Let us talk safe havens. Because I am officially paid to be a bit contrarian and therefore gloomy, you might think I am constantly bearish. Overall, however, I am in fact a fairly bullish sort, and in my investing, I am probably a mixture of aggressive tech bull and cautious value bargain hunter. But the default position is usually risk on.

That has not been a bad tactic for a long time now, but as we enter a new monetary and political policy regime, it is important to think through what might constitute safe havens in a potentially more volatile world. I ask this question because it strikes me that many of the classic safe havens do not make as much sense as they used to. Cash, for instance, is not looking too hot in an era of high inflation and still low interest rates (even if they are heading up).

Most bonds are also looking a bit shaky, and I would not want to be caught defending the idea that the vast majority of corporate bonds are a diversifier within a portfolio. They are not.

Government bonds – especially US Treasuries at the longer end of the maturity curve – and I suppose TIPS (if you are an out-and-out inflationist) might make sense; however, ask yourself this question: how high do you think government bond yields can go before government bonds in Washington and London start feeling hot under the collar?

In the UK, high inflation is already being used by the government to cut back spending on the public health budget because of the increasing cost of past index-linked bond issuance. If all new conventional bonds started costing Treasuries, say, 4-5%, how quickly do you think we would see an almighty fiscal crisis and drastic austerity budgets? All of this leads me to suppose that the upper limit for US 10-year Treasury yields is probably 3-4%, at which point I suspect government bonds might then start to seem a decent bet. But we have got to get to those rates first, which means potentially more losses for conventional government bonds.

Rather more to the point, there is also a significant amount of research that suggests that the old positive relationship/correlation between US Treasuries and US equities is about to re-emerge after the last few decades of negative correlations. Right through to the late 1990s, the correlation between the S&P 500 and 10-year US Treasuries was actually mostly positive, and in many periods from 1969 onwards, that correlation metric was above 0.5, i.e., not tightly correlated, but correlated enough not to provide much diversification benefit.

Over the last few decades, by contrast, that relationship flipped, and correlations turned negative. That might be changing.

Vincent Deluard, global macro strategist at Stone X, said: “The trailing one-year correlation between the returns of long-term US Treasuries and those of the S&P 500 index is [now] close to zero. Long-term US Treasuries have lost a cumulative 1.7% on down days for the S&P 500 index since March 2020, and they have lost an average 20 basis points on large equity sell-offs days in 2021.”

So, a safe haven? Maybe. Let us quickly pass over the ludicrous argument that bitcoin and the other digital currencies might be a safe haven – they are not and never will be anything resembling a safe haven given the sky-high levels of volatility currently being experienced. They might be a bet against the collapse of the Western money fiat order, but at the moment that is not on the cards!

