Commodities have had a pretty appalling five-year performance. Yes, they are cyclical and are governed by supply and demand, but with returns in negative territory in recent years are they still worth investing in?

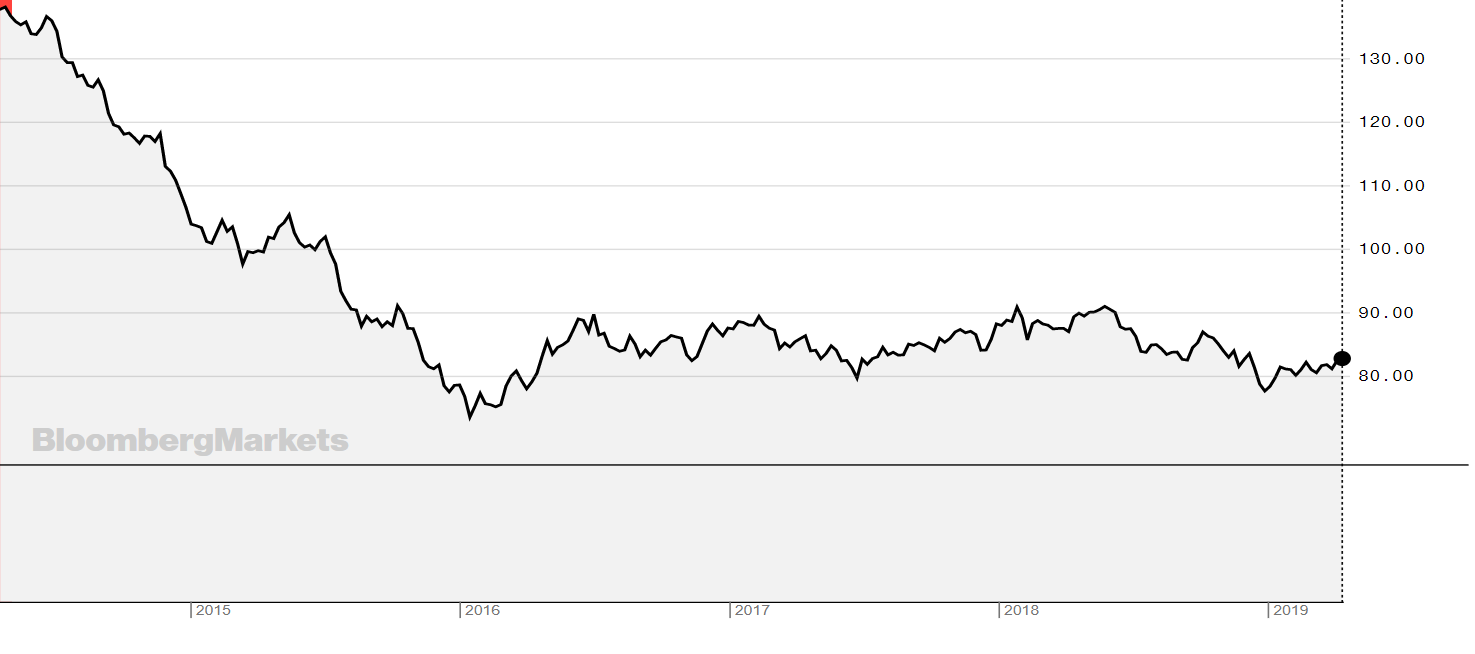

As a graphical illustration - to show what broad commodity returns look like over the past five years - the chart below shows the Bloomberg Commodity index over the past five years:

Source: Bloomberg

The commodity sector can be broken down into four different parts – energy, metals, agricultural commodities, and livestock.

