Warren Buffett’s widely-read annual letters to shareholders offer a fascinating insight into Buffett’s investment philosophy. After analysing his letters, we believe one key phrase is “businesses earning good return on equity while employing little or no debt”1.However, Warren Buffet does not stand alone in his focus on high quality stocks. quality. Investing has a long history behind it and other practitioners like, his mentor, Benjamin Graham or Jeremy Grantham from Grantham, Mayo, & van Otterloo (GMO) are also wellknown proponents. In academia, Fama and French introduced the “quality premium”, using operating profitability as main metric2.

An all-weather approach

Academics have demonstrated that equity factors have the capacity to outperform the market over long periods of time. However, they have also shown that those equity factors are very different and tend to behave very differently. So why focus on quality?

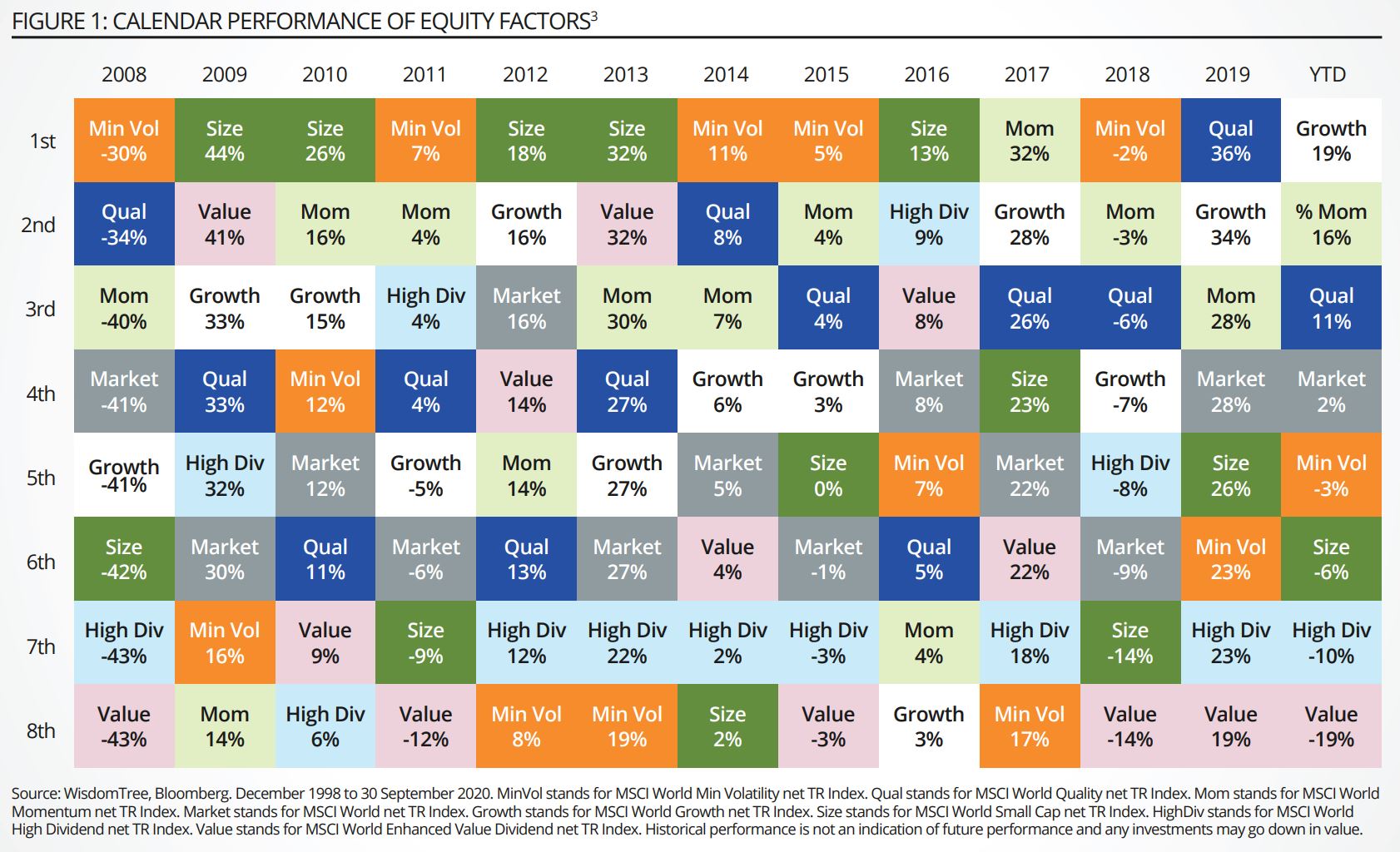

In the following, we look at seven different equity factors in global equities. Over the full period considered (1999 to September 2020, in Figure 1 we show only the last 13 years) they all have outperformed the MSCI World index.