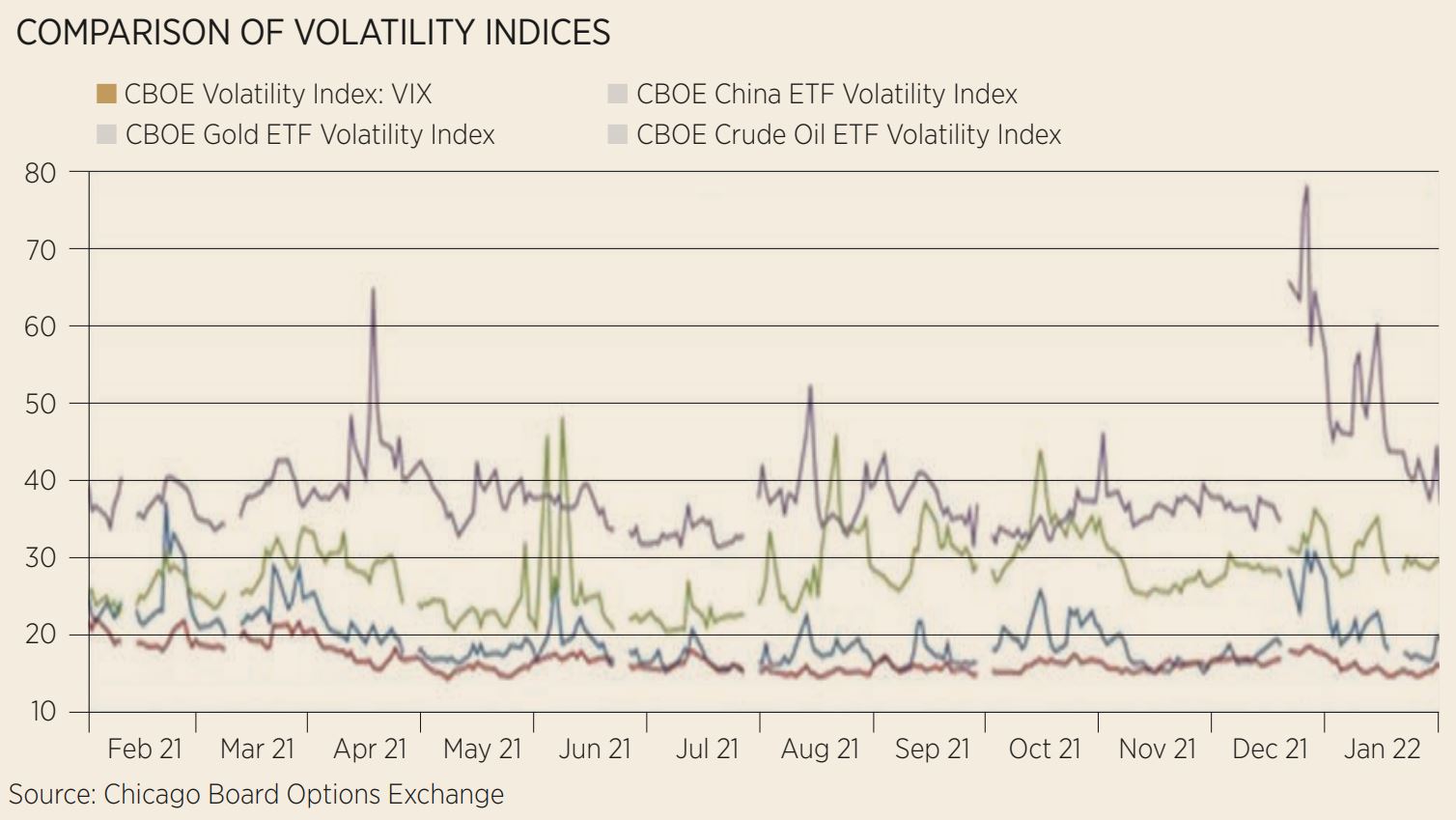

This leaves us with two last relatively liquid asset classes: gold and currencies. Let us start with gold. Gold volatility has in fact been low for the last year, as the chart below shows. Gold prices have certainly been stable, although it’s worth noting that US equities volatility has been lower than gold for some weeks in 2021.

So, if a safe haven is defined as simply a low volatility asset class, then gold looks solid. But my definition of a safe haven is one that: a) is negatively correlated with equities and also bonds; AND b) one that over time does not lose much in value.

The practical challenge here is that gold has lots of cross-cutting asset class relationships which make a snapshot analysis very difficult.

The most well-known relationship is between the US dollar and gold – a strong dollar is usually bad news for gold prices. The next relationship, more tenuous, is between oil and gold. According to Shahbaz et al. (2017), there has been a positive price correlation between gold and oil prices more than 80% of the time in the past 50 years – except of course when there was not as in the middle of the COVID-19 crisis.

For me, much the most interesting relationship is between gold prices and real yields. Charlie Morris, CIO at ByteTree, has pioneered this research – he treats gold as if it were a zero-coupon, 20-year US Treasury inflation-protected security (TIPS).

As he said: “Gold is a store of value, so inflation is the long-term price driver. But the bond model explains medium-term price moves because real interest rates influence gold’s present value.”

