Anecdotal evidence suggests Nordic pension funds and millennials are the main adopters of ESG. However, Nicolas Rabener, managing director of FactorResearch, argues why these two investor-types, in particular, should avoid this latest investment fad.

If investors would be looking for the ETF flavour of the year, then it would likely be ESG as highlighted by the large number of product launches in 2019. In the US, six ESG-focused ETFs have grown to more than $1 billion of assets under management, which is an important milestone that only approximately 400 other ETFs have reached, out of a global universe of close to 7,000.

However, the total AUM in ESG-focused ETFs is only approximately $25 billion, which is less than one percent of total assets in the ETF industry, according to data from ETFGI. Given that most equity and fixed income investment products can be structured to be ESG-compliant, there is plenty of further room to grow. Blackrock, the world’s largest asset manager, predicts ESG ETF assets will hit $400 billion by 2028.

Two investor types that are particularly keen on ESG investing are public pension funds and millennials, essentially representing the old and the young. However, there is a case to be made that neither of these should consider ESG investing, which we will outline in this short research note.

101 OF ESG INVESTING

ESG investing basically means separating good from bad corporate citizens as measured on ESG metrics. Investors evaluating ESG strategies should carefully consider the following:

• ADDITIONAL COSTS: Investing into ESG requires additional resources from investors, either directly or indirectly, if investing is outsourced to a fund manager. Money needs to be spent on buying ESG ratings from data providers like MSCI or FTSE. Furthermore, staff needs to be hired to evaluate the data, which typically requires expensive data scientists given large and complex data sets.

• DATA ISSUES: There are many providers that sell ESG ratings for stocks and no ultimate authority. Unfortunately, in many cases the same company ranks high on ESG metrics in one data set while low in another. This typically happens with complex firms like Exxon Mobile, which does pollute the environment through its core business, but also has a strong focus on treating its employees well and investing in its local communities.

• HIGHER FEES: ESG products charge higher management fees than plain beta ETFs, which have become almost zero-cost.

• STAKEHOLDER APPROACH: Companies that rank high on ESG pursue a stakeholder, not a shareholder approach. Naturally this implies that resources that could have been distributed to shareholders via dividends or share buybacks, are allocated elsewhere.

• REDUCED INVESTMENT UNIVERSE: Avoiding companies that rank low on ESG reduces the universe of investible companies and opportunity set for investors. A surprisingly

small number of stocks tends to be responsible for most stock market returns.

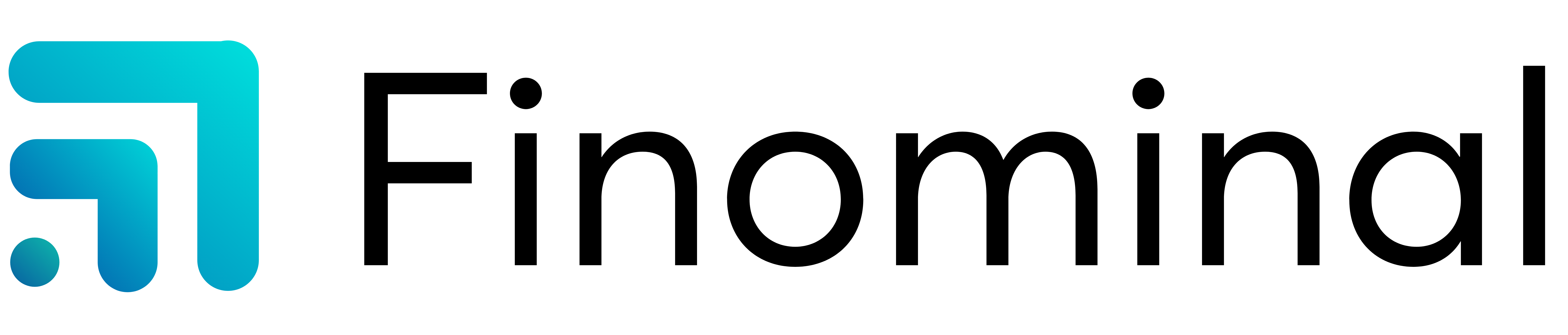

• STRUCTURAL SECTOR BETS: Certain sectors like energy rank structurally low on ESG given industry characteristics, which implies that investing in ESG strategies results in sector biases. Specifically, this results in a structural overweight in technology and underweight in energy stocks. Technology stocks have fallen out of favour before while energy stocks tend to benefit from geopolitical tensions that increase the oil price.

