The rise of thematic ETFs remains a trend to watch, with over $139bn invested in such funds. While this pales in comparison to the $4trn invested in vanilla ETFs, these types of ETFs play a very different role in the portfolio.

Thematic ETFs are typically used as a “satellite” position, meant to complement the core of the portfolio that relies on cheap, index-tracking funds. These funds generally tap into a specific market theme or trend.

As launching an ETF becomes easier, bringing more first-time entrants to the market with niche strategies, the breadth and number of thematic ETFs has grown.

Issuers are getting quicker with taking market themes and trends and packaging them into ETF form. But there is one factor that can make or break a thematic ETF’s success that has nothing to do with the investment rationale itself: timing.

A lucky break

Thematic ETFs often find success due to being launched at just the right time, often unintentionally. One notable example of this is the ETFMG Prime Cyber Security ETF (HACK).

Less than two weeks after the ETF’s launch in November 2014, a hacker group called “Guardians of Peace” leaked confidential info from Sony Pictures. The data included confidential emails, Social Security numbers and other personal information.

In June 2015, the US Office of Personnel Management announced it had experienced one of the largest breaches of government data in US history. The data breach involved personnel records related to government employees and their friends and families.

With both events occurring in the ETF’s first year of existence, shining a light on growing cybersecurity concerns, HACK saw net flows of over $1.3bn.

Though the theme has merit on its own as our increasingly connected lives highlight the need for companies within this space, the fund likely wouldn’t have seen such success without data breaches bringing those concerns to the surface.