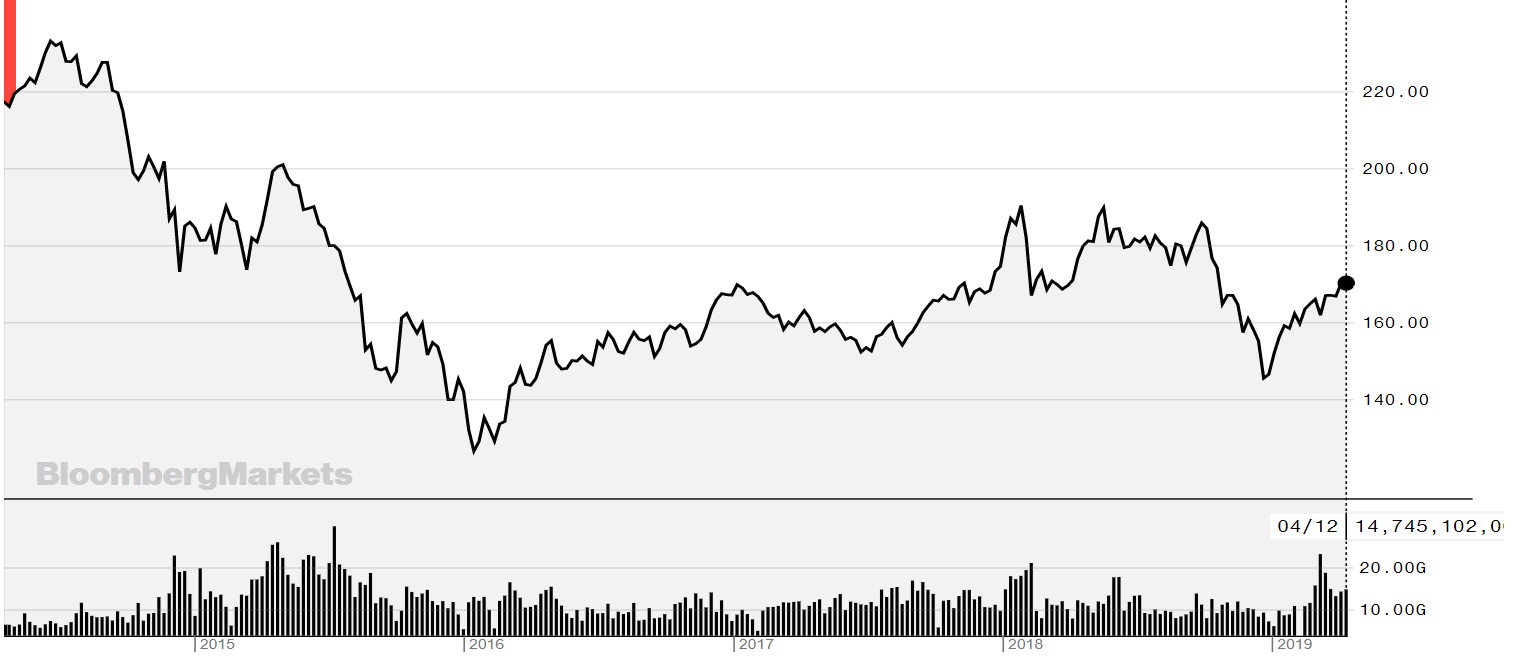

Energy – The Bloomberg World Energy index looks like this over the past five years.

The Bloomberg WTI Crude Oil Subindex is shown below over the past five years.

