World leaders set out their stalls at the 26th annual climate change conference in Glasgow, with progress updates to check the viability of reaching carbon neutrality by 2050. The latest calculations – factoring in the impact of measures being put forward at COP26 – suggest the projected rise in global temperatures could come down to 2°C but not yet to the 1.5°C scientists say will be needed to avoid catastrophe.

Even incremental improvements could have dramatic long-term results. Clearly, more needs to be done to reduce harmful emissions and slow down global warming. While government-funded initiatives are important, companies will be the real drivers of the transition to net-zero economies, both in terms of reducing their own carbon footprints but also in developing the solutions.

Risks and opportunities

In terms of positioning portfolios in relation to climate change, investors can consider it from the perspective of reducing risk and creating opportunity, and they can source ETFs with one or both objectives. While most broad ESG ETFs aim to improve each of the three broad categories including, of course, the environmental issues, some ETFs track indices that set specific targets. For example, the FTSE All Share ex Investment Trusts ESG Climate Select index targets a 50% increase in revenues generated from green projects and 50% reductions in both carbon emissions and fossil fuel reserves, in addition to a 10% uplift in the overall ESG profile (each of these targets versus the parent index).

While ETFs tracking such broad-based ESG indices can provide suitable core exposure for portfolios wanting to align with net-zero objectives, thematic ETFs can offer an arguably more direct and immediate exposure. For example, ETFs that target companies developing clean energy technologies may offer a way for investors to participate in what is likely to be a strong theme for years to come.

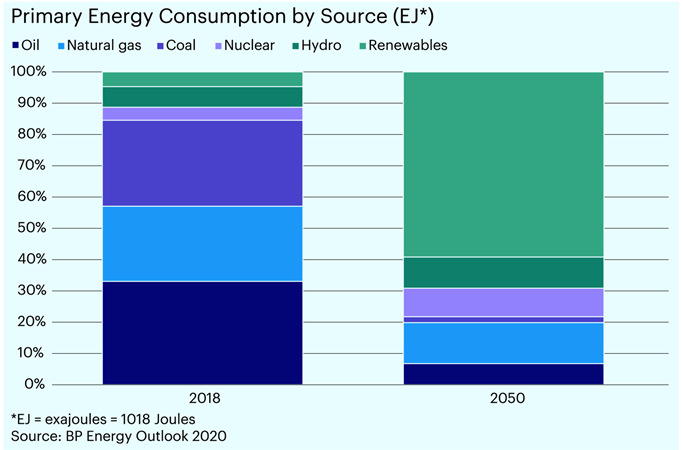

Transition in sources of energy consumption

According to the International Renewable Energy Agency (IRENA), renewable energy along with energy efficiency gains can provide 90% of the emissions reduction needed to reach net-zero by 2050. BP’s Energy Outlook report suggests that 70% of global energy capacity could be met by renewables and hydropower generation by 2050, versus only 11% in 2018.

Solar is already cheaper than fossil fuel

Governments are committed to increasing renewables capacity and, compared to previous periods when efforts proved short-lived due to financial obstacles, it now really makes economic sense – even without subsidies or incentives. Solar costs have fallen by 85% over the past decade, due primarily to technological advancements. As a result, solar is now cheaper than even the lowest-cost fossil fuel in many parts of the world. Wind is also becoming much more economical.

Investing in clean energy – or even solar specifically – is much more than just allocating to solar panel and wind turbine manufacturers. The clean energy space extends not only to other sources, such as hydro, thermal and biomass, but supplementary technologies and services. For instance, more efficient storage solutions are key to having renewable power available 24/7. Improving our use of energy will also be fundamental in helping us reach net zero. And there is still much progress ahead, including technologies at a relatively early stage of development, such as hydrogen – specifically green hydrogen – that could be the solution for shipping and other long-haul industries.

Engage to keep driving forward

Choosing to invest in companies that are either improving their own environmental impact or are developing the solutions for the world to use is an important step and one in which ETFs can provide efficient exposures. Engagement is also important, and we believe it is one of the most powerful tools we have to encourage real change in the companies in which we invest, and that extends to our passive ETFs. While you would expect most of the companies in a climate-focused or clean energy ETF would already be taking action to address ESG risks, there is always more that can be done. And these companies are often open to having these conversations with responsible investors.

If we are all on the path to net-zero, we should all be somehow incentivised to do our part. With so much to do, and so much to be achieved over the next decades, every little bit will help.

Dr. Christopher Mellor is head of ETF equity and commodity product management at Invesco

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested.

Important Information

This marketing communication contains information that is for discussion purposes only, and is intended only for Professional Clients in the UK. Data as at November 2021, unless otherwise stated.

This marketing communication is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This marketing communication has been communicated by Invesco Asset Management Limited, Perpetual Park, Perpetual Park Drive, Henley-on-Thames, Oxfordshire, RG9 1HH, UK. Authorised and regulated by the Financial Conduct Authority.