President Donald Trump had an axe to grind with China’s trading practices long before he was elected in 2016. It was not until 2017, post inauguration, the US trade official Robert Lighthizer said China’s policies regarding intellectual property warranted investigation.

Annually, the US economy suffers a $600bn loss due to counterfeit goods, pirated software and theft of trade secrets, according to the BBC.

The US consequentially implemented tariffs on billions of dollars’ worth of Chinese goods. China similarly retaliated and resulted in on and off talks between both countries who kept increasing tariffs. Increasing the costs for importing goods encourages buyers to stick with domestic manufacturers, improving the local economy.

In 2018, China suffered three tariff hikes on more than $250bn worth of goods. In frustration, China imposed tariffs on $110bn worth of US goods. Trump wanted to make the last move and refused to back down, despite calling truce back in December 2018.

On 5 May 2019, following months of talks and negotiations, Donald Trump tweeted: For 10 months, China has been paying tariffs to the USA of 25% on 50 billion dollars of high tech, and 10% on 200 billion dollars of other goods. These payments are partially responsible for our great economic results.

“The 10% will go up to 25% on Friday. 325 billion dollars of additional goods sent to us by China remain untaxed, but will be shortly, at a rate of 25%. The tariffs paid to the USA have had little impact on product cost, mostly borne by China. The Trade Deal with China continues, but too slowly, as they attempt to renegotiate. No!”

Trump’s tariff increases from 10% to 25% on “other goods” would result in the S&P 500 having its worst performance of the year so far.

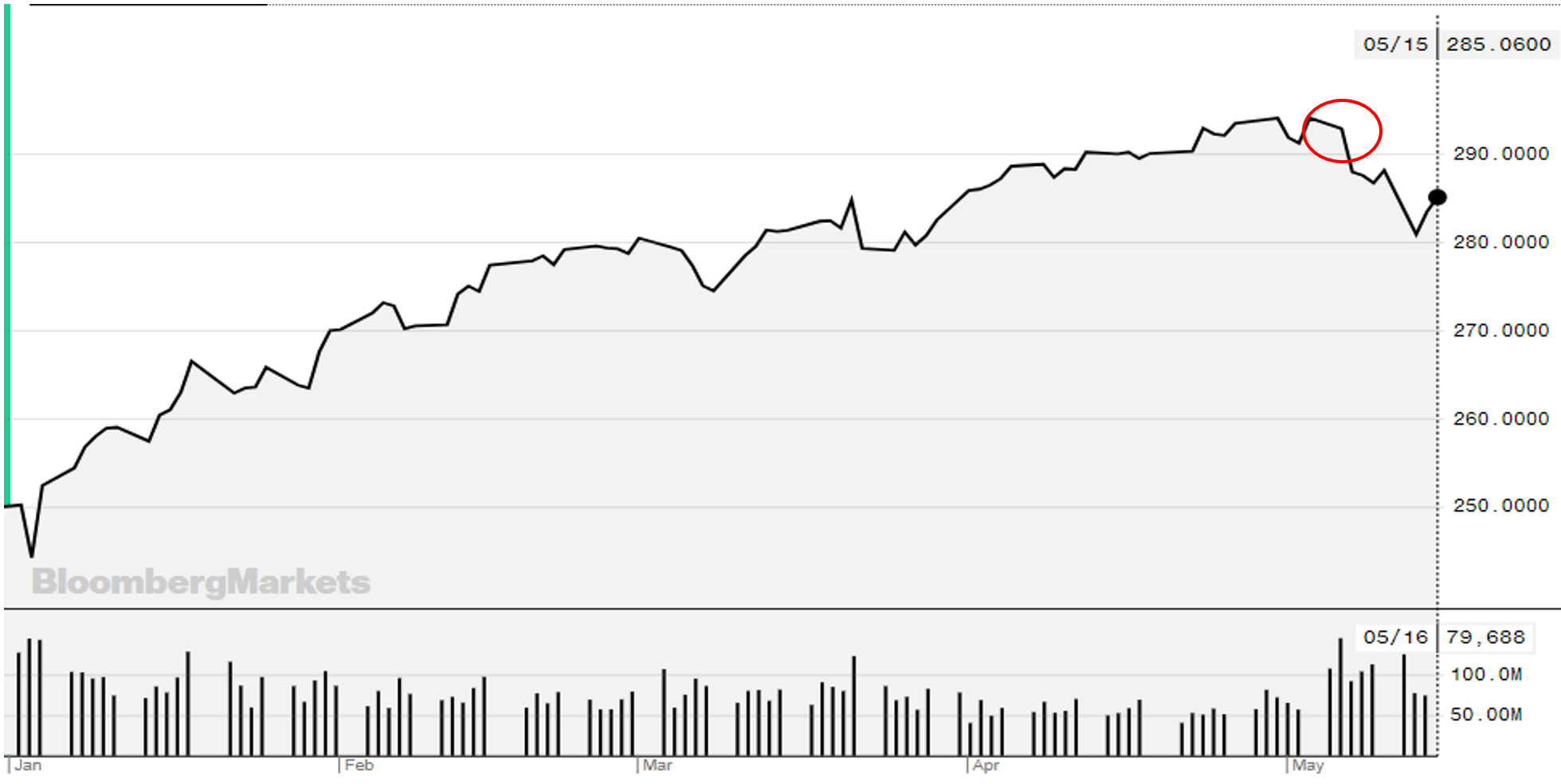

S&P 500 one-month performance - Source: Bloomberg

On 6 May (circled), the S&P 500 fell 4.1% over the next week. This forced Donald Trump and Chinese President Xi Jinping to continue negotiations.