Source: ByteTree Asset Management

The chart above shows that ratio, and suggests that gold is now roughly at fair value. Logically this ratio makes sense. If real rates are high, then gold is much less attractive. But if real rates are rock bottom, then what have you got to lose from holding gold? But again, the actual relationship between real rates and gold is probably a little more complicated.

At the start of the year, the World Gold Council put out its latest analysis accompanied by predictions for 2022, and the following passage stood out: “Gold’s short- and medium-term performance tends to often respond to real rates which combine two important drivers of gold performance: “opportunity cost” and “risk and uncertainty”.

Furthermore, low interest rates – both nominal and real – are shifting investment portfolios more towards risk-on assets. And this, in turn increases the need for a high-quality liquid asset such as gold.

“Gold has historically underperformed in the months leading up to a Fed tightening cycle, only to significantly outperform in the months following the first interest rate hike. Gold may have partly been aided by the US dollar which exhibited the opposite pattern. Finally, US equities had their strongest performance ahead of a tightening cycle but delivered softer returns thereafter.”

That last point about the importance of the US dollar is also worth considering. All these complex relationships depend on which country you hold your portfolio in. Joachim Klement, investment strategist at Liberum, reminds us that what might work for someone in Germany or the US, for instance, might be a total waste of space in the UK.

“Dirk Baur from the University of Western Australia has done a nice little exercise of measuring the correlation of gold with the local stock market in 68 countries. He did that using gold prices in US dollars and gold prices in local currencies.

