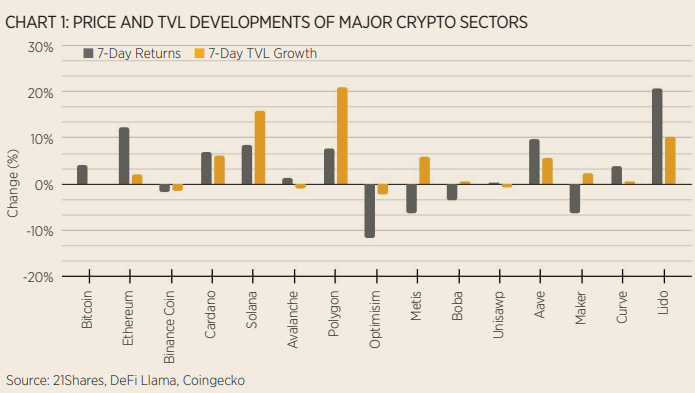

It was announced last Thursday, that the last stop before the merge on 19 September, the Goerli testnet, was implemented successfully, creating a rally across interrelated parts of the ecosystem such as solana, polygon and lido, as depicted in Chart 1.

Macro and regulations

In its earnings report, Coinbase reported a net loss of $1.1bn in Q2, including impairment charges. The company also missed the $874m revenue estimate, reporting $803m. On the flipside, Coinbase expressed eagerness to continue with their targeted merger and acquisition (M&A) to make the best out of the bear market.

Less than a week after the US Treasury banned Tornado Cash, the Dutch authorities arrested one of its developers, who was later revealed to be Alexey Pertsev, as a result of investigations that started in June. This news spread a wave of agony among the crypto community, unable to comprehend why authorities would go after developers who merely write code rather than the actual users who have committed illicit activities on the crypto mixer.

While Tornado Cash spurs controversy around the globe, NFTs have been doing rounds in Europe. A regulator expressed concerns at a conference in South Korea that NFT collections are to be treated like crypto under the Markets in Crypto Assets (MiCA) law. As technical negotiations for the MiCA framework are still taking place until the end of September, parties are negotiating the mechanisms determining when NFTs are both fungible and not unique and thus would fall under MICA obligations.

In other news, the EU is set to create a sixth anti-money laundering authority, AMLD6, to have direct oversight over the crypto industry. In a bid to reduce jurisdictional arbitrage between different member states, the European Commission first announced its plans in July 2021 and then the European Council published an update towards the end of June 2022, revealing January 2023 to be the date AMLD6 is to be established. The European Parliament aims to discuss it further with its members after the continent’s August vacation.

In the US, the CFTC and SEC have proposed a new law obliging hedge funds with over $500m of net assets to disclose their crypto exposure along with information related to concentrations and borrowing in a confidential filing. This new law aims to enhance the Financial Stability Oversight Council’s ability to monitor systemic risk and bolster wider regulatory oversight.

To combat illegal gold mining, which accounts for half of Brazil’s gold mining industry, a new bill in the South American country is proposing tokenizing mined gold via blockchain technology.

