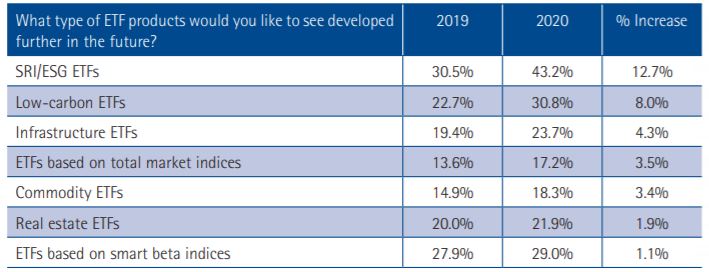

ESG and low carbon ETFs were cited as the top two areas where investors would like to see further product development, according to the latest EDHEC-Risk Institute survey.

The survey, which interviewed 191 European ETF and smart beta investors in partnership with Amundi, found 43.2% of respondents cited further product development in the ESG ETF space, a 12.7 percentage point increase from 2019.

Meanwhile, 30.8% of investors cited low carbon ETFs as another area, an 8 percentage point increase and second on the list having been just tenth in 2019.

Source: EDHEC Risk-Institute

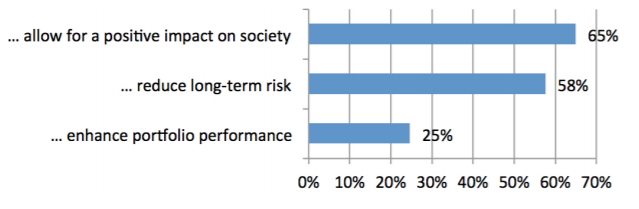

The key reason why respondents incorporate ESG factors was to “allow for a positive impact on society” (63%) while to “reduce long-term risk” was highlighted by 58% of respondents.

Source: EDHEC-Risk Institute

Somewhat interesting, 63% of respondents said they did not want to incorporate ESG at the expense of performance, however, “enhancing portfolio performance” was cited by just 25% of investors as a reason for incorporating sustainable factors.

The ‘E’ was highlighted as the most important dimension of ESG with 57% indicating this while the ‘G’ was cited by 36% and the ‘S’ by just 7%.

The increasing demand for ESG ETFs is reinforced by the high satisfaction rates. This year, 49% of respondents are investing in ESG. Of this, 55% have used ETFs, up from 33% in 2019, while satisfaction rates are at 87%, 29 percentage points higher than last year.

ESG and ETFs: The superior approach to sustainable investing?

The preferred approach for respondents was to adopt a positive screening (best-in-class) which scored 45% of respondents preferring this methodology.

Some 30% of respondents highlighted a thematic approach while just 25% went for negative screening or exclusions.

Lionel Martellini (pictured), director of EDHEC-Risk Institute, commented: “These findings confirm that ESG investing has become a key force in the industry, and that ESG exposure can be achieved not only via active managers, but also via passive investment vehicles.

“The high level of interest among respondents in ESG is remarkable. It was not mandatory to answer these five questions and yet at least 95% of respondents did so.”

ETF issuers not focusing on ESG are set to lose out in a big way

Overall, demand continues to be high for ETFs with 54% of investors planning to increase their use of ETFs in the future despite the high maturity of the market.

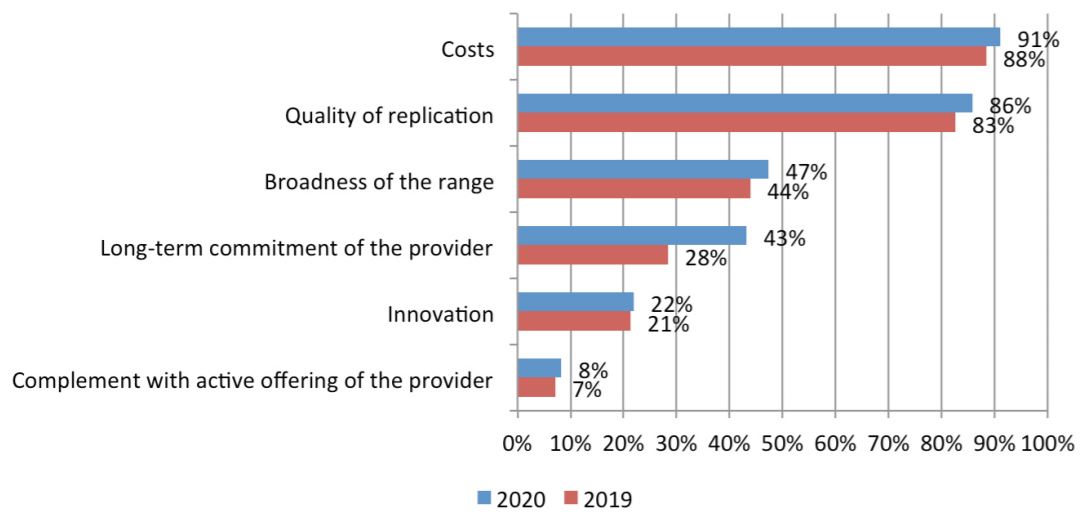

The key factors for respondents when selecting an ETF provider were costs (91%) and quality of replication (86%). Long term commitment of the ETF provider was cited by 43% of respondents, up from just 28% in 2019.

Source: EDHEC-Risk Institute

“Given that the key decision criteria are more product-specific and are actually “hard” measurable criteria, while “soft” criteria that may be more provider-specific have less importance, competition for offering the best products can be expected to remain strong in the ETF market,” Martellini explained.

“This implies that it will be difficult for existing providers to build barriers to entry unless they involve hurdles associated with an ability to offer products with low cost and high replication quality.”