Naturally, some of these considerations apply to all strategies that deviate from a benchmark index like the S&P 500, but are worth highlighting (see Table 1).

BENCHMARKING ESG ETFS IN THE US

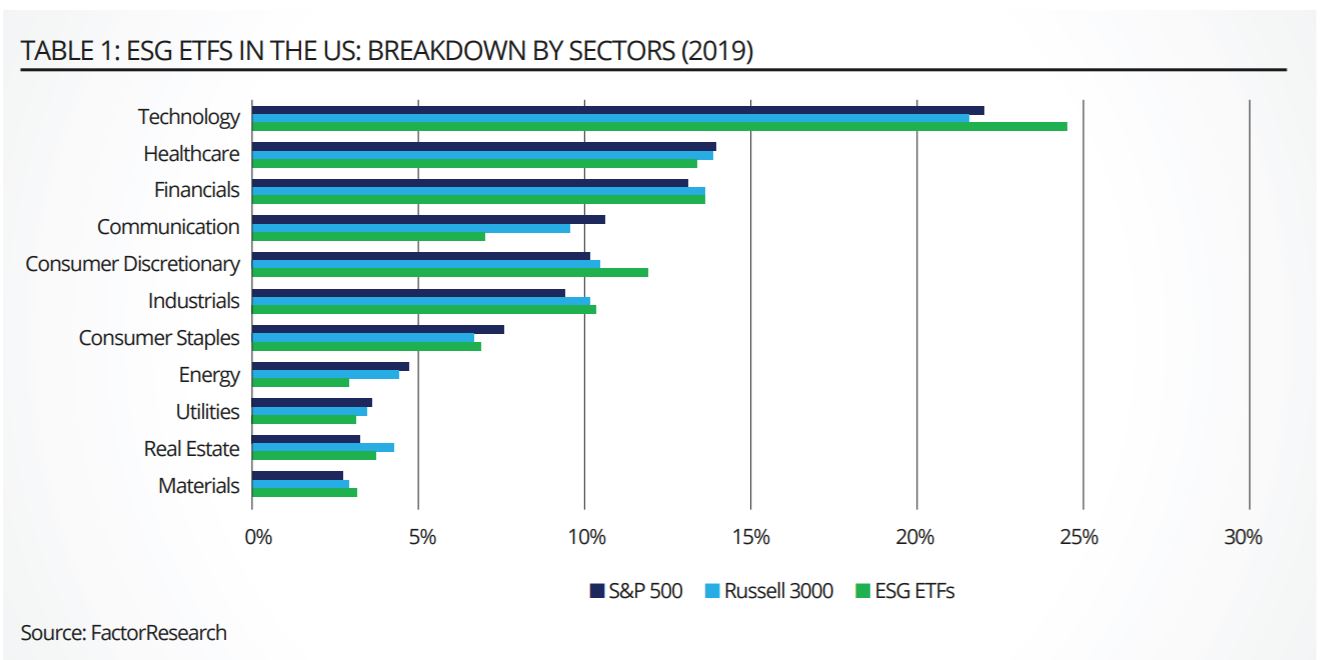

The first ESG-focused ETF in the US stock market was launched in 2005 and many further came thereafter, which provides investors with a full market cycle for benchmarking the performance against equity indices like the S&P 500 or Russell 3000. We observe that an equalweighted index of ESG ETFs would have slightly underperformed either benchmark index since 2005 (see Table 2).

