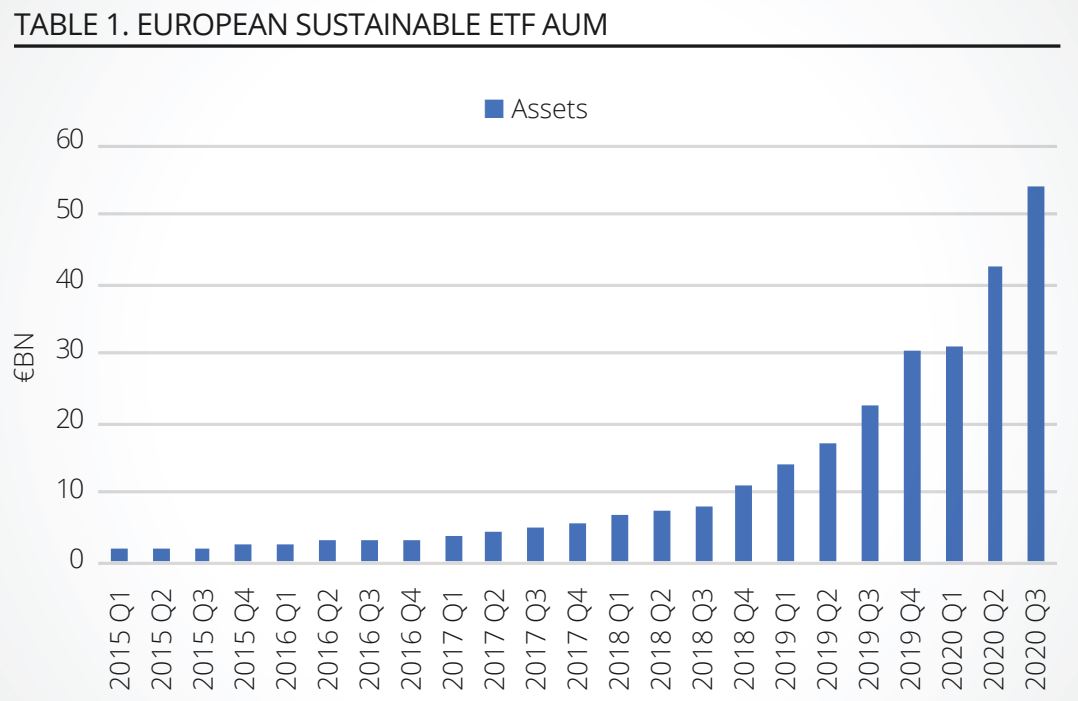

History may well remember 2020 as the year of COVID-19, but for those operating in the European ETF market it may also be remembered as the year of ESG. Assets in sustainable ETFs have nearly doubled to €54.2bn year-to-date. This eye-popping growth has been supported by record net inflows, which have totalled over €22bn.

The uptake has been driven by changing attitudes from both investors and fund providers. This asset growth reflects a growing recognition that ESG factors can be material to long-term financial performance, as companies face greater scrutiny from consumers, regulators, and employees alike over their ESG practices.

The crisis caused by the coronavirus pandemic has further highlighted the importance of building sustainable and resilient business models based on multi-stakeholder considerations.

