Index funds and ETFs that track the share markets of the major European economies – the UK, France, Germany – have now gone nowhere in 21 years if the effects of dividends are excluded.

Thanks to the panic selling triggered by the coronavirus, European index funds have tumbled below the peaks they saw in 2000 and 2007. This means that investors who bought into European index funds during the dotcom bubble have seen no share price growth in two decades.

Both Germany and the UK are below their peaks two decades ago. Germany's share market - like its football team - has been better performing than the UK's.

In the UK, the FTSE 100 has fallen below the highs it saw in June 1999. In Germany, the DAXK – an index of Germany’s 30 biggest public companies, which excludes dividends – is trading comfortably below its high in 2000. France’s CAC 40 is also well below peak.

The picture in Europe’s “club Med” countries – Portugal, Italy, Greece, Spain – is even worse, with each country’s share market trading at prices less than half of their dotcom levels.

Spain's IBEX 35 and Portugal's PIS 20 have yet to recover from the financial crisis and the Eurozone crisis.

In Asia-Pacific, things are a little different. Share markets in Australia, Hong Kong, China, Korea and Japan are all trading below peaks seen the past decade.

The price depression suggests that buying and holding of index funds – in a manner preached by prominent investment firms – only really works if investors spread their purchases over large periods of time. (A practice known as “dollar cost averaging”).

ETF dividend forecasting made cheaper

It also suggests that index investing only works in the richest countries – especially the US where the strategy has been most successful.

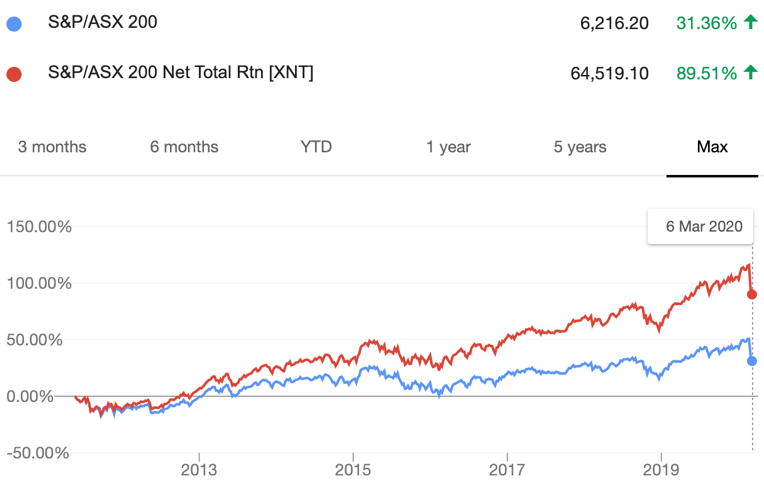

Finally, it shows that the reinvestment of dividends is essential. In several rich countries the picture of index investing turns far rosier when total return indexes – which include dividends – are included.

Countries share market indexes with and without dividend reinvestment

Switzerland's astounding returns once dividends are included

Germany's returns are even stronger than Switzerland's once dividends are included

Australia, known for its generous dividends, has had strong returns since the financial crisis