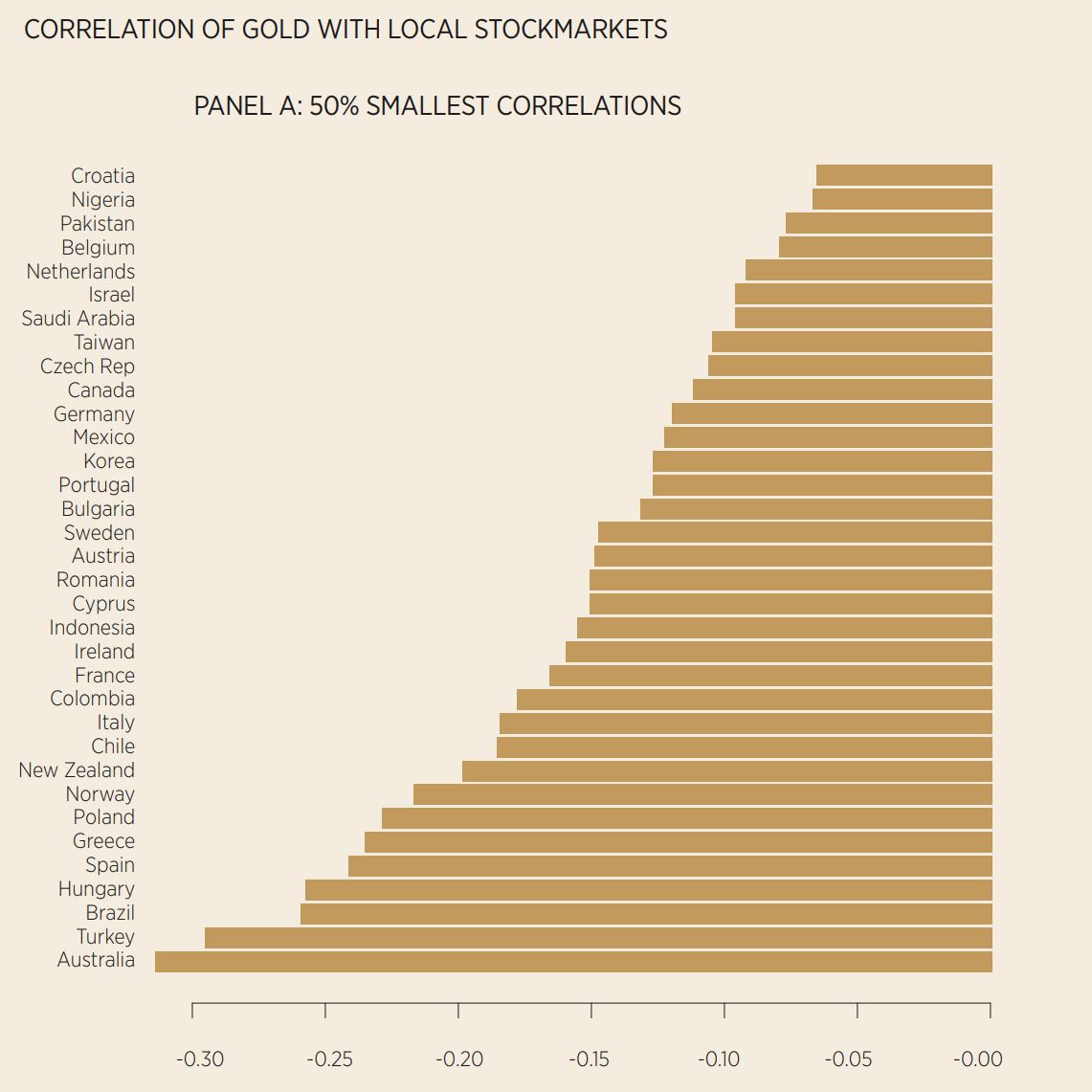

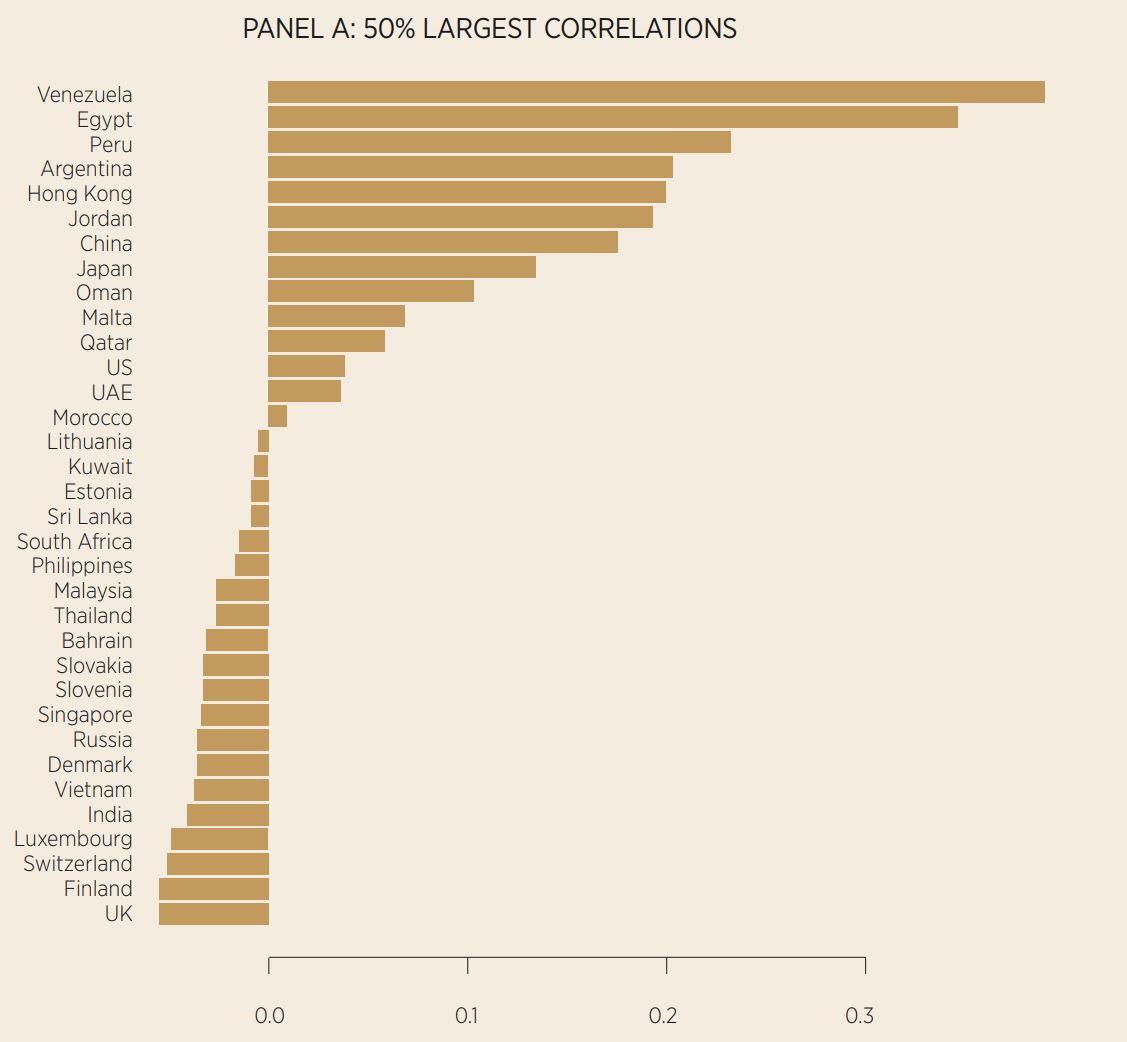

“The chart below shows the correlations between local stock markets and gold in local currencies. Note how Venezuela has the highest positive correlation.”

It will not come as a great to surprise to see that in Venezuela, there is a very tight correlation. In a hyperinflationary environment, anything faintly looking like a real asset – buildings, cash-flow producing businesses and gold – looks attractive. But the protection qualities of gold significantly increase as we head down the list.

"For countries starting with Oman and the US down to Israel or Taiwan, gold has essentially a correlation of zero with the local equity market and therefore provides pretty good diversification.

"But if you find yourself in the countries at the bottom of the list which includes pretty much all eurozone countries, Sweden, Norway, and Australia then you are in luck. Gold has a significantly negative correlation with the local equity market and thus is an excellent protection asset."

So, one can probably conclude that gold does still have significant diversification benefits for many developed world investors, but probably not all, and certainly not all the time!

But there is another asset class is even more rewarding: currencies, of which two in particular stand out – Switzerland and Japan.

At this point, it is back to Deluard, a dedicated controversialist. He recently put out a paper that makes a very strong case for the Swiss franc as the most liquid, most obvious safe haven asset.