Source: Morningstar

Menu expands

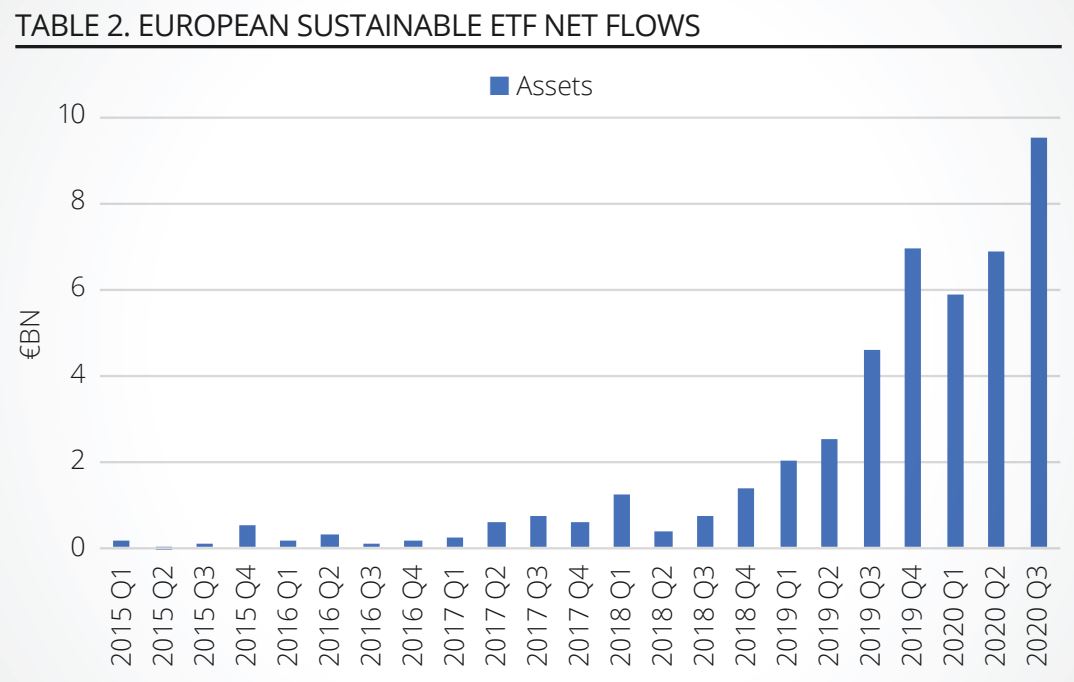

As assets have begun to arrive en masse, most ETF providers have rushed to launch or expand their sustainability offerings. Some 72, or more than half of the ETFs launched in Europe year-to-date integrate sustainable criteria into their investment process.

The diverse range of approaches to sustainable investing, combined with the almost infinite number of ways they can be mixed and matched with different markets, asset classes, and investment styles, has fanned the flames of product development. Europe has been the epicentre of much of the sustainable product development.

This year saw the launch of the world’s first sustainable ETF targeting the ‘blue economy’. The BNP Paribas Easy ECPI Global ESG Blue Economy UCITS ETF (BLUE) invests in firms specialising in offshore wind farms and those firms targeting sustainable fishery and marine operations.

Source: Morningstar

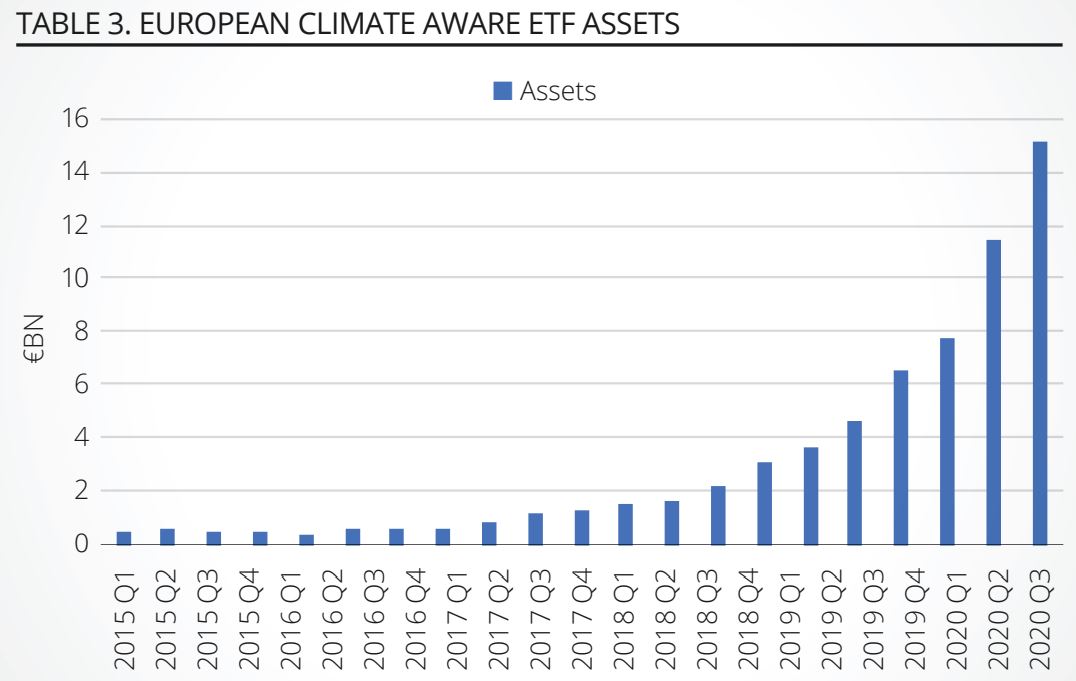

The rise of climate-aware ETFs

Climate risk has become an increasingly important issue for investors. Assets in climate aware ETFs have more than doubled since the beginning of the year and sit at record levels.

Nearly one quarter of all ETF launches in Europe this year has an explicit climate-focus. New entrants range from the CSIF (IE) FTSE EPRA Nareit Developed Green Blue ETF (GREIT), which reweights REITs based on their green building certification and energy usage, through to iShares’ new range of MSCI minimum volatility ESG ETFs, which track low carbon indices.

