Analysing the crypto market so far this year in the wake of the Terra and UST collapse, the conclusions are apparent – 2022 has not been crypto’s finest.

Despite a general bearish sentiment in the market, commentary from the Federal Reserve and ethereum’s price rally in the build-up to the highly anticipated merge fuelled the Bloomberg Ethereum Global index to increase by 43% during the month of July.1

In spite of the recent rally of bitcoin and ethereum, the aggregated market capitalisation of the crypto market is still down from just under $3trn in 2021 to $1trn, as of August.

Considering the performance of the underlying crypto market, as detailed above, it should come as no surprise that exchange-traded products (ETPs) tracking the underlying crypto assets are similarly presenting negative returns YTD. This supports the concept that the ETPs are doing what they were designed to do in tracking the underlying market and being priced correctly by the market makers.

Contrary to these market dynamics, net inflows to crypto ETPs still remain positive YTD as evidenced in Chart 1, outlining the YTD net inflows of $296m, as at 23 August. A key conclusion, looking at the net positive inflows into the ETPs, is that demand for crypto-based products such as ETPs is actually increasing.

Chart 1: Cryptocurrency ETP flow in 2022, as at 23 August

Source: Flow Traders, Bloomberg

There are several factors attributing to the continued appetite for crypto ETPs as reflected in the AUM growth, as seen in Chart 2.

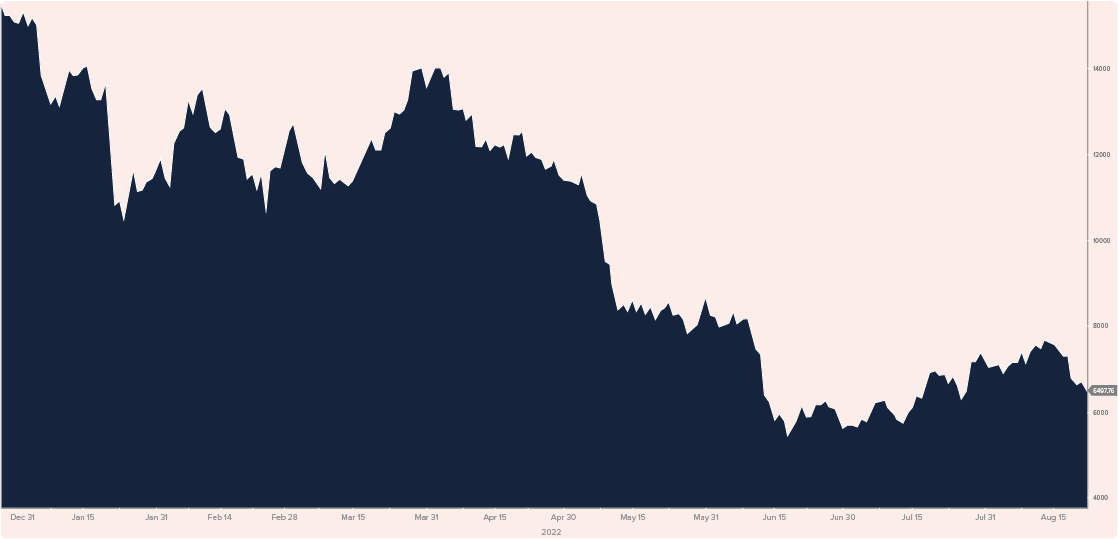

Chart 2: MVIS Crypto Compare Digital Assets 100 index is down 56.9% as of 23 August

Source: Bloomberg

A key benefit of trading crypto ETPs is they are a gateway for institutional investors to gain exposure to the underlying product without having to deal with custodial and regulatory issues of having the underlying spot products on their balance sheet. Moreover, buying and selling of crypto ETPs are executed in the same manner as their equity or fixed income counterparts, many being traded via regulated exchanges, and platforms such as Tradeweb and Bloomberg RFQe. The products also settle in the same manner via existing prime brokers.

