At the beginning of November 2020, we invested in clean energy equities as a thematic addition to our higher-risk fully managed portfolios. Thematic investments seek to capture long-term, transformative forces that are changing the world we live in, driving innovation and redefining business models.

There are a number of long–term structural drivers that make clean energy attractive, including the policy direction of the US economy and the transition to carbon alternatives within the global energy mix. Some of these drivers are only set to accelerate in the decade ahead.

We still see clean energy as an attractive long-term investment theme but, in recent weeks, we have become concerned over the risks of investors crowding into clean energy stocks – a risk we no longer believe we can ignore. As such, we have now removed our holding in clean energy themed ETFs from Nutmeg portfolios.

What has changed?

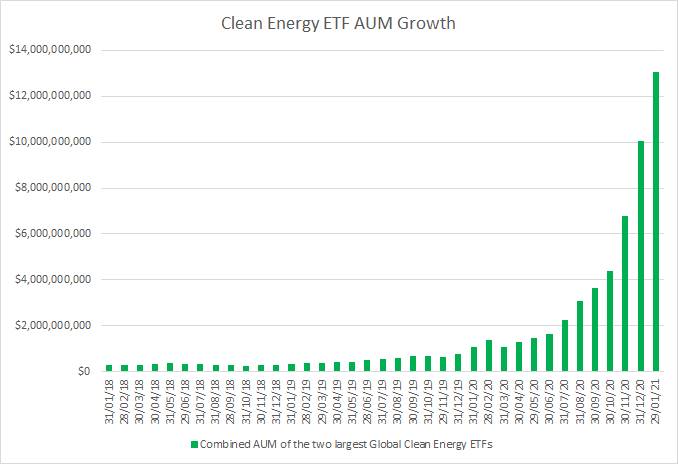

Following the US presidential election and subsequent Democrat Senate election victory, clean energy investments globally have seen significant investor interest. In fact, the two largest ETFs tracking the clean energy sector have seen their assets increase by a magnitude of 12x over the previous year. By our analysis, they have received a staggering $5.7bn inflows in the past three months alone, as at 9 February.

Source: Bloomberg, iShares Clean Energy ETF and iShares Clean Energy UCITS ETF (INRG) assets under management in USD, 31/01/2018 to 29/01/2021

This is turn has had an effect on the underlying companies within the ETFs, with demand for clean energy shares driving prices higher. The underlying index, the S&P Global Clean Energy index, is predominantly mid and small-cap companies and currently contains only 30 index holdings. Given the concentrated nature of the index and the mid-small cap focus, the liquidity dynamics of the underlying stocks and flows associated with them are of paramount importance.

Record demand for clean energy ETFs causing liquidity risks

Recognising the large inflows witnessed by the sector over the previous three months, we have assessed whether the mix of underlying assets and size of the fund now presents a concentration risk for investors and whether this sub-sector is now showing signs of investor exuberance and bubble-like behaviour.

Assessing the risk-reward

While the position of clean energy in Nutmeg portfolios is relatively small, the total assets invested in the sector are significant given its concentrated nature. This significance becomes amplified as investors utilise fund products, like ETFs, to identify companies associated with the clean energy theme.

For example, our research now shows that the percentage that the clean energy ETF owns of the underlying companies has grown markedly since October – with the two largest clean energy ETFs alone now collectively owning over 5% of the shares of the underlying companies in half of their holdings. This is a significantownership level for a thematic ETF strategy and it means that any reversal in investor interest would be likely to exert significant selling pressure on the underlying stocks.

Of course, ETFs aren’t the only buyers of these stocks. The clean energy revolution promised by President Biden has acted as a tipping point for investor interest, pushing the performance and valuation metrics of many clean energy associated companies to extremes. The S&P Clean Energy index has risen 53.1% since the beginning of November and a staggering 147.5% from its starting point one year ago. These rises in share price also have an effect on the valuation metrics of the companies – with many companies now trading at sharply elevated levels, even when considering their growth potential.

While we would stop short of calling the clean energy sector a ‘bubble’, there are certainly now bubble-like behaviours on display. Bubbles are typically characterised by sharp accelerations in performance, exuberant behaviour leading to the crowding of investors into an asset, and an appetite to discount a high price today on the promise of future growth. While it is difficult to predict when a bubble will burst, these patterns can create the risk that it is only further investor interest (not real company value) that can drive prices even higher.

The result of our analysis is that we now believe the extent of recent investor interest in the sector fundamentally changes the risk-reward equation for investing in this theme at the current time, especially given its concentrated nature.

Investment management is risk management

At Nutmeg, our core investment principles underpin the way we manage our clients’ portfolios, the attributes of the investment strategy we implement and how we seek to deliver above-average long-term returns.

Diversification and liquidity are two of our core principles and in the context of the current bull market in clean energy ETFs, they are key. Economist and Nobel prize laureate Harry Markowitz described diversification as ‘the only free lunch available in investing’, due to its ability to increase potential return whilst reducing risk. Our emphasis on liquidity, the relative ease at which assets can be bought and sold, stems from the lessons that must be learnt through the industry’s prior failures.

We will always prioritise our core investment principles and the management of risk in our portfolios, to the benefit of our clients’ long term investment objectives. Diversification of risk is key to the Nutmeg investment strategy and we actively monitor the risk to our investment portfolios on a daily basis to ensure their ongoing suitability for clients’ investment objectives. Where we identify potential risks our investment team are active in analysing and addressing them.

We continue to believe that the clean energy sector is an attractive investment theme for the next decade as structural shifts fundamentally alter the global energy mix. However, given the strong performance and significant asset flows into a concentrated sector over the previous three months, we have removed these positions from our portfolios at the current time.

James McManus is CIO at Nutmeg