ETF trading across European stock exchanges has increased dramatically over the past 12 months, in a sign investors are moving away from over-the-counter (OTC) trading in favour of increased transparency and reduced settlement risk.

The London Stock Exchange (LSE) saw ETP orders jump to £154.8bn in 2020, up 50%, versus a turnover increase of just 5.9% across the overall market. Likewise, ETPs accounted for 12.4% of the LSE’s order book in 2020, up from just 5% in 2015.

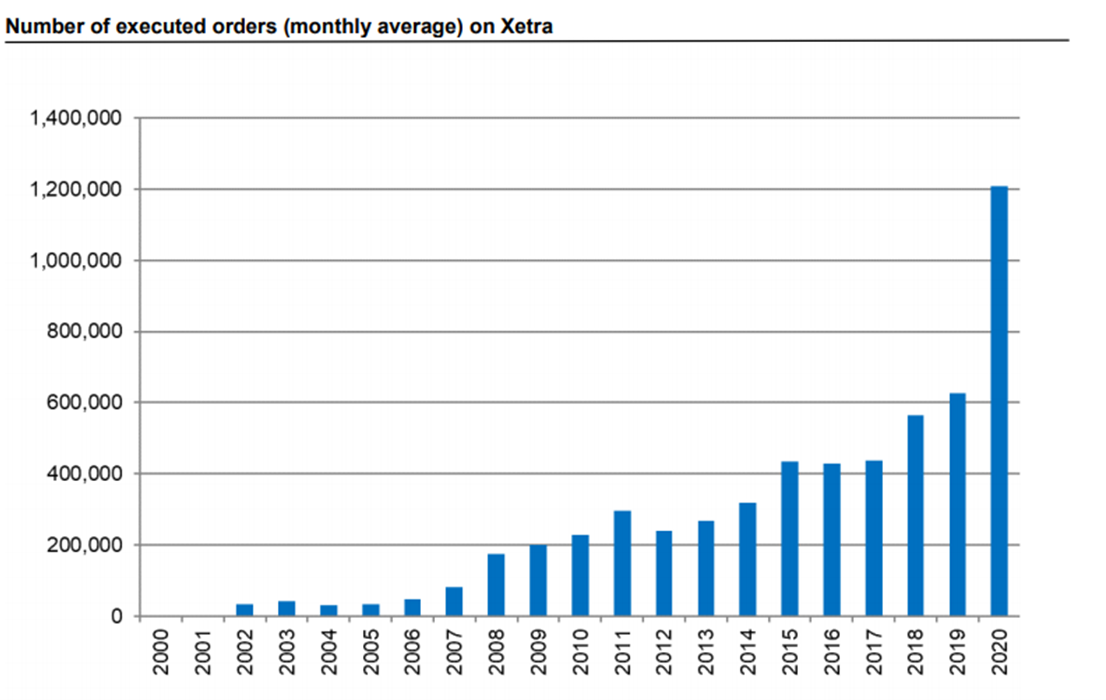

Meanwhile, Deutsche Boerse’s Xetra led the way with ETP turnover of €214.4bn, up 58% year-on-year – and set against a 22.6% increase in equity trading. Furthermore, the number of average monthly orders jumped to more than 1.2 million in 2020, up from 627,000 in 2019 and little over 200,000 a decade earlier.

Source: Deutsche Boerse

According to data from BlackRock, total on-exchange ETF trading jumped 46% to $828bn in 2020 compared to the previous year while the proportion of on-exchange trades rose from 25% to 30% as total ETF volumes hit $2.8trn.

Traditionally, the majority of ETF trades in Europe have taken place OTC, however, the introduction of MiFID II in 2018 had the consequence of pushing volumes to lit venues and mainly the request-for-quote (RFQ) platforms such as Tradeweb and Bloomberg.

However, investors are starting to recognise the benefits of trading on-exchange versus OTC and RFQ. One benefit Ciaran Fitzpatrick,head of ETF servicing Europe at State Street, highlighted, was the transparency of volumes and liquidity data on offer.

On-exchange trading enables investors to examine and compare the liquidity profiles of individuals ETFs, something which cannot be achieved OTC.

“This brings more confidence to investors around pricing of trades and liquidity of products on exchange which can only be beneficial,” Fitzpatrick stressed.

Thelack of a consolidated tape, however, remains a big issue for the European market as investors are unable to see the full liquidity picture of the ETFs they are trading.

Steps have been taken to address this issue with Bloomberg introducing an ETF Aggregate Volume feed which covers roughly 80% of the market.

Furthermore, in 2019, Deutsche Boerselaunched a liquidity indicator, theXetra Liquidity Measure (iXLM), in a move to improve transparency within ETF trading.

“We published a liquidity measure based on intraday shifts in order book liquidity which helps investors to identify optimal execution times throughout the trading day.” Stephan Kraus, head of Deutsche Boerse's ETF segment, added.

Another benefit is on-exchange trading facilitates lower execution prices. By allowing investors to interact with market makers, proprietary trading firms, and retail and institutional investors, Kraus explained exchanges bundle the liquidity of diverse groups into a single order book. In turn, this can lead to tighter spreads and lower overall execution costs.

“Furthermore, investors are not bound to accept prices given by market makers as is the case on OTC and RFQ platforms but can actually submit their own limit orders to the order book. This can result in further cost savings by obtaining a more favourable execution price.” Kraus continued.

Finally, exchanges offer an added safety net. Via their centralised clearing model, the LSE, Deutsche Boerse, and other exchanges reduce the risk of settlement failures during ETF trades, and these capabilities may improve further following the implementation of the Central Securities Depositary Regime (CSDR) in February 2022.

Kraus said: “On the post-trade side, central clearing reduces settlement risks by providing investors with settlement netting, failed trades management and client asset protection services, therefore adding an additional layer of security to on-exchange trading.”

However, Fitzpatrick was keen to stress the nature of ETFs means there will always be a high level of trading on RFQs and OTC despite the sharp rise in ox-exchange volumes.

To counter this, Ivan Gilmore, head of ETP trading at the LSE, said exchanges are launching their own RFQ platforms.

As Pravin Bagree, head of ETF capital markets at UBS Asset Management, told ETF Stream: “We continue to see more clients using RFQ platforms and view the development of exchange RFQs as positive for the ETF trading ecosystem.

“RFQ platforms have transformed the order workflow and embedded the concept of competition when executing. Clients will need a compelling reason to change, however, we strongly believe investors require different execution options depending on their benchmark and size of trade.”