The US stock market is by far the biggest in the world, still accounting for about half the value of the global market. And it contains a large number of very impressive companies: Amazon, Apple, Starbucks, Procter & Gamble, McDonalds and many, many more.

At the time of writing, valuations are high compared to most other markets but if you're a long-term investor, I'd argue that you must have some exposure to the US. Your weighting doesn't need to be anything like as high as 50% - that's the US weighting in the global market - but some exposure makes sense. You can't afford to cut yourself off from so many great companies.

ETFs are a cheap and simple way to invest in the US market, so let's look at five top US ETFs for you to consider:

A broad US ETF: iShares Core S&P 500 UCITS ETF (CSPX)

The S&P 500 is the flagship US index and includes a good range of US large-cap companies. There are several ETFs that track the index for a very low cost, and the iShares Core S&P 500 ETF is one of that bunch with an annual charge of just 0.07% a year. So if your investment is worth £1000, you'll pay just £70p a year to iShares.

Other cheap S&P 500 ETFs include the Invesco S&P 500 UCITS ETF (SPXS) with an even cheaper 0.05% charge, and the Vanguard S&P 500 UCITS ETF (VUSA) (0.07% charge.)

I've gone for the ishares ETF because it has the lowest tracking error. In other words, it's been the best at tracking the S&P 500 index over the last three years. Here are some more stats for each ETF:

iShares Core S&P 500

3 years1 yearPerformance+46.1 %+3.3 %Tracking Difference+1.1 %+0.25 %Tracking Error+0.2 bps+0.17 bs

Ongoing charge (OCF)0.07%Fund size$32.3 bn

Invesco S&P 500

3 years1 yearPerformance+46.5 %+3.5 %Tracking difference+1.6 %0.5%Tracking Error+0.22 bps+0.28 bps

Ongoing charge (OCF)0.05%Fund size$4.5 bn

Vanguard S&P 500

3 years1 yearPerformance+45.3 %+2.8 %Tracking difference+0.3 %-0.3 %Tracking Error+1.7 bps+3.0 bps

Ongoing charge (OCF)0.07 %Fund size$22.6 bn

Small cap: iShares S&P Smallcap 600 UCITS ETF (IDP6)

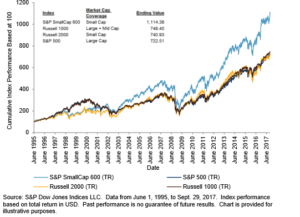

There's plenty of evidence that smaller companies do better over the very long term, so it makes sense to get some exposure to the US small cap market.

I've gone for an ETF that tracks the S&P Smallcap 600 index which isn't as well known as the Russell 2000 index for smallcaps. I prefer the S&P index because its performance has been better.

That's probably because S&P applies an 'earnings screen' before stocks are admitted to the index. Stocks must have been in the black over the previous quarter and on average over the previous four quarters.

The ongoing charge is 0.4% and the fund size is just under $900 million. That's a decent size which means it's highly unlikely the ETF will ever be closed down.

3. Technology: Invesco EQQQ NASDAQ-100 UCITS ETF (EQQ)

The US is famous for its thriving technology sector - only China comes anywhere close in this area. You could argue that technology is an area where active managers may be able to add value and investment trusts such as the Allianz Technology investment have done well in recent years.

But with low fees there's also a strong argument for technology ETFs.

I've gone for the Invesco Nasdaq-100 ETF even though it isn't strictly a technology ETF. It tracks the Nasdaq-100 index which, although heavily weighted towards technology, doesn't just include technology stocks. The attraction is that it's an easy way to gain exposure to many of the best-known tech stocks. Look at the top ten stocks:

Stocks% of ETFMicrosoft9.9Apple9.8Amazon9.3Alphabet 'C'4.8Facebook 'A'4.8Alphabet 'A'4.2Intel3.1Cisco3.0Comcast 'A'2.3PepsiCo2.1

The ongoing charge is fairly low at 0.3% and the tracking difference is slightly lower than a very similar Nasdaq-100 ETF from iShares.

Another option is to go for an ETF that IT and Telecom services sectors of the S&P. One example is the Invesco Technology S&P US Select Sector UCITS ETF. The problem though is that Facebook, Amazon and Alphabet aren't in the ETF because they're in different sectors. Here's the top ten stocks for this ETF:

Stocks% of ETFMicrosoft18.2Apple16.5Visa5.4Intel4.8Cisco4.6MasterCard4.1Oracle2.8IBM2.7Adobe2.6Salesforce2.5

If you're investing in a broad technology fund, it must include Amazon and Alphabet in my view, so that's why I've gone for the Nasdaq ETF.

There are, of course, many more narrow technology ETFs out there, some purely US-focused, some with a more global approach. I don't have space to look at them all here, but these articles are good starting points for further research:

Remember with all of these tech ETFs, that investing in technology is higher risk that investing across the US stock market as a whole. So be careful with your weightings - unless you're very risk-tolerant, don't put too much money into technology on its own.

Value: iShares Edge MSCI USA Value Factor UCITS ETF USD (IUVL)

I'm a fan of

. They're on relatively cheap historic valuations and we're probably not too far from a point in the cycle where they traditionally do well - the beginnings of an economic recovery. (I realise we've got to go through a recession first!)

I've gone for this iShares ETF because it has a low charge of 0.2% a year and it has a sensible strategy of targeting the cheapest stocks in each US market sector.

Equal weight: Xtrackers S&P 500 Equal Weight UCITS ETF

I like the simplicity of Equal Weight. With this ETF, you're getting exposure to every stock in the S&P 500, and each stock comprises 0.2% of the index - at least when the stocks are rebalanced. That means you don't get over-exposed to the largest stocks which may have been bid up too high. This Xtrackers ETF gives you that exposure with a nice cheap charge of just 0.25% a year.

For more ETF ideas, read Four top emerging markets ETFs or Four top property ETFs