Market makers play an essential role, as the industry and market are reliant on the skills and expertise of participants like market makers and authorised participants to provide liquidity in both the primary and the secondary market. Challenges that market makers face when trading crypto ETPs can range from topics such as market infrastructure, liquidity and counterparty risk, which over the past few years has seen significant improvement. One challenge unique to crypto ETPs is hard forks.

A hard fork is a system upgrade or upgrades to the underlying blockchain protocol. In the case of hard forks, the new blocks created under the updated rules are no longer accepted by nodes running the older legacy version of the software and are de facto rejected.

This rejection creates a scenario where the two chains are no longer compatible. Historically there have been a number of hard forks such at bitcoin core, bitcoin cash and ethereum classic to name a few.

Current headlines have been populated with speculation and commentary around the upcoming ethereum merge. For those who have not been following recent developments, ethereum’s mainnet is set to merge with the Beacon Chain’s proof-of-stake system, which will mark the end of the proof-of-work ethereum we know today and begin the next phase of ethereum 2.0 – the version that will be based on a proof-of-stake consensus algorithm.

While the broader ethereum community has widely supported the merge, there has been some pushback over the impact it will have on miners. As a result, there has been some resistance which has manifested as a plan to fork the ethereum blockchain and preserve a proof-of-work network.

If a fork happens, the original chain is now forked into two chains. The original chain transitioning to the new proof-of-stake network (ETHS) and the newly forked proof-of-work (ETHW) network. The current community sentiment is to support the proof-of-stake network, however, a handful of esteemed investors and miners have voiced their backing for the proof-of-work fork. Stablecoin issuers circle (USDC) and tether (USDT), with a combined market cap of $120bn, announced exclusive support for the proof-of-stake ethereum.

Historically, a hard fork where there was a chain split in the underlying asset of an ETP was in November 2020, which was the underlying asset of 21Shares Bitcoin Cash ETP, in line with the prevailing sentiment the ETP supported the new forked chain. Days before the hard fork 21Shares halted creation and redemption mechanisms until after the hard fork the chain was determined stable again. In addition, the airdropped BCHA token was sold on primary markets and the value of the sale was passed on to ETP holders at the end-of-day close.2

Market makers also face an array of challenges with upgrades like the ethereum merge. After seeing two consecutive months of positive inflows, ETP issuers have to decide on what to do during the merge. The aforementioned example is one of the few possibilities issuers could take after the occurrence of the hard fork. It is essential there is transparency for market makers to accurately price products with ethereum as an underlying product during the merge.

Issuers have a wide range of options when it comes to the merge. One option is incorporating both the ETHW and ETHS token as underlying for their issued ETPs, or issue a new ETH proof-of-work product. Another avenue would be to sell the ETHW tokens on primary markets. If they were to choose the latter they could either pass on the value of the sale to holders of their ETP as 21Shares did in 2020 or alternatively keep it in their own treasury.

Whatever path the issuers of ethereum ETPs choose, market makers will continue to provide liquidity in the ETPs. In order to provide the necessary liquidity and to ensure products accurately track the underlying asset, market makers have various ways of determining the price accurately.

Utilising the pricing of Deribit and CME futures gives a good indication of what the market expects ETHW to be worth on a spot-future basis. In addition, there are also newly-listed ethereum derivative contracts ETHS and ETHW on exchanges such as BitMEX and Poloniex that give an idea of at what level the ethereum proof-of-work contract will be trading.

By always providing liquidity, even in uncertain or volatile times, market makers like Flow Traders continue to have a crucial role in enabling markets and participants to trade. Even with challenges that can come from upgrades like the merge, market makers have the capability, knowledge and resources to accurately price the products for all market participants.

Edd Carlton is institutional digital assets trader and Ruben Brons is business developer at Flow Traders

1. Strack, Ben. “Crypto Etps Saw ‘Abysmal’ Returns in June.” Blockworks, 5 July 2022, https://blockworks.co/crypto-etps-saw-abysmal-returns-in-june/2. 21Shares: Bitcoin Cash Undergoes Hard Fork. Bloomberg, 13 Nov. 2020, https://www.bloomberg.com/press-releases/2020-11-13/21shares-bitcoin-cash-undergoes-hard-fork