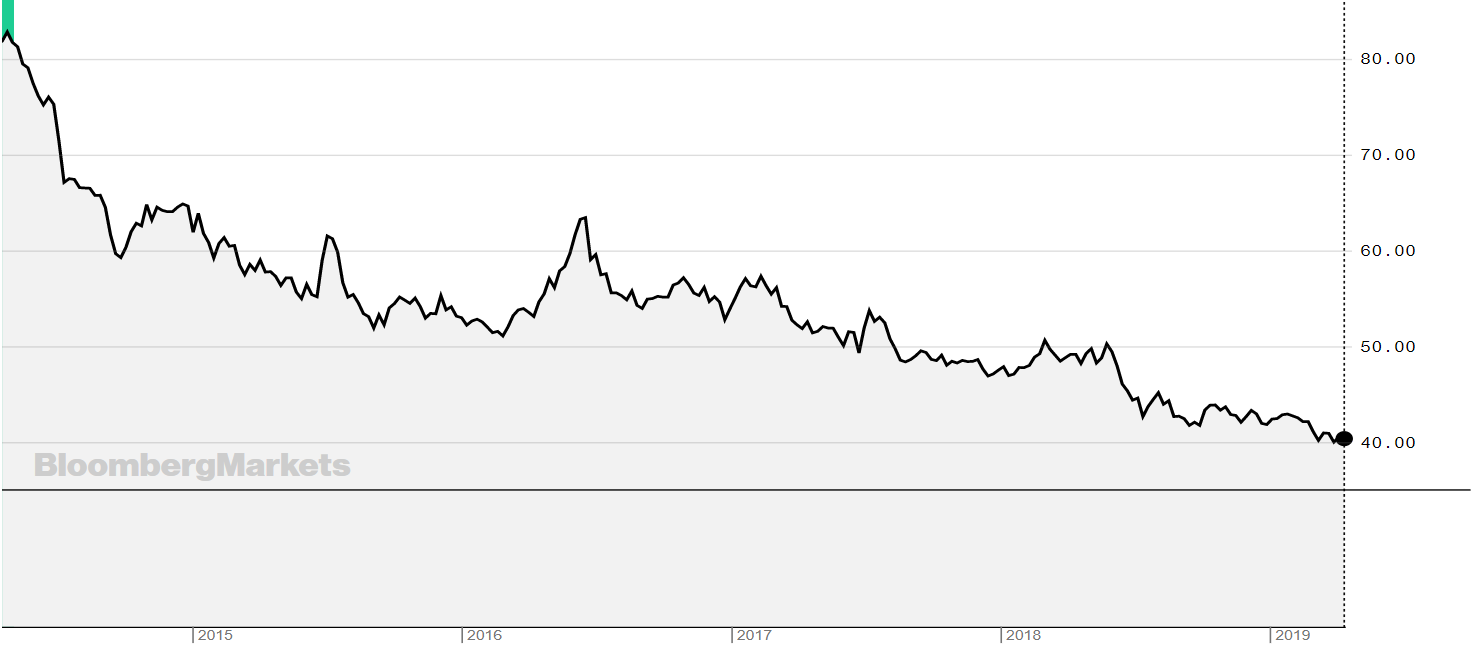

The Bloomberg Agriculture Subindex below over five years.

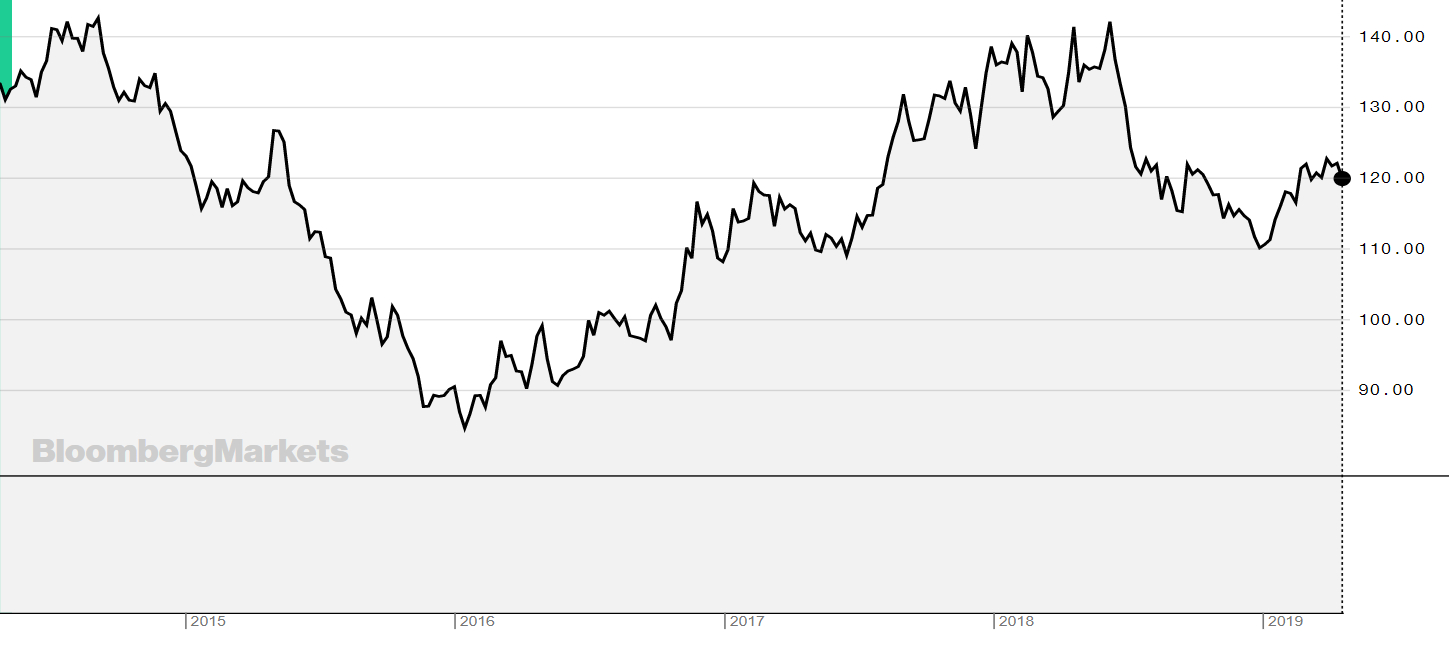

And the Bloomberg industrial metals subindex below. Which has done better than the other three sectors although still down on its peak.

So, what is happening and is investing in commodities best avoided?

No, but it does require patience and research.