Source: Morningstar

'Paris-aligned' destination

As the popularity of climate investing grows, so do the accompanying accusations of ‘greenwashing’. To address this, a number of index providers have worked with the European Commission to ensure that their strategies are aligned to the Paris Climate Agreement goal to limit global average temperatures to below 2°C above pre-industrial levels.

Climate change ETFs: What is all the fuss about?

This goal-focused approach and the stamp of approval from such a respected third party will please many investors. So far, Amundi, Lyxor and Franklin Templeton have all launched ‘Paris-aligned’ core equity ETFs, and we expect more to follow.

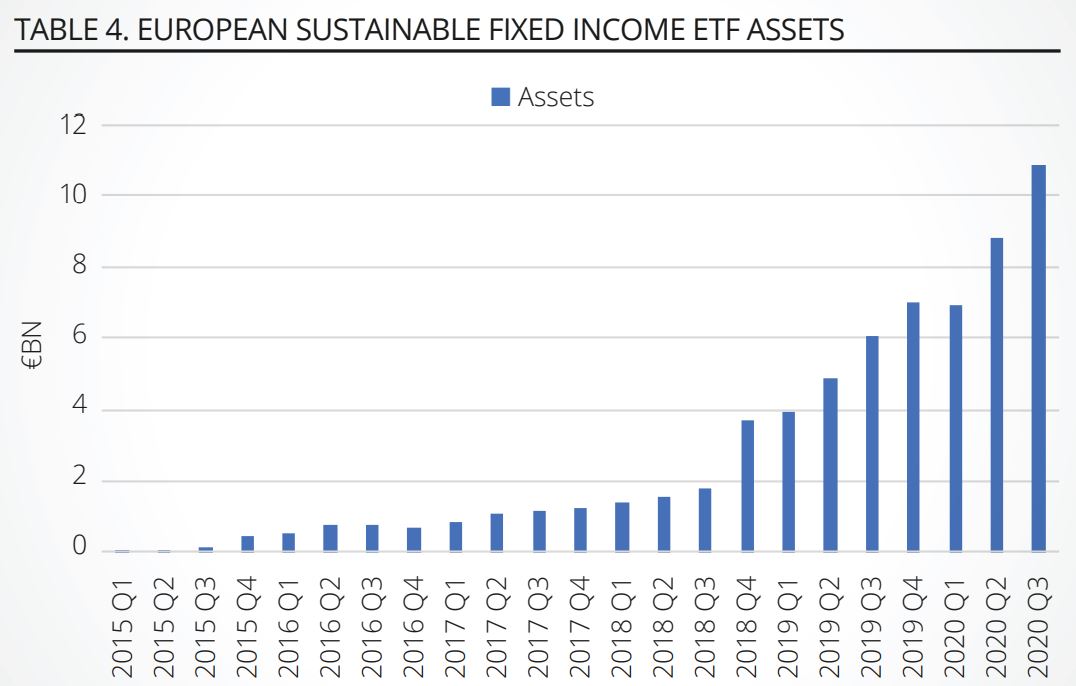

Fixed income grows, but still lags

Assets in sustainable fixed income ETFs grew by 50% over the first three quarters of the year and sit at record levels. We have also seen a record number of launches so far this year, with 16 coming to market.

That said, representing 20% of the European sustainable ETF market, fixed income assets still fall short of their 30% market share in the broader European ETF market.

Source: Morningstar

This underdevelopment can be attributed to both the lack of sustainability data for bonds and the challenges of assigning ESG ratings to government debt. While corporate bonds can be scored using a similar ESG scoring system to equities, there are still question marks over how to best evaluate government debt, where there is a fine line between making an objective ESG assessment and straying into political territory.

Taking a stand against the policies of an elected government, even if rationalised from an ESG perspective, is something that individual investors may find easy to do; however, large asset managers or ESG-rating companies’ risk being accused of unduly interfering with a political process. ESG assessment of governments is an area that is still a work in progress.

Amundi’s Fagan: Fixed income ESG ETFs will only continue to accelerate

Also, in the case of developed sovereigns, applying ESG filters can lead to outcomes that are difficult to implement. For example, some ESG-conscious investors may consider some of the policies of the former US administration – like the withdrawal from the Paris Climate Agreement – to go against the most basic of ESG principles. One must seriously consider, though, the implications of excluding the largest developed government-bond market in the world from a bond fund.

These difficulties are laid bare, when we consider that at there are just five sustainable government bond ETFs listed in Europe with combined assets of only €1.5bn.

Kenneth Lamont is senior analyst, manager research, passive strategies, at Morningstar

This article first appeared in the Q4 2020 edition of Beyond Beta, the world’s only smart beta publication. To receive a full copy,click here.