BetaShares' bears have found some honey.

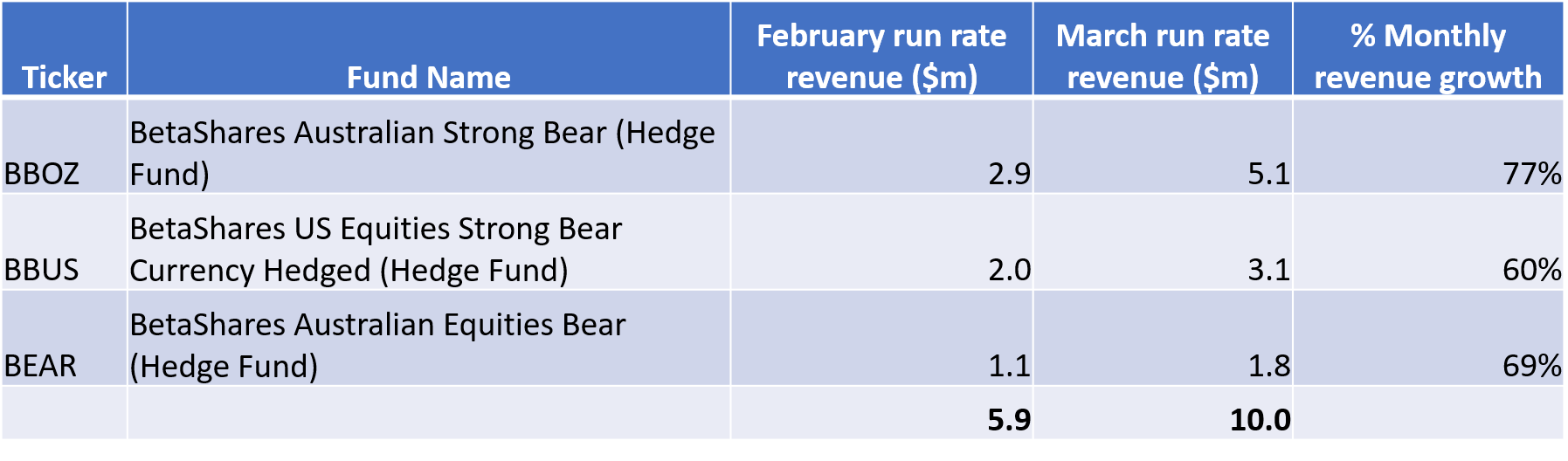

BetaShares is set to reap an extra $4 million profit this year thanks to Aussie investors newfound love of its speculative “bear” ETFs, an analysis by ETF Stream indicates.

Thanks to coronavirus volatility, BetaShares’ suite of bear ETFs – which profit when markets fall by short selling futures – have seen a tidal wave of new investor money enter in.

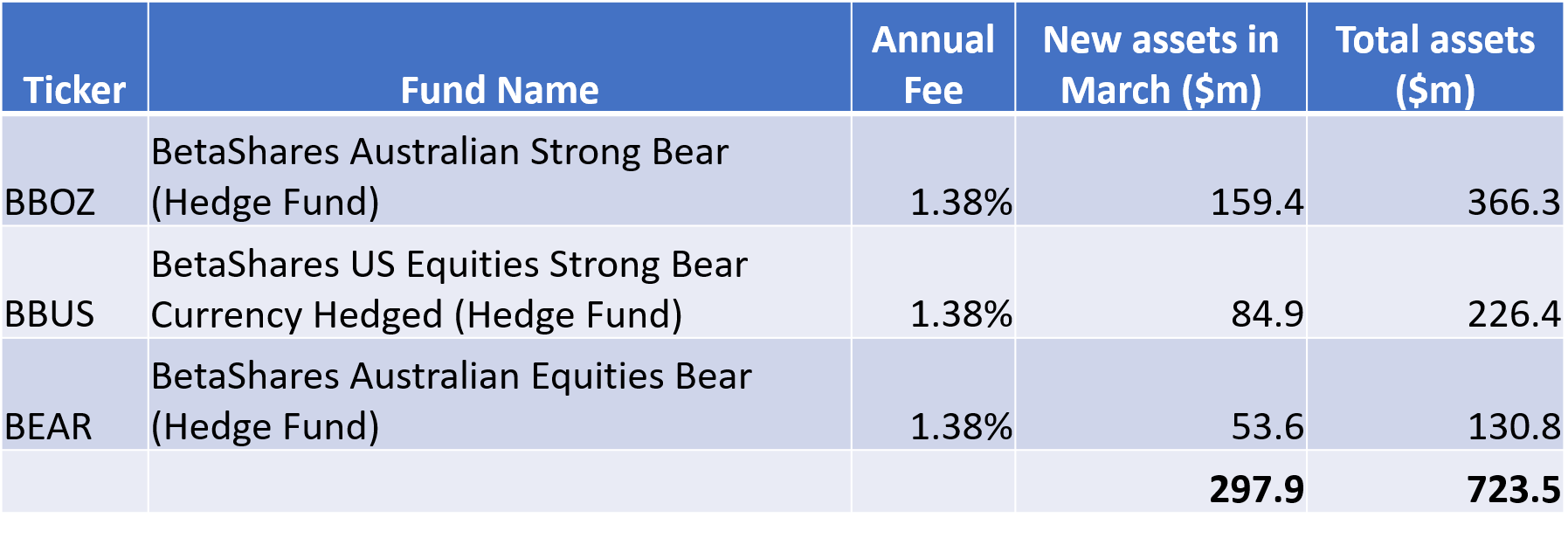

Source: ASX, ETF Stream

Throughout March, the company’s three little bears licked up a $300 million honeypot, ASX data shows. If that $300 million stays invested for a full year, BetaShares will make an extra $4 million in revenue, given the funds' fees.

Almost all of the $4 million bumper revenue would turn to profit, as the cost of scaling these ETFs is very low. The funds already held enough assets to be profitable prior to March.

Source: ASX, ETF Stream

BetaShares's bear ETFs are some of the most expensive – and profitable – ETFs on the market. They have the advantage of running against no competition as the "big three" ETF providers – State Street, BlackRock, Vanguard – have a negativeview of inverse and leveraged ETPs.

**************

Image: Alex Vynokur, chief executive of BetaShares. Source: supplied