It is worth understanding the different way each set of commodities work and the different cycles and returns they generate based on reactions to supply and demand and geopolitical issues.

For example, oil fell 7% on 13 November 2018 to a one-year low, its worst day since September 2015, over fears of a supply glut. CNN reported that "the losses in the oil world have been staggering as worries deepen about excess supply. Crude is down 12 straight days, the longest losing streak since futures trading began in March 1983". Oil is now trading at a six-month high which shows how volatile oil can be.

Another example using sugar, shows how its price cycle is slow, around five years. Not only is it impacted by supply and demand, but there are other factors to consider such as US corn, Brazilian ethanol, gasoline and crude oil as well as connecting with Emerging Market sentiment (Brazil, Thailand and India main producers) as well as Global Macro aspects such as the DXY.

Gurdev Gill, agricultural options broker at Marex Spectron, explained: “On the face of it sugar production does not look like an attractive investment.”

Gill cites world prices being low (12.50 c/lb or $275 per tonne), which is considered well below the cost of production in even the most efficient producing countries like Australia, Thailand and Brazil.

“Prices are not likely to improve radically in the foreseeable future. Cane production is notoriously inelastic, and beet producers for various reasons are unlikely to cut production for at least another full season,” he says.

There are also changes in the way people view food and nutrition that are impacting demand for sugar. Typically, growth in global consumption would eat through world stocks and produce a balanced or deficit market within a few years, but this is changing due to obesity and health scares, and more specifically, multinational brands reducing sugar content, and governments taxing high-sugar-content products.

However, there are still reasons to be positive on this commodity. As Gill points out, “There is always room for the 'right investment'. Sugar is protected in most countries, and domestic prices are very high in some areas, e.g. China, USA, and India. So, a rational new sugar project in certain specific areas still makes sense.”

It is likely that the sugar market is now two to three years from the next sugar deficit and therefore high prices.

“It takes about three years to create a new sugar factory from scratch, so the timing actually might be perfect,” says Gurdev.

This is just a snapshot of one soft commodity, but there are wider more macro views that still support investing in commodities.

Despite being weighed down by poor performance between 2011 and 2015, 2016 and 2017 were better years before the downturn last year.

“This was a result of the market fearing demand destruction from trade-wars,” says Nitesh Shah, director, research at WisdomTree. “The market has now become optimistic that the US and China will reach a trade pact and we have been seeing a relief rally this year reflecting this optimism, with the Bloomberg Commodity Index returning 6.6% year-to-date.

"While the trade deal is unlikely to be reached imminently (and therefore the relief rally could be on pause for a short period of time), the fundamentals for many commodities remains strong. As the market moves from being sentiment-driven to being fundamentals-driven, we see commodity prices regaining strength, even after the relief rally takes place."

Using industrial metals as an example of a commodity group that has done relatively well recently, they are now in supply deficit and supply prospects are just getting tighter. Inventory on the London Metal Exchange is declining as a result. All of which support prices.

Shah is also optimistic for oil and gold. “The Organization of Petroleum Exporting Countries (OPEC) is currently cutting back on crude oil supply, offering a tailwind for oil prices. Higher oil prices should lift most of the energy complex,” he says.

This could also be beneficial for investors with broader commodity exposure given that energy typically takes up the highest portion in indices. In the Bloomberg commodity index, energy accounts for 30.34%.

Shah adds that, more broadly, “more accommodative policy from the world’s central banks (with outright stimuli from the People’s Bank of China), should strengthen the demand potential for commodities as a group. China is also engaging in fiscal stimuli and could ramp up commodity-intensive infrastructure spending in as it targets an economic growth rate of 6-6.5%. As a result, we do not think the positive performance in commodities this year so far is temporary – it has further to go.”

But the volatility that goes hand in hand with commodities has some market watchers arguing that they are best avoided.

The Balance says that commodities may be a poor investment for most investors, but there are cases where they make sense. In particular, precious metals like gold may serve as a useful hedge over a short period when an investor is concerned about a crisis.

We have previously written about gold’s use as a safe haven and hedge. But this use as a hedge or protection in portfolios may be the lifeline that commodities need.

They have a low correlation with stock market return, so when the stock market is falling, they can act as a hedge. At the end of last year, between 4 September and 24 December the Bloomberg Commodity index fell 7%, while the S&P 500 fell 18.5%.

Investing or not investing in commodities is individual to each investors, but either way access is easy with the large number of commodity ETPs. I do not have a crystal ball on whether commodity markets will continue to perform poorly, or whether they will pick up, but I do think their use as a hedge still holds some value.