Shorting at the right time

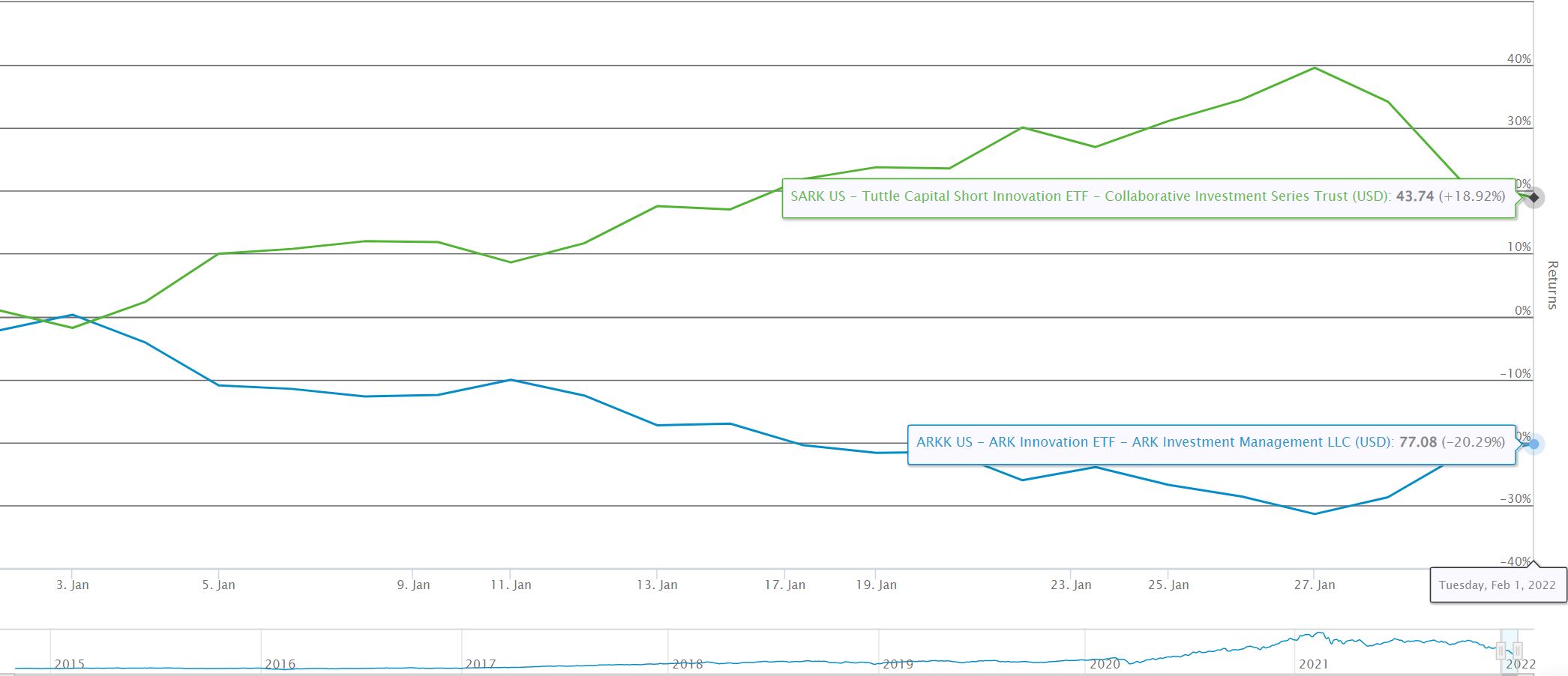

A more recent example is the November 2021 launch of the Tuttle Capital Short Innovation ETF (SARK). Despite being less than three months old, SARK has already gathered over $330m by providing inverse exposure to a popular struggling ETF – the Ark Innovation ETF (ARKK).

In fact, since launch, ARKK has over-delivered on its promise – another example of how longer-term performance of leveraged and inverse ETFs can be path-dependent – rising by 61.8% while ARKK has dropped by 42.6%.

Chart 1: ARKK vs SARK YTD returns

Source: ETFLogic

While ARKK’s performance had been on a downward trend since February 2020, the actively managed fund has struggled more than similar ETFs, amplifying SARK’s gain.

Tickers lucky too

The Roundhill Ball Metaverse ETF (META) saw a dramatic increase in flows in late October of last year, coinciding with Mark Zuckerberg’s announcement that Facebook would be rebranding to Meta.

While META was the beneficiary of this announcement, likely due to its ticker as well as the term “metaverse” going mainstream, there is speculation that Roundhill might be benefiting in another way.

Although neither company has commented on the fate of the “META” ticker, Roundhill has announced that it will be changing the ticker at the end of January. Separately, the company formerly known as Facebook has delayed its own ticker swap until sometime this quarter, with some speculating that it purchased the ticker from Roundhill.

Other side of the coin

But luck can be good or bad. And some ETFs that might otherwise have flourished if launched at a different time have instead died on the vine.

The Sprott Buzz Social Media Insights ETF (BUZ) launched in 2016, using artificial intelligence to identify stocks with bullish investor perception based on social media. While this ETF would have been perfect for January 2021, when GameStop and AMC skyrocketed on retail trader interest, BUZ instead fizzled out, closing in 2019 after gathering only $10m AUM.

In comparison, an ETF that launched in March 2021 based on the same idea had greater success. The VanEck Social Sentiment ETF (BUZZ) gathered more than $350m assets in its first month. The fund’s assets have since fallen to $112m but this stands head and shoulders above later entrants.

These similar ETFs that launched a few months later appeared to have been too late to the party. The FOMO ETF (FOMO) launched just two months later, in May 2021. FOMO has gathered only $6m and is underperforming the S&P 500 by more than 17%.

The newest entrant to the meme stock ETF mania is the Roundhill Meme ETF (MEME). While the ETF’s process uses social media activity and short interest – the same factors that drove GameStop and AMC to highs – MEME has struggled since its December launch.

Momentary or more?

It seems the drivers underpinning the rationale for these meme stock ETFs might have been temporary, working for a few short months in early 2021. Absent a resurgence of this retail frenzy, it seems unlikely that these ETFs will be able to generate outperformance and gather sizable assets, ensuring their longevity.

While shorter-term trends can still be used to an investor’s advantage, investing in ETFs for this purpose requires a higher level of oversight and a greater tolerance for risk, as the time between conception and launch of related ETFs could deem them already irrelevant.

Investors in thematic ETFs need to consider whether the investment rationale underpinning an ETF is a momentary flash in the pan or a larger secular trend that could drive outperformance for years to come.

This story was originally published onETF.com

Related articles