Last year was a record 12 months for the European ETF industry with inflows hitting an all-time high of €107bn and total ETP assets crossing the

$1trn milestone for the first time.

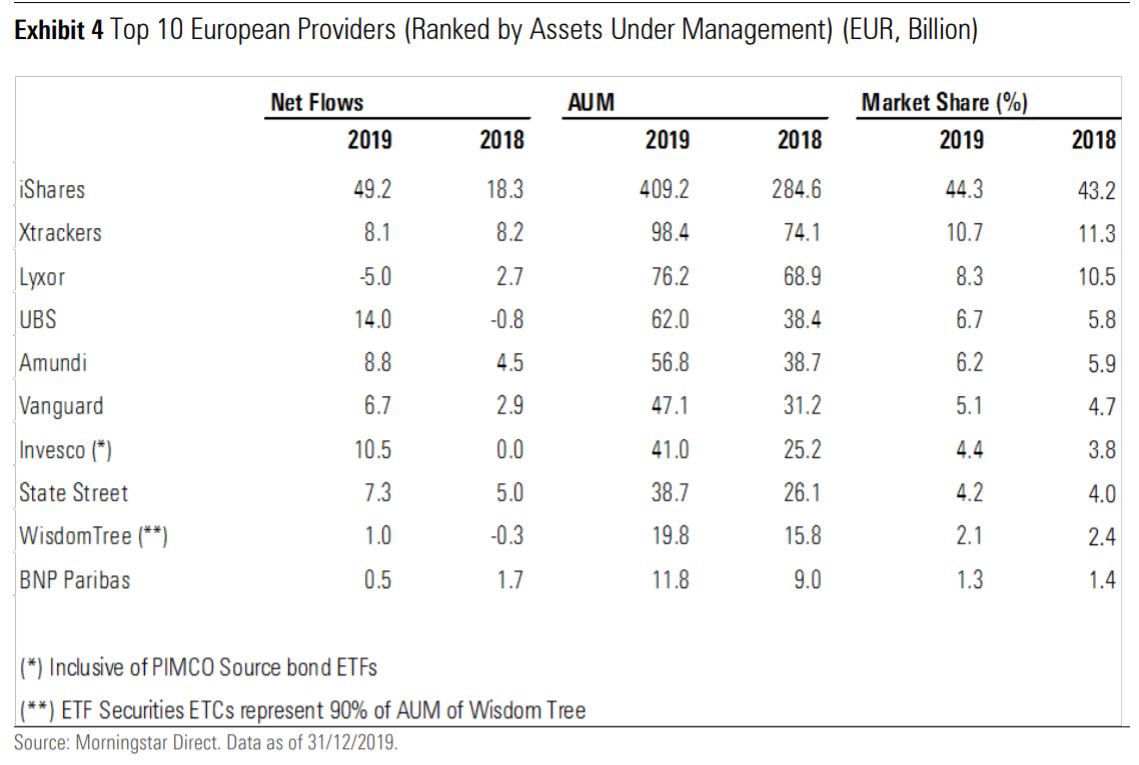

According to data from Morningstar, BlackRock continued its dominance in Europe capturing €49.2bn inflows for the year, miles ahead of any of its competitors. Last year’s flows take the world’s largest asset managers European ETF assets to €409.2bn, a 44.3% market share.

UBS and Invesco also posted strong years in 2019 with inflows of €14bn and €10.5bn, respectively.

Jose Garcia-Zarate, associate director, passive strategies research at Morningstar, said UBS saw the majority of flows into equity ETFs. The Swiss asset manager finished the year as Europe’s fourth largest ETF provider with €62bn assets under management (AUM).

Meanwhile, Garcia-Zarate cited Invesco’s low-priced bond ETFs as the reason behind their flows. In Europe, bond ETFs were very popular with €54bn of net new money.

Amundi also had a strong 2019. Following a major recruitment drive in the UK and the launch of its core ETF range in March, the French asset manager saw inflows of €8.8bn in 2019, the fourth highest and taking its overall AUM to €56.8bn.

Its French counterpart, Lyxor, was the only ETF provider in the top 10 to see outflows last year of €5bn.

The firm has been the subject of speculation around a possible sale, European equities have continued to remain out of favour and it has only just completed the acquisition of Commerzbank’s ETF range last November.

US providers State Street Global Advisors and Vanguard both had good years seeing inflows of €7.3bn and €6.7bn, respectively.

Goldman Sachs made its long-awaited entry into the market in September 2019, however, BMO pulled the plug on its European adventure highlighting the difficulty of running a successful ETF business this side of the pond.