On-chain Indicators

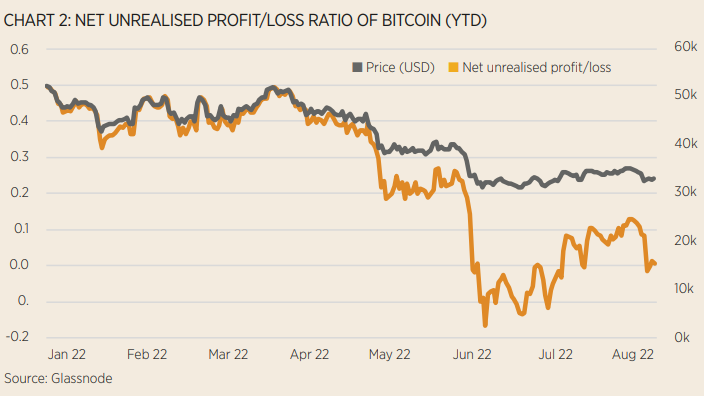

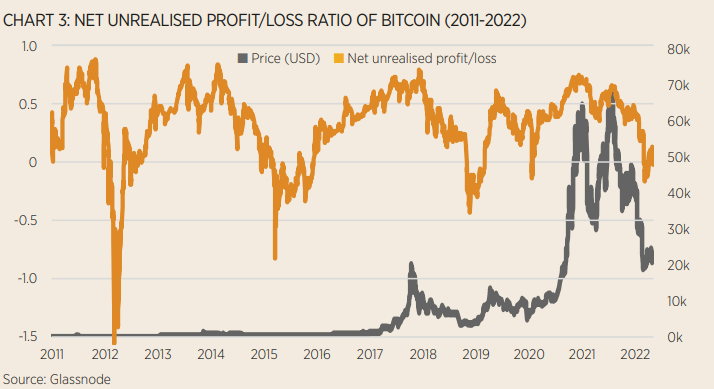

As the name suggests, the Net Unrealised Profit/Loss ratio aims to describe the state of profit and loss of Bitcoin. Chart 2 shows that Bitcoin has entered the Hope/Fear phase after a month of capitulation. In fact, the ratio has increased from 0.08 to 0.12 over the past week, indicating higher profitability.Historically, that would mean bitcoin’s profitability is close to 2019 levels, as shown in Chart 3.

DeFi

The Ethereum ecosystem remains the focal point of discussion following the latest successful testnet merge. We have covered how some heavyweight DeFi projects have already signaled the demise of the ETHPOW potential fork since they will exclusively support the new POS chain. This week, Circle of USDC announced they would solely support the POS chain, following suit with tether, frax and chainlink’s decision. The absence of reliable service providers on the forked chain indicates that DeFi will experience rough conditions, which means that ETHPOW might become a ghost chain without any active financial ecosystems.

The repercussions of the tornado cash ban on DeFi began to emerge immediately following the verdict. First, Circle banned 37 addresses with ties to the sanctioned mixer, freezing $75,000 in the process as a matter of complying with the treasury department’s order. DyDx, the derivatives offering, also locked out a handful of users on the back of their interaction with the mixer. Other users expressed their frustration as they were wrongly flagged, with the speculation that their ether (ETH) hopped by the mixer protocol at some point which meant that it was now considered tainted funds.

To showcase the intricacy of enforcing the newly issued sanction, an unknown individual sent 0.1 ETH to more than 600 prominent crypto addresses including Brian Armstrong of Coinbase, Jimmy Fallon and Randi Zuckerberg. Justin Sun of Tron was also among this group as he revealed he was blocked from interacting with the Aava front- and end- users, as his address was tagged due to TRM’s integration. The DeFi protocol was not the only compliant dApp as UniSwap, Balancer and Oasis have all censored tornado-linked addresses as a function of integrating the same TRM sanctions screening tool. Aave and DyDx have both unblocked multiple accounts since then who were identified to be victims of the dust attack, however, this demonstrates the fragility of the issued sanction against software rather than individuals and the delicacy of enforcement.

In the same vein, MakerDAO’s founder weighed out the possibility of an ‘emergency shutdown’ if the FED sanctions begin reaching for DAI addresses. This is plausible as DAI is backed by 35% of USDC, making it the largest single collateral backing the stablecoin.

Another systematic issue the protocol is facing is its reliance on USDC to maintain DAI’s peg stability. That is why the protocol is also considering a $3.5bn ETH market buy order to convert the stability reliance from USDC. Although this is bullish for the biggest smart-contract platform by market cap, we remain cautious as this move somewhat mirrors terra luna’s decision to have bitcoin (BTC) as collateral backing its UST stablecoin. That said, using BTC as a collateral did not prove to be a sturdy backstop for the cryptoasset, and therefore, we remain sceptical of the sustainability of such a decision.

Crypto infrastructure

All eyes were on Ethereum when the Goerli network executed its final merge rehearsal as the testnet successfully transitioned to proof-of-stake. The road is now paved for the main Ethereum network to complete its own merge on 15/16 September, depending on when specifically, the blockchain achieves its required total terminal difficulty TTD level to begin listening to the new POS chain.

Nevertheless, the captivating story was overshadowed by the unfortunate ramifications of the Tornado Cash mixer ban. The privacy-preserving dApp has been resorted to in the money laundering activities within the space by scammers and hackers, a case in point where the DOJ accused the protocol of aiding the Lazarus group in laundering more than $450m of stolen funds from the Ronin hack. Furthermore, predicated on the ban’s guidelines, several crypto-native service providers started terminating accessibility to the protocol such as Infura and Alchemy. Both projects are now blocking Ethereum API access to all users to prevent interaction with the smart contract.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.