However, Figure 1 shows that every year a different one won and a different one lost and they all exhibited a different behaviour:

• Min volatility has historically been very strong in equity down years, but very poor in stronger equity years. It outperformed in 11 out of the 22 years but was top two or bottom two, in 14, showing large outperformance or large underperformance.• Size behaved in an almost opposite way as min vol (If min vol is ‘defence’, size would be ‘offence’). It outperformed in 14 years but was top two or bottom two in 14 as well.• Quality outperformance over the benchmark has been more consistent. It outperformed the benchmark in 14 years also, but it ended up in the top two or bottom two only eight times. In most years, it delivered a controlled outperformance which means that it could have been used strategically with limited risk of a significant underperforming year.

In other words, quality stocks benefit from strong business models and steady financial results over time. When building investment strategies focused on quality stocks, this historically translated into steady, robust returns in many market scenarios.

WisdomTree's approach

Turning to our approach to quality investing, we focus on profitability with companies with high return on equity and low debt. Our quality dividend growth approach invests in a diversified basket of highly profitable, environmental, social, and corporate governance (“ESG”) compliant companies.

The following general principles are used in creating our Quality Dividend Growth indices:• Companies must meet our ESG guidelines4 (companies which are breaching UN Global Compact principles or are involved in controversial weapons, tobacco or thermal coal are excluded).• Companies must have dividend coverage ratios greater than 1.0x.• Companies must meet our risk management framework4 that excludes low momentum and low-quality stocks as well as potential value traps.• The indices comprise of companies with the best combined rank of quality and growth factors from this universe:- Quality is based on return on assets (ROA) and return on equity (ROE).- Growth is based on analysts’ long-term earnings growth expectations over the company’s next full business cycle.• Weighting: The Indices are rebalanced annually according to the “dividend stream” i.e. weighted to reflect the proportionate share of the aggregate cash dividends bringing valuation discipline to the strategies.

Managing an eventful 2020

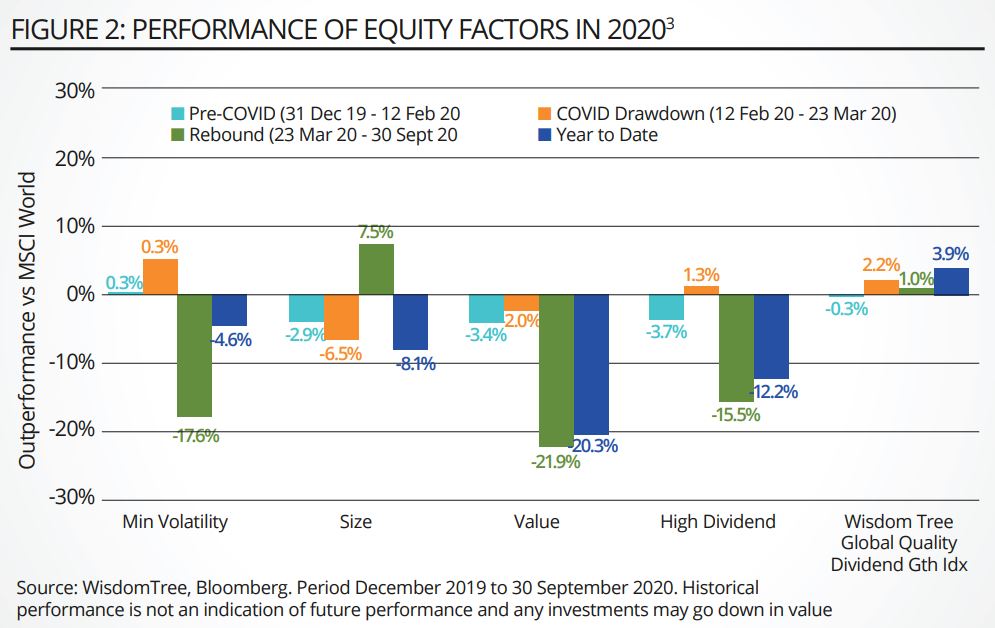

Looking back at the past 9 months, equity markets had to cope with the fastest drawdown in history followed by one of the fastest rebound. In such a difficult environment, equity factors did not all pass the test with flying colours.

• Min volatility was the best factor in the drawdown itself (+5.2% versus the market). However, its sluggish rebound left it trailing the market by 4.6% after nine months.• Size did the best in the rebound, but it suffered so much in early 2020 that it is still trailing the market by 8.1%.• Income oriented strategies endured a very difficult year. Some did well in the drawdown, some did not but all struggled early in the year and in the current rebound. Overall, they trail the markets by double digit numbers.• Looking at the WisdomTree Global Quality Dividend Growth strategy, it did not “win” any of the sub periods, but by its sheer consistency, it is showing an outperformance of 3.9% versus the market year to date. It beat the market both in the drawdown as well as in the rebound.

1 Buffett, Warren. 27 February 2015.2 Fama, Eugene F. & Kenneth R. French. “A Five-Factor Asset Pricing Model”3 Equity Factors are proxied by the relevant MSCI World net TR indices.4 From 22 October 2020

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources.

As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Pierre Debru(pictured) is director of research at WisdomTree

This article first appeared in the Q4 2020 edition of Beyond Beta, the world’s only smart beta publication. To receive a full copy,click here.