Emerging market equities have had a terrible year, but reports wager that they are to set to make a comeback in 2019, so which ETFs give the best access?

The sector has struggled as a result of US monetary policy, a strong US dollar and local political instability, which have hurt the emerging market economies. However, it's all set to turnaround in 2019 as growth looks good and steady, and many currencies now look cheap.

The emerging markets sell-off this year has put discounts at around the widest they've been in a decade. The FT reported in October that "This year's sharp sell-off in emerging market equities has opened up a wide valuation differential with developed world stocks, by one measure at least. And if the past is any guide to the future, it could be time to fill your boots."

However, the paper warns that this could also be a sign that the market increasingly views EM stocks as lower quality or as more likely to face a harsher backdrop in the years to come — in the form of a spiralling trade war, say, or weaker domestic economic growth.

Below is a chart from Lyxor, which shows its Emerging Market ETF (LEMD) in black against its S&P 500 ETF (LSPU) in the orange. LEMD is down -16.62% YTD.

Source: Bloomberg

There are several other factors that support emerging market equities doing well. These include valuations looking good, currencies looking cheap, and a possible US dollar depreciation, which could be a boon.

According to Schroders earlier this month , "aggregate valuations are attractive, with both price-book and price-earnings ratios below their long term averages, as highlighted in the chart below. Sentiment is cautious, but investor allocations remain elevated following significant inflows into EM funds in 2017."

In addition to this Moodys put out a report in November that said the outlook for emerging markets would be broadly stable next year.

Peter Sleep, senior portfolio manager at 7IM, said: "I would say that some areas of the market that look particularly unloved might include EM equity."

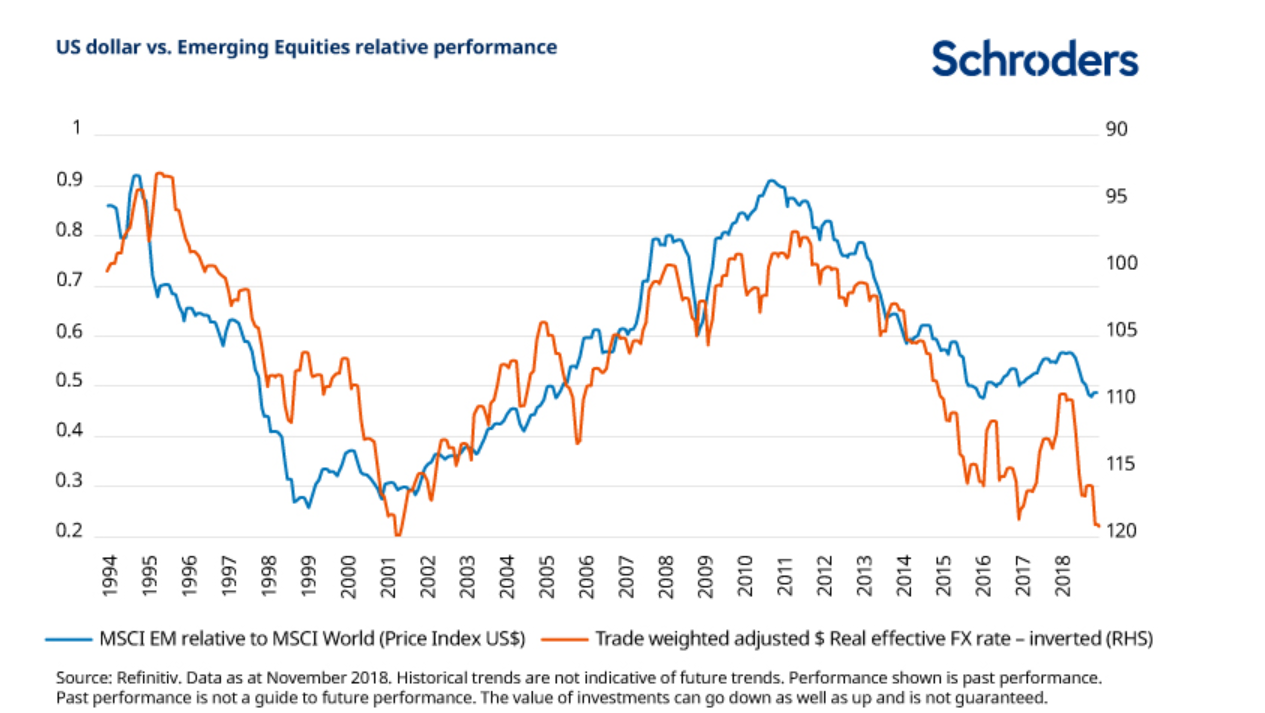

The US dollar is a key component in how EM equities perform. The more expensive the dollar the harder it is to trade, buy and repay debt. According to the IMF, between 2009 and 2013 emerging markets received nearly half of all global capital flows in the four years. If the dollar gets too strong, then international capital flows away from emerging markets - as reflected in the performance of the EM ETFs listed below.

