'Active’ ETFs combine the benefits of ETFs - transparency, low cost and risk control - with the potential for higher returns available in often more complex asset classes.

These investment products still allow investors to frequently track the value of the underlying holdings as they are published intraday.

They are also managed according to a strict set of constraints and are available to trade in an accessible and liquid way that can be tax efficient.

Active ETF benefits

ETF investors do not all seek to track an index; instead, some seek better risk-adjusted returns than their passive peers or specific outcomes. While a passive ETF can provide low-cost, transparent access to an index a more active approach also benefits from additional research.

By employing a specific investment objective, or focusing on a theme such as climate or sustainability active ETFs can offer more tailored investment solutions and often more flexibility over the amount of and timing of rebalancing.

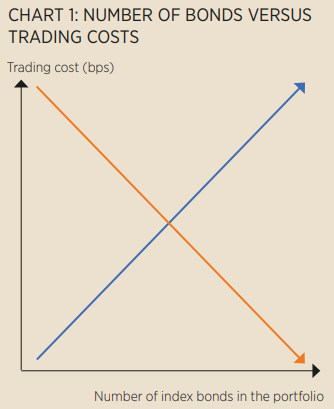

By contrast, passive ETFs may suit investors aiming to generate return and risk profiles similar to an index without the specific requirements for additional performance. For example, bond indices often contain multiple bonds from the same issuer, frequently include new issues, hold many illiquid bonds, and face high trading costs. There is an inflection point where once the number of bonds in an index reaches a certain level, the cost of trading can become prohibitively high.

Index replication can be a practical solution for many fixed income investors, although it is generally considered easier to achieve in equities due to the fewer number of securities, lower frequency of new issues and greater liquidity.

Incorporating sustainability

In Fidelity’s active ETF range, we leverage the forward-looking insights of our skilled in-house analysts in both equities and fixed income. Not only does this seek better risk-adjusted returns, but we have also found that our analysts have a strong track record in identifying issuers likely to experience downgrades, and by incorporating sustainability we seek to mitigate ESG tail risks.

We do not separate the job of fundamental and sustainability research. We have found that there is a strong correlation between the securities we rate highly from a fundamental perspective and those we rate positively for sustainability. It is the same analyst that assesses a company for both these characteristics, encouraging a deeper forward-looking understanding of a company’s overall prospects.

Our active ETF portfolios benefit from Fidelity’s firmwide engagement policies in addition certain exclusions: Specifically, issuers Fidelity believes to be in violation of UNGC compact principles are excluded, as are issuers involved in certain activities including manufacturers of weapons, tobacco, arctic oil and gas.

Active engagement over exclusion happens extensively at the issuer level for the benefit of both fixed income and equities investors. We participate in c.15,000 interactions with companies each year and in 2021 we carried out 1,464 engagements. We also undertake proxy voting at the firm-wide level to support the interests of our investors.

By constructing portfolios in this way, we seek to offer products that have similar characteristics to the broader market yet offer the potential for better risk-adjusted returns.

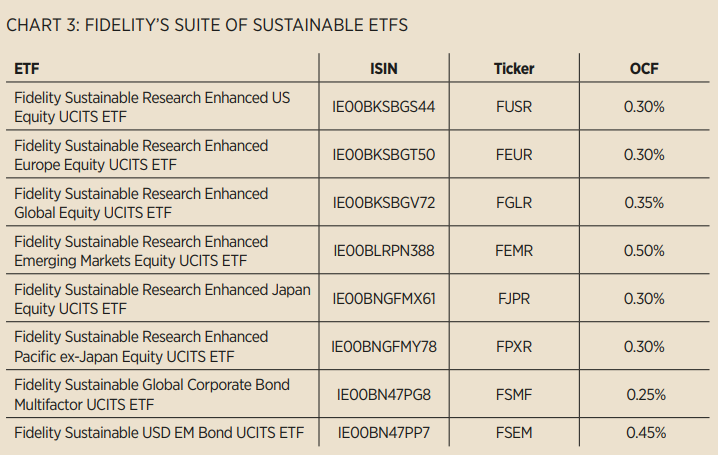

For example, the Sustainable Research Enhanced Index equities ETFs (Article 8 SFDR) have an annual alpha target of 1% gross per annum (through the cycle i.e., >5 years). They aim to achieve this by directly harnessing the fundamental and sustainable research of the analyst team and tilting portfolios towards buy-rated securities and those with positive forward-looking stable/improving sustainable profiles.