In a paean to the mountainous land-locked republic, Deluard lists the big picture macro positives for Switzerland:

Every Swiss owns $85,000 in net foreign assets, $106,000 in currency reserves and $17,400 in US stocks (!).

The latest 13F form filed with the SEC reveals that the Swiss National Bank owns a mind-boggling $157bn in US stocks, or $17,444 per capita. Thanks to the SNB’s mostly passive purchases of US stocks, every Swiss owns about $1,000 in Apple’s stock, $890 in Microsoft, $680 in Alphabet and $670 in Amazon.

Real GDP is soaring, inflation is contained and the government’s budget should be in surplus this year. Real GDP is expanding by more than 4%, and consumption by just 2.8%. The unemployment rate has fallen to 2.5%. Despite the pandemic, the government deficit is just 2% of GDP, and should be in surplus next year.

Deluard’s bottom line? "The Swiss franc should benefit from increased volatility in 2022 and US Treasuries’ failure to hedge equity risk.

"Due to inflation, the Swiss National Bank should tolerate a higher Swiss franc next year and the Swiss economy can handle a strong currency. Swiss francs are already expensive but have room to become a lot more overvalued in 2022."

So, what is on my short list for safe havens in 2022? Probably gold, certainly Swiss francs, probably the Japanese yen and maybe US Treasuries.

David Stevenson is founder and strategic adviser at ETF Stream

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

Related articles