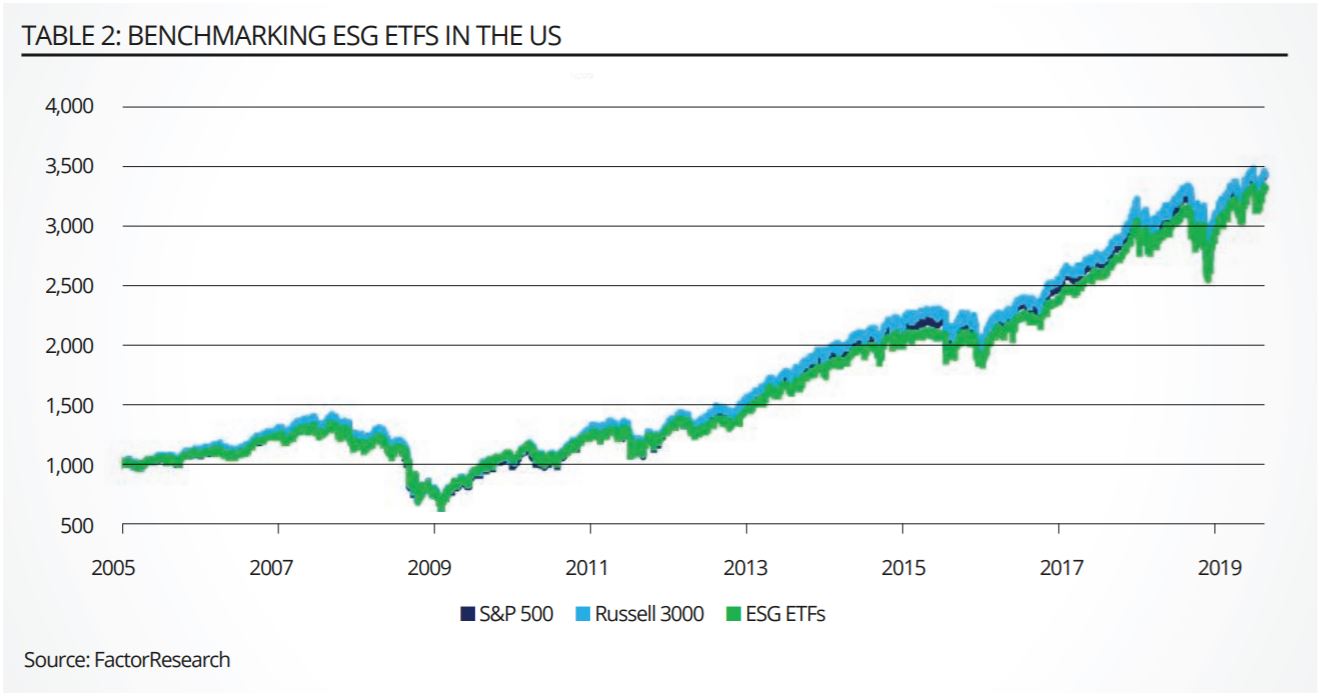

Investors could challenge that ESG-focused ETFs might have fared better, if a different starting point for benchmarking was chosen. However, if we compare the over- or underperformance of ESG ETFs to the S&P 500 or Russell 3000 per calendar year, we observe a rather random picture. ESG investing certainly does not generate consistent outperformance (see Table 3).

WHY PENSION FUNDS AND MILLENNIALS SHOULD AVOID ESG INVESTING

Anecdotal evidence suggests public pension funds globally show a keen interest in ESG investing. Given that most members of public pension fund investment committees are deeply ingrained in their local communities, it is natural for them to show support for companies that treat their employees well, aid local schools, and aim to avoid polluting the environment.

