AMP has left the ETF industry, shutting the three ETFs it built in partnership with BetaShares.

The exit comes after the ETFs failed to entice investors. The funds will remain open in their managed fund form.

TickerShuttered fundsFeeRENTAMP Capital Global Property Securities Fund (Unhedged) (Managed Fund)0.99%DMKTAMP Capital Dynamic Markets Fund (Hedge Fund)0.61%GLINAMP Capital Global Infrastructure Securities Fund (Unhedged) (Managed Fund)0.94%

ETF closures are common. As ETFs are expensive to operate, when they struggle to collect assets they tend to get closed. Almost every major Australian ETF provider has closed an ETF.

Nonetheless, AMP's exit is unusual.

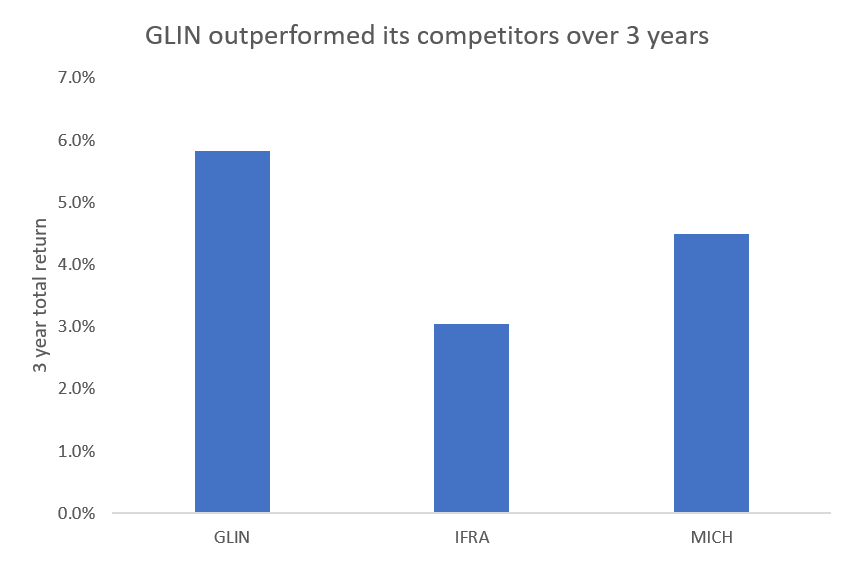

ETFs are one of the fastest growing and most exciting pockets of Australian financial services. This in itself makes it odd that an investment manager like AMP would want to leave. But making things stranger, the shuttered funds had outperformed their competitor ETFs, all of which are still open and drawing in new money.

Not the Royal Commission or ETF fees

So what’s going on?

Two obvious explanations can be ruled out.

The first obvious – and wrong – explanation is the Hayne Royal Commission, in which AMP’s reputation was ruined. Reputations are crucial for fund managers. Ruined reputations cost inflows and profits.

But the commission is unlikely to be the reason. The three ETFs were listed in 2016 – two years prior to Hayne. They gathered no assets in the years prior either.