On 10 May, Trump again tweeted: “Over the course of the past two days, the United States and China have held candid and constructive conversations on the status of the trade relationship between both countries.

The relationship between President Xi and myself remains a very strong one, and conversations into the future will continue. In the meantime, the United States has imposed Tariffs on China, which may or may not be removed depending on what happens with respect to future negotiations!”

Four days later, China further raised its tariffs on $60bn of US goods to be implemented from 1 June.

Impact on the ETF market

Last week, the SPDR S&P 500 ETF (SPY) saw outflows of $7.1bn, following the S&P 500’s slump, according to Ultumus. While SPY saw significant outflows, other S&P 500 ETFs were pulling in new cash.

SPY YTD-performance – Source: Bloomberg

SPY had significantly strong performance for the first four months of 2019, climbing 17.2%. However, the ETF faced a major sell off after Trump announced the US’s most recent tariff hike.

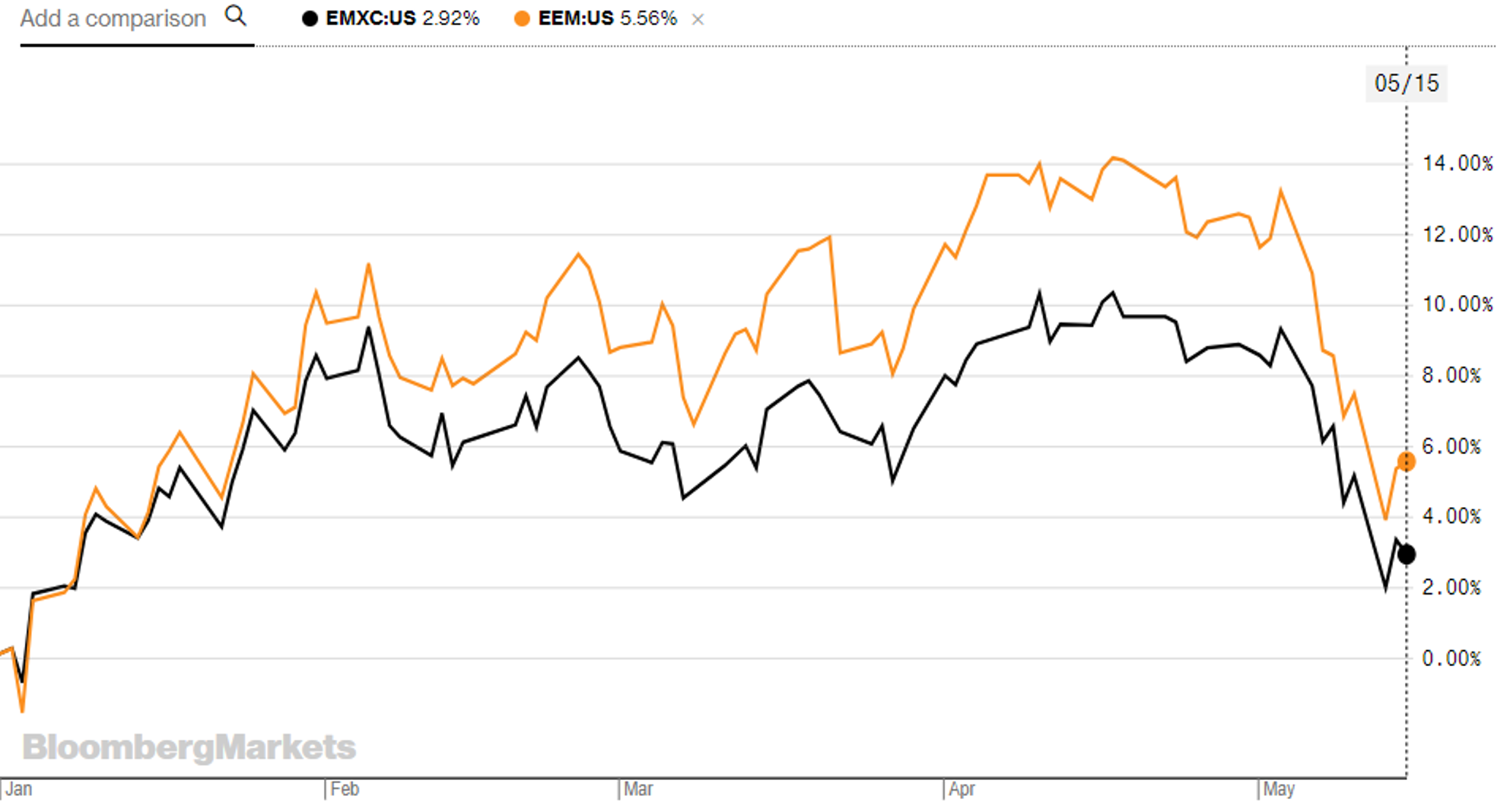

It is a similar story for ETFs with exposure to Asia and emerging markets. Prior to Trump’s tweet, the iShares MSCI Emerging Markets ETF (EEM) had a Year-To-Date performance of 13.2% but has since fallen 7.6%.

Similarly, the iShares MSCI Emerging Markets ex China ETF (EMXC) had a YTD performance of 9.3% prior to the news but has also fallen 6.4% since.

EMXC and EEM YTD-performance – Source: Bloomberg