By looking at annual flow numbers and assets under management, it is clear that ETFs are more than just a trend. Some market observers are already concerned, as they expect ETFs to take over the majority of assets under management for investment vehicles in the foreseeable future.

Even as this might be too optimistic, it seems like ETFs have become a threat for active managers, as some active fund managers started to run campaigns against passive products. At the same time, an increasing number of investors are considering ETFs as their investment vehicle of choice since they were disappointed by the returns delivered by active managers.

As a result, the increased use of ETFs is reshaping the asset management industry at the moment and will continue to do so in the future as the demand for ETFs is driven by regulatory tailwinds, structural market developments such as the evolution of crypto securities, and changing investor preferences.

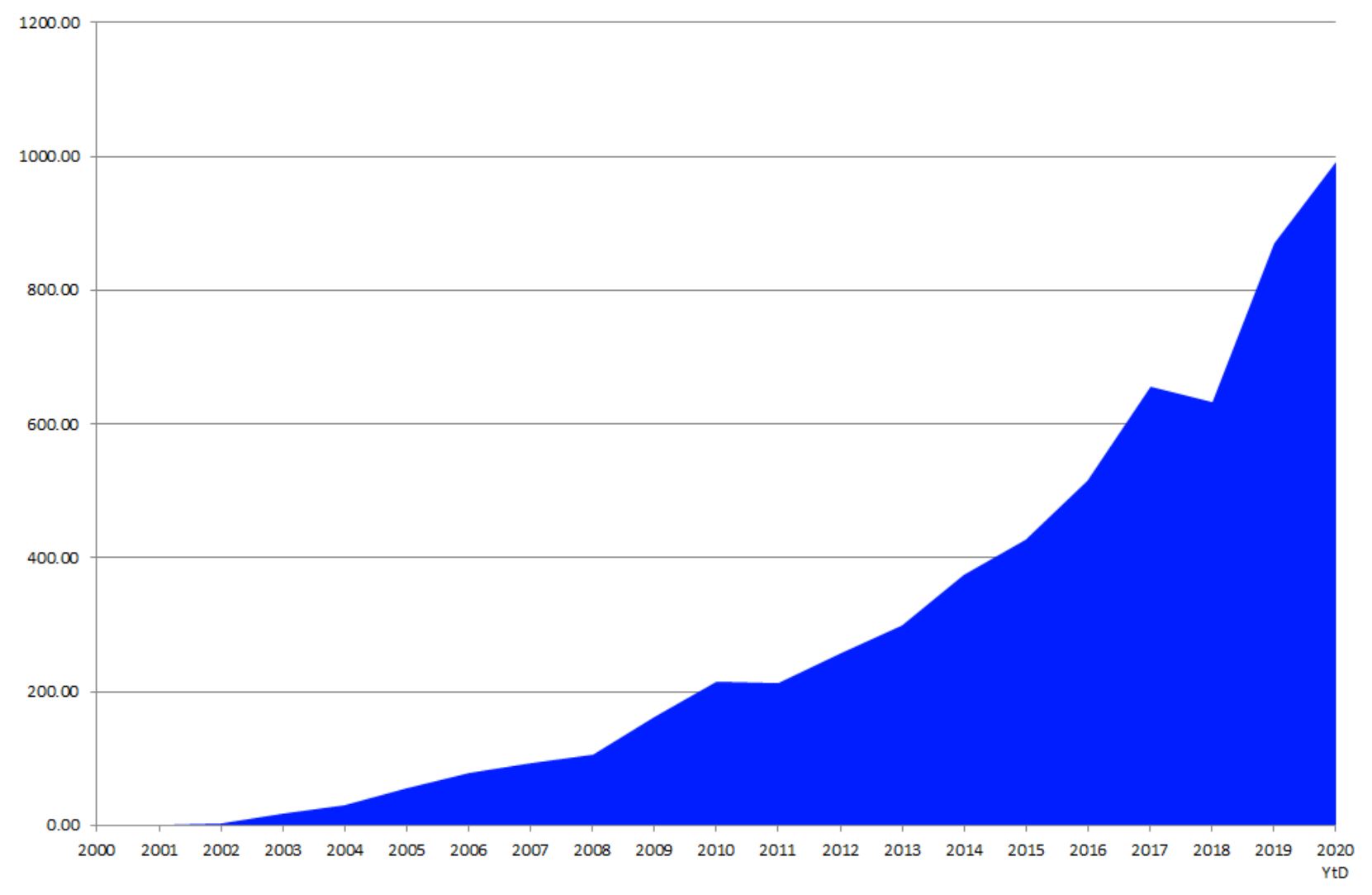

Chart 1: AUM in the European ETF industry (1 January 2000-31 December 2020)

Source: Refinitiv Lipper

With regards to this, the ongoing active versus passive discussion is not leading in the right direction since ETFs are a wrapper with powerful distribution potential which asset managers can use to deliver their existing products via new distribution channels to investors.

Therefore, asset managers should not think of ETFs as being a new business. Instead, they should see ETFs as an extension of their existing distribution strategy since an ETF offering enables asset managers to reach every type of fund buyer, from large institutions to retail investors inside and outside of Europe.

In addition, ETFs help to access new clients, as the number of ETF-only investors is increasing. In this regard, it is not surprising that more global asset managers are building ETF offerings since they recognize this distribution opportunity.

The main driver for structural market development is the fact that the world is becoming increasingly automated, which can be seen in the new regulations regarding so-called crypto securities. In addition, the COVID-19 induced lockdowns accelerated the trend that an increasing number of investors trades securities and funds on their phones and tablets, which is beneficial to ETFs.

This means that ETFs align the asset management industry with an on-demand world, as services such as Amazon Prime have changed consumer behaviour and expectations. As a result, investors nowadays expect that product information and prices are instantly available and that the delivery of goods should take less than 24 hours.

This is especially true for the new generation of investors, as they are digital natives and will therefore do things differently than established investors. This means they may not stick with their parent’s advisor or fund provider if it does not meet their needs or demand.

With regards to this, all asset managers need a strategic view on their role in the competition between ETFs and traditional mutual funds. This means that all fund promoters need to formulate their own ETF strategy if they do not already have one.

Even if the outcome from this strategy review is “do nothing now,” it is better than nothing, as this does at least mean that the respective fund promoter is aware of the changing market environment.

Detlef Glow is head of Lipper EMEA research at Refinitiv