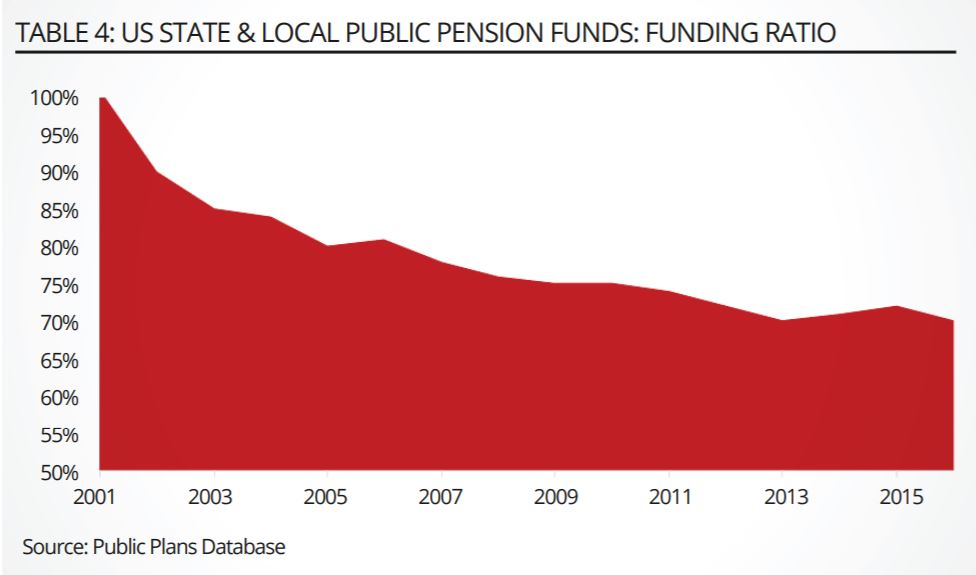

However, in many countries pension funds, public as well as corporate, are significantly underfunded. US state and local pension funds had a funding ratio below 75% in 2016, which is difficult to rectify, especially in a low interestrate environment. Unfortunately, this implies that most workers that retire in the future will have to accept haircuts on their pensions. Millions will age with reduced living standards or even in poverty.

The only real obligation that pension funds have is to meet their liabilities and pay full pensions to retired workers. With regards to ESG investing there is only one question that is relevant for the investment officers at pension funds: How sure are you that ESG investing will not cost performance?

Unless there is absolute certainty that ESG strategies will not underperform plain beta benchmarks, they should be avoided. Especially considering that the track record of ESG ETFs in the US since 2005 already indicates lower returns, which can be reasonable explained by higher fees, a constrained stock universe, and sector bets (see Table 4).

A survey from Bank of America showed that 78% of millennials review their investment portfolios from an ESG perspective, compared to only 63% from Generation X. Modern investment firms such as robo-advisors like Wealthfront or Betterment, which target millennials, have therefore integrated ESG in their core product offering.

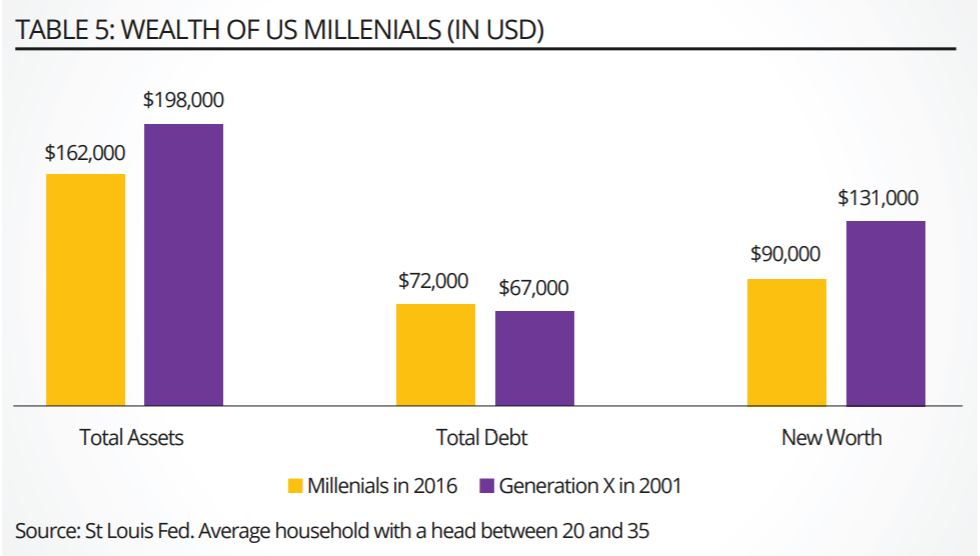

Unfortunately, millennials are financially in poor shape, similar to public pension funds, although they will benefit from a generational wealth transfer over time. In comparison to Generation X, millennials have less assets and more debt, which results in a lower net worth. It is therefore questionable if millennials should take the risk of potentially lower equity returns on their investment portfolios. Particularly when they are already facing substantial outstanding student loans and cities where buying a home has become almost unaffordable and requires significantly more debt (see Table 5).

FURTHER THOUGHTS

New research on ESG investing is published almost daily, which frequently portrays that making investment portfolios ESG-friendly comes at no costs and sometimes even with benefits. Albeit much of that research is from product providers, which should be viewed with scepticism given clear conflicts of interests.

There are few free lunches for investors and if an investment strategy or product sounds too good to be true, then it usually is. Investing in good corporate citizens at no additional cost certainly sounds enticing.

Nicolas Rabener is managing director of FactorResearch

This article first appeared in the Q4 2019 edition of our new publication, Beyond Beta. To receive a full copy, click here.