The MSCI Emerging Markets index has MSCI Emerging Markets index was down -12.24 YTD (as of 30th November), according to MSCI data. But this could be an opportunity.

The chart below from Schroders shows the relationship between the US dollar and EM equities performance.

We last wrote about emerging markets in Q3 and since then they have continued to dive, the ETFs tracking the EM indexes have also continued to produce negative returns. The worst performing ETF is Lyxor's Emerging Market ETF (LEMD) which is down -16.62%. It's also one of the pricier ETFs on offer.

The best performing ETF (in dollar terms) is the Franklin LibertyQ EM ETF (FREM). The index it tracks is based on the MSCI EM index, but has a smart beta twist, using a Franklin Templeton strategy that gives exposure to four factors: Quality, Value, Momentum and Low Volatility.

In this case smart beta has helped reduce losses.

If performance reverses and becomes positive it is unclear whether a smart beta strategy will be the best strategy, but if not then the cheapest ETF on offer is Amundi's AUEG, followed by Vanguards EM ETF. Both of which have had similar performance YTD.

The ETFs available on the London Stock Exchange are listed below.

VDEM

VFEM

IEEM

0.2% (Exp Ratio)

0.49% (Exp Ratio)

0.2% (Exp Ratio)

0.225% (Exp Ratio)

0.225% (Exp Ratio)

0.49% (Exp Ratio)

(EMRD)

ETFTERYTD RTNINDEXVANGUARD FTSE EMERGING MARKETS UCITS ETF0.25%-13.97%FTSE Emerging Markets IndexVANGUARD FTSE EMERGING MARKETS UCITS ETF0.25%-8.22%FTSE Emerging Markets IndexiShares MSCI EM ETF USD Dist0.75%-10.20%MSCI Emerging Markets IndexiShares MSCI EM ETF USD Acc (SEMA)0.68%-9.76%MSCI Emerging Markets IndexiShares MSCI EM ETF USD Dist (IDEM)0.75%-16.07%MSCI Emerging Markets IndexiShares MSCI EM ETF USD Acc (IEMA)0.68%-15.22%MSCI Emerging Markets IndexAmundi MSCI Emerging Markets ETF (AUEG)0.2%-10.17%MSCI Emerging Markets IndexXtrackers MSCI EM ETF (XMMS)0.1% (m'mnt fee)-2.07% (over three months only)MSCI Emerging Markets IndexXtrackers MSCI Emerging Markets Swap ETF (XMMD)0.29% (m'mnt fee)-16.11%MSCI Emerging Markets IndexXtrackers MSCI EM ETF (XMME)0.1% (m'mnt fee)-16.05%MSCI Emerging Markets IndexInvesco MSCI Emerging Markets ETF (MXFP)0.29%-10.32%MSCI Emerging Markets TR IndexInvesco MSCI Emerging Markets ETF (MXFS)0.29%-16.14%MSCI Emerging Markets TR IndexLyxor MSCI Emerging Markets ETF (LEMD)0.55%-16.62%MSCI Emerging Markets IndexLyxor MSCI Emerging Markets ETF (LEML)0.55%-10.57%MSCI Emerging Markets IndexUBS MSCI Emerging Markets ETF (UB30)0.23% (m'mnt fee)-15.75%MSCI Emerging Markets IndexUBS MSCI Emerging Markets ETF (UB32)0.23% (m'mnt fee)-9.89%MSCI Emerging Markets IndexXtrackers MSCI Emerging Markets Swap ETF (XMMD)0.29% (m'mnt fee)-16.11%MSCI Emerging Markets IndexHSBC MSCI Emerging Markets ETF (HMEM)0.4%-16.12%MSCI Emerging Markets IndexHSBC MSCI Emerging Markets ETF (HMEF)0.4%-10.25%MSCI Emerging Markets IndexSPDR MSCI Emerging Markets UCITS ETF0.42%-15.48%MSCI Emerging Markets Small Cap IndexFranklin LibertyQ Emerging Markets UCITS ETF (FREM)0.55%-12.07%LibertyQ Emerging Markets Index.Franklin LibertyQ Emerging Markets UCITS ETF (FLXE)0.55%-6%LibertyQ Emerging Markets Index.

Source: Bloomberg & LSE

You can read more about emerging markets and ETFs in Four top emerging markets ETFs.