In fixed income, the Sustainable Global Corporate Bond UCITS ETF and the Sustainable USD EM bond ETF (both Article 8 SFDR) use their tracking error by aiming to outperform passive peers and mitigate downside credit risk. They systematically capture the characteristics of the broad market while seeking to generate alpha and enhanced sustainability profiles through security selection.

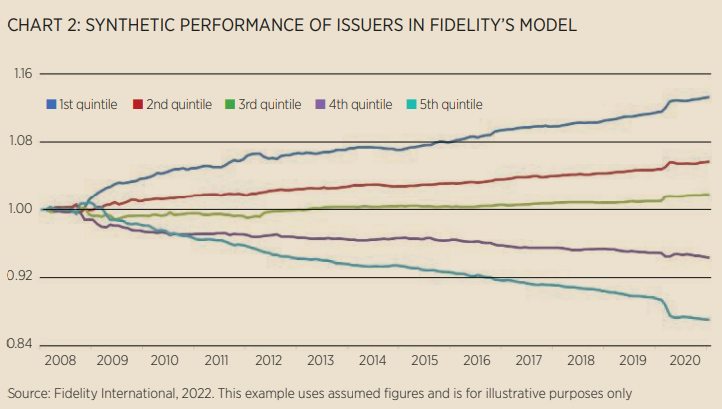

At the heart of the strategies is Fidelity’s proprietary multifactor model. This model categorizes bonds into valuation, sentiment, and fundamental elements to create a proprietary ‘credit factor’ that is used in our optimization system and subject to specific ESG constraints. The process isolates mispriced securities and ranks them by attractiveness. Bonds in the bottom quintile have substantially underperformed their peers over time.

At Fidelity, our active range of ETFs are based on leveraging our unique data set in proprietary quantitative, fundamental and sustainable research. This data set cannot be replicated elsewhere; and our clients can benefit from the breadth and depth of knowledge accumulated through c.50 years of fundamental research.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

Risk warnings

This information must not be reproduced or circulated without prior permission. The value of investments and the income from them can go down as well as up so you/the client may get back less than you/they invest.

This fund invests in overseas markets and so the value of investments can be affected by changes in currency exchange rates. This fund invests in emerging markets which can be more volatile than other more developed markets. There is a risk that the issuers of bonds may not be able to repay the money they have borrowed or make interest payments. When interest rates rise, bonds may fall in value. Rising interest rates may cause the value of your investment to fall. This fund uses financial derivative instruments for investment purposes, which may expose the fund to a higher degree of risk and can cause investments to experience larger than average price fluctuations.

Due to the greater possibility of default an investment in a corporate bond is generally less secure than an investment in government bonds.

The fund promotes environmental and/or social characteristics. The Investment Manager’s focus on securities of issuers which maintain sustainable characteristics may affect the fund’s investment performance favourably or unfavourably in comparison to similar funds without such focus. The sustainable characteristics of securities may change over time.

The ETF tracks an equity index and as a result the value of the fund may go down as well as up. Performance data is based on the net asset value (NAV) of the ETF which may not be the same as the market price of the ETF. Individual shareholders may realise returns that are different to the NAV performance.

Disclaimer

The latest annual reports, Key Investor Information Document (KIID) and factsheets can be obtained from our website at www.fidelityinternational.com. The full prospectus may also be obtained from Fidelity. Fidelity UCITS ICAV and Fidelity UCITS II ICAV are registered in Ireland pursuant to the Irish Collective Asset-management Vehicles Act 2015 and are authorised by the Central Bank of Ireland as a UCITS. Fidelity UCITS ICAV and Fidelity UCITS II ICAV are managed by FIL Fund Management (Ireland) Limited. Issued by FIL Fund Management (Ireland) Limited, a firm authorised and regulated in Ireland as a management company by the Central Bank of Ireland. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited.