?

Economists are generally confident inflation will peak around the mid-point of the year before fading over the following 18 months, although at a higher rate than first anticipated. The big worry for investors is just how far it will fall above the central bank’s target.

At the end of January, the 10-year breakeven rate, a market indicator of inflation expectations, stood at 2.33%, higher than previous years but lower than the 2.8% reached in November of last year. While not too far removed from Fed chair Jerome Powell’s prediction, the investment community thinks it will be closer to 3%.

Mike Bell, global market strategist at JP Morgan Asset Management, says that despite headline contributors to inflation such as energy prices and semiconductor chip shortages looking like they will alleviate in the coming months, underlying drivers such as a tight labour market and the rental vacancy rate in the US will keep inflation above target on a sustained basis.

“We think the underlying core inflationary pressure is going to be sustained because labour markets are so tight, particularly in the US,” he says. “You have a shortage of workers relative to the demand for jobs and that’s going to put continued pressure on wages. That is what drives underlying inflation.”

Paul Syms, head of EMEA ETF fixed income product management at Invesco, agrees that a tight labour market because of better-than-expected unemployment could also lead to lingering inflation.

“Employment is in a healthier position than a lot of central bankers and even governments expected as furlough schemes in the UK worked well. We are back to pretty much pre-COVID-19 levels of unemployment and that is starting to lead into some wage inflation,” he says.

Dan Boardman-Weston, chief investment officer at BRI Wealth Management, also argues inflation is likely to settle above its target at around 3%: “The short-term temporary factors pushing inflation higher will start to ease, and will settle in the 3% range by the tail end of the year in the US and the UK.”

He adds he expects to see four hikes from the Fed this year but would not be surprised if it “took its foot off the gas” if its policy has a serious effect on markets.

Bell says it is unlikely we will get more than a 1% rate hike from the Fed this year but we could see hikes continue into 2023. “Markets are pricing that rates will peak at about 1.7% in the US and less than that in the UK,” he continues. “Our view is it is quite plausible the Fed will put interest rates up over the next few years to around 2.5%, maybe 3%.”

Syms adds the challenge for central banks is to work out how much of the inflationary pressure currently in the market is related to COVID-19 and how much is related to the reopening of the economy. “A rate hike will not have any influence on the price of gas and pipelines from Eastern Europe or Russia,” he says.

“Central banks have to run this tightrope of thinking, ‘some of this inflation we can act on by hiking rates to try and bring it under control, while reducing the feedthrough into wages, but energy prices are a tax on the consumer that will naturally slow demand’.”

What are investors doing?

While the inflation narrative is being played out – although at a higher level than had been anticipated – investors hedging decisions made over the past 12 months are being put to the test while difficult calls based on future interest rates are being made.

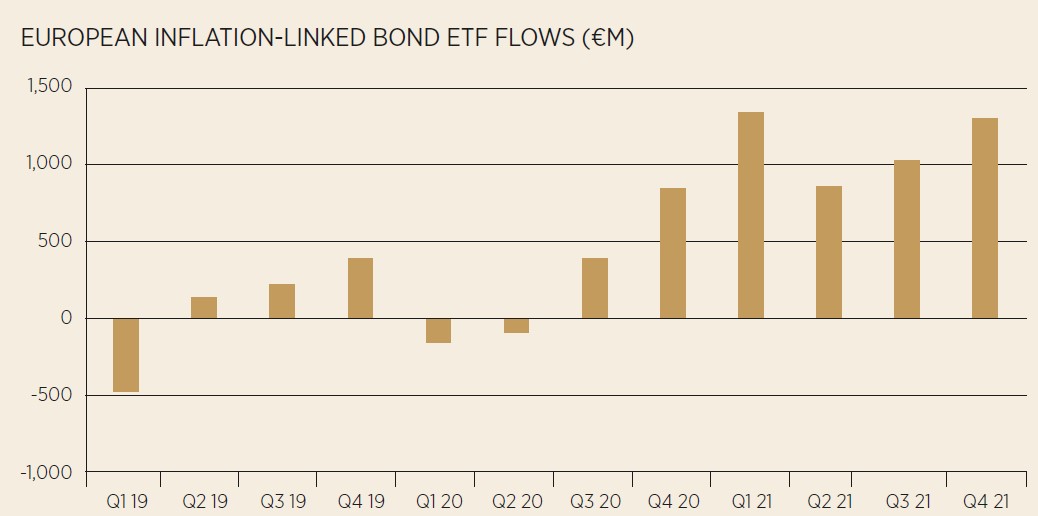

Jose Garcia-Zarate, associate director of passive strategies at Morningstar, says ETFs are a strong gauge of market sentiment, with many positioning themselves for a high inflationary environment in 2021. “Certainly, in fixed income, we have seen a lot of short-duration strategies and inflation-linked bonds ETFs – the two key pillars of the inflation fighting strategy,” he explains.

Source: Morningstar

Olivier Paquier, head of ETF distribution for EMEA at JP Morgan Asset Management, says investors used a barbell approach in 2021, with a rush to quality equity ETFs to capture the re-opening trade earlier in the year, followed by a move into inflation-linked bonds.

“ETFs have been either capturing trends from the growth and the economic recovery that was brought in over the past year, or inflation. They were either taking advantage of the inflation or trying to find a hedge to catch,” he adds.

One of the hedges Paquier pointed to is the ultrashort-duration bonds – traditionally offering less volatility with a maturity of three years or less – as investors predict an end to accommodative monetary policy. He says: “Investors are trying to capture decent inflation-adjusted returns and still mitigate their duration risk, keeping it very low. It’s one of the main conversations we had last year.”

Highlighting this, the iShares € Corp Bond 0-3yr ESG UCITS ETF (SUSS) and the iShares € Ultrashort Bond UCITS ETF (ERNE) have been two of the most popular bond ETFs over the past 12 months, with inflows of $1.6bn and $1.1bn, respectively, according to ETFLogic.

Syms agrees there has been a trend towards shorter duration in the latter part of 2021 as investors moved to hedge against rising rates interest rates. “Investors initially moved into inflation-linked and are now moving into shorter duration, looking at those parts of the market where there is still some value and yield,” he says.

Capturing the trend

According to data from Invesco, there were $7bn inflows into inflation-linked ETFs during 2021, second only to China bonds in the fixed income space, and Syms predicted flows into shorter duration will continue rising as inflation edges towards its peak.

Capturing this trend, the Invesco AT1 Capital Bond UCITS ETF (AT1D) recorded roughly $464m inflows last year as investors sought yield from less traditional strategies.

“The duration on AT1D is just over three years but you are getting a yield of around 4.3%. This is not necessarily combating short term inflation, which is at decade highs, but if that comes back, it should give you a small positive real return,” he says.

Despite an uptick in inflation-linked bonds in the second half of the year, fixed income accounted for just 24% of all ETF flows in 2021, meaning in the face of inflationary pressures, it was still very much the year of equities.

The asset class might have had a rocky start to the year on the Fed’s rate hike news but has also been tipped as one of the best long-term inflation hedges, particularly in the infrastructure and commercial property space.

BRI Wealth Management’s Boardman-Weston says investors should not overlook quality equities as a store of value against inflation. “The businesses that are generating cash flow and have good pricing power are long-term stores of value,” he says. “Short-term equity markets can react quite violently to inflation, but we have taken a longer-term approach and been buying a lot of quality infrastructure assets for our client portfolios.”

One of the products tipped by Boardman-Weston is the $1.6bn SPDR Morningstar Multi-Asset Global Infrastructure UCITS ETF (ZPRI), which, despite being split 50/50 between fixed income and equities, invests in infrastructure projects that have a “good degree of linkage with the level of inflation”.

Elsewhere, he says commodities with a focus on oil and gas and financials have been a great hedge against inflation for the moment: “We have quite a lot of financial exposure through funds and ETFs which benefit from interest rate increases and which reflect the market, which is value and inflation hedged.”

Deflationary assets

If market consensus is predicting rising inflation to peak in the second quarter of 2022 before falling back in the second half of the year, how and when should investors be readying their portfolios for a deflationary environment?

With markets moving into reverse at the start of the year, Bank of America research suggested signs of peaking inflation over the next few months is likely to be the catalyst for market direction.

“Rates volatility is still elevated and creeping higher, and the pricing of hikes is still going up. We think both need to come down for markets to ‘buy the dip’ in rate-sensitive areas such as investment-grade debt,” Barnaby Martin, credit strategist at the bank, says.

Paquier, along with Syms, forecasts investors will continue to favour short duration in the near term, and expects the space to be sticky over the next few years as institutional investors see out their hedges. “Looking at the institutional interest in this space there does not tend to be a brutal reallocation in ETFs who will allocate for at least a couple of years if not more and will be an interesting element for the short-duration corporate bond space,” he says.

One outside prediction Syms is willing to make is the extension of the fallen angel trade of 2020. “We are coming through the period of fallen angels to a period of rising stars,” he says.

“The investment bank forecasts a pretty positive outlook, in the region of $100bn of upgrades this year, meaning $100bn of rising stars this year.

“The fallen angel strategy will benefit the rising stars as they get upgraded or are anticipated to be upgraded and will see a price rally as they move from high yield to the investment-grade space,” he adds.

Despite this, Garcia-Zarate says it is too early for investors to start thinking about unwinding short-duration plays with many uncertainties still prevalent and they are likely to wait for the latest cycle of interest rate hikes to come to an end.

He concludes: “Investors will want to start thinking about the length and duration but it is probably too early to do that. We are at the mercy of an unknown factor, which is whether the virus is done, and that is not something anybody can forecast.”

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

Related articles