BlackRock and Vanguard captured the lion’s share of ETF flows in Europe last year as investors opted for low-cost passive strategies amid a turbulent market environment while DWS and PIMCO suffered outflows.

According to data from Bloomberg Intelligence, UCITS ETFs saw €80.1bn inflows in 2022 outpacing mutual fund flows in every month until November, a sign of the ETF wrapper’s resilience during one of the most challenging market environments since the Global Financial Crisis in 2008.

It also shows how ETFs are becoming the vehicle of choice for investors across Europe who used the volatility to rotate out of mutual funds and into ETFs.

In particular, core building blocks such as the iShares Core MSCI World UCITS ETF (IWDA), the iShares Core S&P 500 UCITS ETF (CSPX), the Xtrackers DAX UCITS ETF (DBXD) and the Vanguard FTSE All-World UCITS ETF (VWRL) were among the strategies that captured the most inflows over the past 12 months.

Amid this demand for broad-based ETFs, Vanguard was the standout performer in 2022, seeing €11.3bn inflows across its 34-strong European ETF range.

The US giant saw particular demand across three products, VWRL, the Vanguard S&P 500 UCITS ETF (VUSA) and the Vanguard FTSE All-World High Dividend Yield UCITS ETF (VHYL), which saw a combined €6.1bn inflows.

Henry Jim, ETF analyst at Bloomberg Intelligence, said this indicates investors are “looking for a place to hide” in broad ETFs.

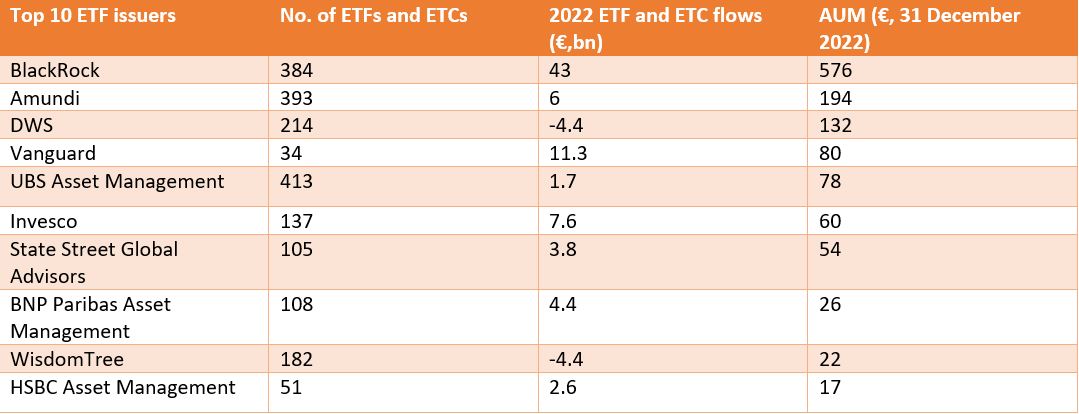

Elsewhere, the ever-present BlackRock saw the highest inflows across all ETF issuers in Europe with €43bn inflows, over 50% of the entire market flows in 2022.

This takes their overall assets under management (AUM) to €576bn as investors turned to US Treasury ETFs including the iShares $ Treasury Bond 7-10yr UCITS ETF (IBTM) and iShares $ Treasury Bond 3-7yr UCITS ETF (CBU7) which saw $4.7bn and $3.2bn inflows, respectively.

Source: Bloomberg Intelligence

There were also strong years for BNP Paribas Asset Management and JP Morgan Asset Management which collected €4.7bn and €2.8bn inflows, respectively.

Behind BlackRock and Vanguard, the duo had the strongest years in terms of flow per ETF with JPMAM’s AUM climbing to €9.6bn and BNPP AM’s hitting €26.3bn.

JPMAM’s strong year highlights the increasing demand for active ETFs this side of the pond. According to a recent survey of professional investors conducted by ETF Stream in partnership with JPMAM, some 58% of respondents believe 2023 will be the year of active management, a potential boon for active ETFs.

Furthermore, Amundi and Invesco also had strong years with inflows of €7.6bn and €6bn, respectively.

Last year, the French asset manager kicked-off the process of merging the Lyxor ETF range with Amundi equivalents as it looks to realise economies of scale following the completed acquisition of its rival in January 2022.

At the other end of the spectrum, Amundi’s rival for the number two spot in Europe, DWS, had a challenging year. The German asset manager saw outflows of €4.4bn driven by waning demand for its Euro Stoxx 50 ETF. DWS currently has €132bn AUM versus Amundi’s €194bn.

Meanwhile, heavy outflows from its short-duration US ETF meant PIMCO suffered €2bn net redemptions as investors opted for more duration over the course of 2022.

Related articles