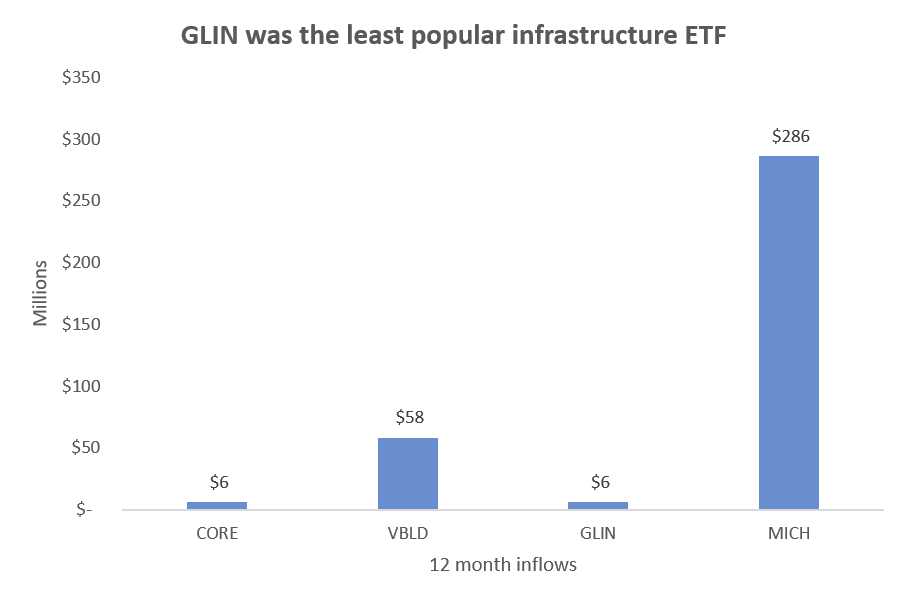

Another obvious – and wrong – explanation is fees. AMP's ETF fees were high compared to index ETFs – yes. But they were lower than its most direct competitors – such as the Magellan infrastructure ETF (MICH). Magellan’s infrastructure ETF has captured more inflows despite being worse performing and more expensive.

So what are the likely reasons?

AMP wants to be acquired

The first is surely money. ETFs require their own sales teams and marketing spend as they’re bought and traded by different people than managed funds. Managed funds, for their part, are mostly used by financial planners and advisers. Planners especially can prefer managed funds as they don’t need the day trading that ETFs provide.

ETFs for their part have a different core constituency. ETFs are also heavily bought by advisers. But far more money in the ETF industry is in direct retail and the broker community. And this comes with its own sales and marketing needs – neither of which AMP developed for its ETFs.

AMP could have built out its sales team, just like Schroders and Fidelity both did for their active ETFs. But building these things takes time and more importantly money.

The second reason is surely that AMP’s primary goal, at this stage, is to get acquired quickly. AMP’s share price and profits have fallen like led balloons. Investors trying to pick the bottom, anticipating a rebound, have learnt the lesson about dead cats. A closer look at AMP's business allows you to see why.

Growth prospects for AMP’s banking division are low. Falling interest rates and tougher competition have caused the return on equity for all Australian banks to decline. AMP Bank is no exception.

AMP wealth management, meanwhile, is getting crushed for well-publicised reasons.

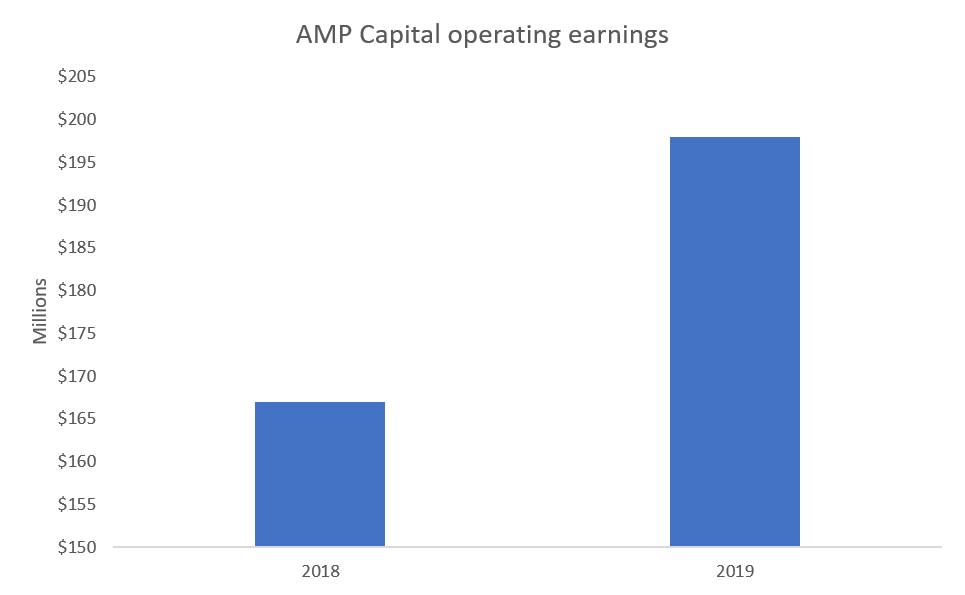

The only way back for the share price is via an acquisition. And here, the only thing worth acquiring is AMP Capital – the division that provided the ETFs.

AMP Capital runs all kinds of funds, from public share funds to those that manage real assets like airports and trains. Last year things went very well, with AMP Capital’s 2019 operating earnings jumping from $167 million up to $198 million. Things look likely to continue, too, as real assets do well in low interest rate environments.

By shutting the ETFs, AMP can help clean up the books with a view to getting acquired.