One of Wall Street’s most accurate recession indicators briefly flashed red, spooking some investors and causing others to wonder whether things are “different this time”. The spread between the 10-year US Treasury yield and the two-year US Treasury yield inverted by as much as seven basis points last Friday, before reversing course over the next few days.

A yield curve inversion – when shorter-dated US Treasuries yield more than longer-dated US Treasuries – is an unusual occurrence in modern times, and one that typically precedes recessions.

It is much more typical for the US Treasury yield curve to slope upward, with yields increasing for longer-dated maturities, as economic uncertainty is greater the further out in time you go. Longer-dated maturities also have more interest rate risk than shorter-dated maturities.Bottom of Form

The last time the 10-year to two-year section of the yield curve inverted was in August 2019, months before COVID-19 slammed the economy, causing a short but dramatic economic downturn.

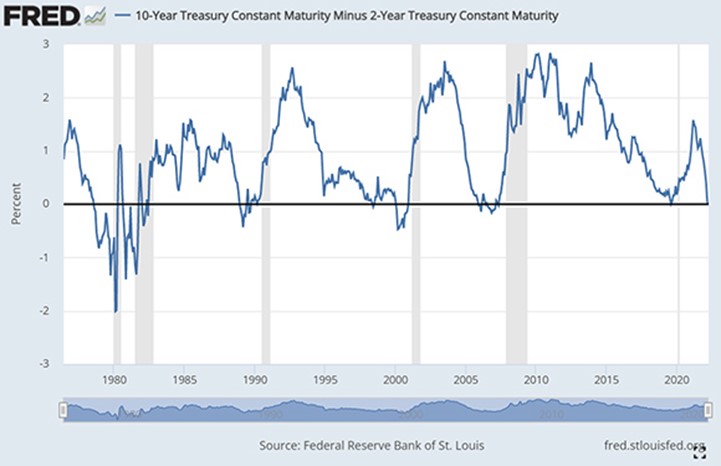

While the pandemic was impossible to foresee, yield curve inversions have preceded every recession since 1970, as can be seen from the chart below (recessions are shaded in grey):

The 10-year to two-year spread is just one yield curve indicator that investors keep an eye on. Others, like the 30-year to five-year spread and the 10-year to three-month spread are also seen as signals of a potential recession.

The 30-yearr to five-year spread inverted at the end of March and remains inverted today, while the 10-year to three-month spread is far from inverting because the three-month US Treasury bill yield is closely tied to the Federal Reserve’s benchmark federal funds rate, and both are still less than 0.75%.

Are things “different this time”?

Regardless of which yield curve inversion signal you look at, a recession tends to follow not long after the signal is triggered, with a one- to two-year gap between the inversion and the start of the recession.

But not everyone is convinced that just because the yield curve inverts, a recession is inevitable. Speaking at his post-FOMC press conference in March, Fed Chair Jerome Powell said that it’s “hard to have some economic theory on why [it] would make sense” for the 10-year to two-year Treasury yield to be a good recession indicator.

Others say that because of the significant amount of Fed intervention in bond markets – especially at the long end – the yield curve is not the indicator it used to be. Historically low rates also make it so the curve will naturally invert more often than it has in the past, reducing its forecasting ability, they argue.

Still a useful indicator

On the other hand, there is the case to be made that the yield curve is still one of the best recession indicators we have.

The US Treasury yield curve normally slopes upward. An inverted curve reflects the bond market’s expectation for the Fed to cut rates down the line. The Fed normally cuts rates in response to an economic downturn, hence why an inverted curve could be a recession signal.

Another interpretation along the same lines is that longer-dated US Treasury yields are more influenced by market forces, while shorter-dated yields are more influenced by the Fed. When short-term rates exceed long-term rates, it may suggest that the Fed has moved above what the market considers to be the appropriate interest rate, with all the risks to economic growth that entails.

For ETF investors, an inverted yield curve is something to pay attention to. No one knows if a recession is on the horizon or whether this is the first time in 50 years that the inverted yield curve turns out to be a false signal. Regardless of what happens, investors should be prepared.

Trying to time the market is foolish but now is as good a time as ever for investors to revaluate their portfolios to see whether they would be comfortable with their current allocations even in an economic downturn.

This story was originally published onETF.com

Related articles